Summary

ETN is a proof-of-work crypto currency based on the CryptoNight hash algorithm. It was forked from Monero and aims for mass adoption as an “enablement currency” through mobile applications and instant payment technology, particularly in the developing world.

_1.png)

What sets them apart?

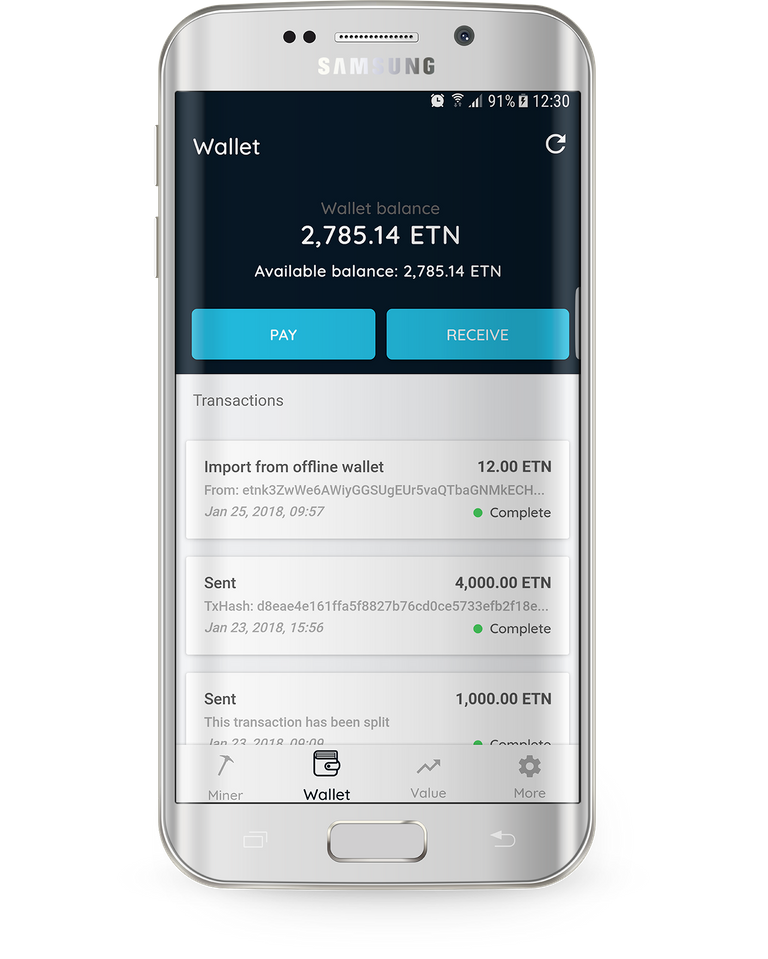

Electroneum is focussed primarily on mobile adoption through its wallet based app and mobile mining experience. The wallet provides a non-custodial means to store and process ETN, but with ease of use that is more associated with well known custodial wallet solutions. The additional mobile mining experience (just a simulator based on available CPU capacity, rather than actually mining) that is contained in the same app exposes users to the idea of mining crypto currency without the complexity and knowledge normally required. It effectively gamifies this process in an incentivised way (with users earning up to a few dollars a month), and is meant to encourage viral growth and mass adoption of the wider eco-system (p2p and pos payments), especially in more developing nations. That has led to partnerships with mobile network operators in these areas in particular, who see the potential to offer consumers an offset mobile contract by participating in the ETN network.

_2.jpg)

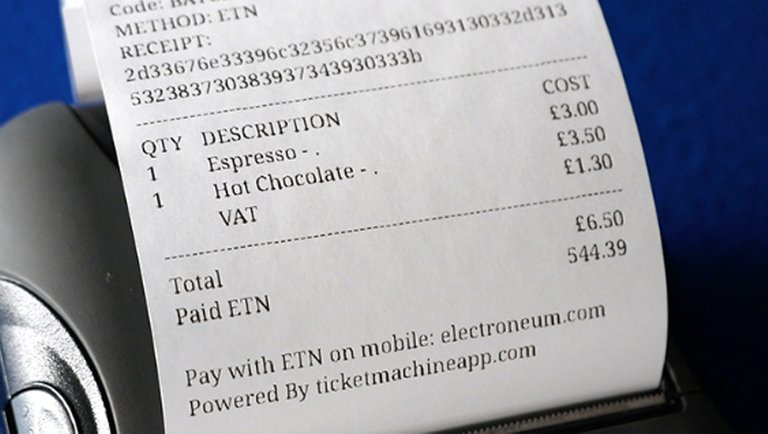

In April, Electroneum announced that global patent pending status had been granted to their instant crypto currency payment process (using ETN, Bitcoin or other crypto currencies). This allows for simple integration into existing electronic point of sale systems for restaurants, retailers and other vendors through their API system, rather than requiring any specialist new equipment or different crypto wallets. It “ring-fences” the relevant balance in the wallet allowing the instant checkout process we are used to with cards, but then typically settling in up to 1 hour, compared to the days it can take to settle card payments. On the customer side the smartphone app process is fairly simple and comparable to using the likes of Apple Pay. It also works between mobile phones for transactions in developing countries, again providing instant confirmation of payment rather than potentially waiting for slow blockchain confirmations. Currently, payment is retained in the form of crypto currency by the vendor. For those that do not want to deal with the volatility associated with this, further integration with instant fiat conversion may be possible, though that would negate the settlement benefits.

_3.jpg)

Team

The Electroneum team is headed up by founder Richard Ells. Richard has 20 years experience in running digital businesses, the most recent of which being Retortal (a social media management platform). He brought with him a team of experienced developers, strategists, marketers and user experience specialists, something of a first compared to the stereotypically tech-heavy teams of prior crypto projects. They are a transparent business, registered in the UK and prepared to stake the credible reputation of their members on this project.

What are they trying to accomplish?

ETN is described by Electroneum as an “enablement currency”. They aim to make it far easier than existing crypto currencies for peer to peer and point of sale transactions by focussing on user experience and viral mass adoption (including the mining simulator), primarily at the market of mobile phone users and focussing on providing a digital payment solution to the developing world. Impressively, they have recently reached over 2.2 million app users (just on Android, with iOS yet to launch), and in less than a year can boast faster viral growth than Facebook or Twitter comparatively. Longer term, Electroneum are looking to establish a gig economy platform for the ETN network.

_4.png)

Does it solve a real problem?

Industry progress in the developing world generally relies on funding. Previously this has come in the form of various crypto foundations literally paying for the infrastructure required to support one crypto currency project or another in that region (not a bad thing). By incentivising viral mass adoption of a principally mobile-based crypto currency however, in a way that covers the cost of the main infrastructure (mobile equipment and service) required to participate in that ecosystem, that’s a pretty unique and powerful means of solving a real problem of both gaining access to these new platforms and enabling the transactional cost savings for participants as a result.

In the developed world, it provides a relatively simple means of enabling vendors to accept crypto currency payment with enough certainty to allow instant checkout, and with the bonus of significantly reduced settlement time.

SWOT Analysis

Strengths

- Extensive business development and marketing expertise not always found in crypto projects, suitable for its mass adoption goals.

- A core member of the Monero team was involved from the outset, bringing invaluable blockchain experience.

- Decentralised proof-of-work network.

- Small transfer fee (0.01 ETN) compares well to other platforms whilst helping to protect the network from malicious attacks.

- Widely adopted app available in 20 different languages.

Opportunities

- One of the largest ICOs by user number - over 250,000 registrations and 110,000 contributors, raising $40m.

- Large community development and viral adoption potential from the mobile mining simulation.

- Actively targeting the developing world market.

- Partnerships with global mobile networks to offset mobile costs through ETN mining and open up ETN to a potential 100m users.

- Providing instant crypto currency payment/settlement capabilities to a global network of vendors via their existing systems (planned to go live this month).

- Enabling a new $3 trillion market by allowing 350m smartphone users in the developing world to enter the digital market for the first time.

- BETA release of an e-commerce integration for accepting ETN via Wordpress and Woocommerce.

- Future gig economy platform.

Weaknesses

- Upon initial launch in November 2017, the network came under attack and was inaccessible for ICO investors for several weeks whilst HackerOne were brought in to help address security concerns. It subsequently re-launched successfully in December 2017* having secured everyone’s funds, albeit with some delay. (This frustrated many, but was preferable to having funds stolen by proceeding with the initial launch).

- The blockchain development experience of the Electroneum core team has been called into question in the past (notably from competitors however).

- Indecision relating to forking to remove ASIC miners, then forking to reverse this causing blockchain instability.

- No high-level exchange listing since launch.

Threats

- Only one central business (Electroneum Ltd) currently building on the ETN blockchain.

- Strong competition in instant payments and adoption in the developing world.

- Whilst the ICO was considered successful, Electroneum Ltd were vocal in not wishing to cash in those investments on launch due to their belief in the wider crypto economy. This was a noble statement, however the timing with which these funds have, or have not now been converted, given the recent industry bear market, will dramatically impact the level of funding now remaining to continue their efforts.

Community Activity

ETN has developed a significant community with over 2.2 million app users to complement social media communities in excess of 100k. Given the incentivised viral nature of the app, the community is likely to continue to enjoy further growth.

_5.png)

Conclusion

Despite early challenges, issues and security concerns that impacted the reputation of the project, Electroneum came though these to develop one of the fastest growing communities of users and are building out real world solutions for genuine use cases. The unique way this infrastructure is being built, in a user friendly manor and at negligible cost to end users through viral incentivisation and cost offsetting, is both impressive and self-fulfilling. Whilst there are many challenges that lie ahead, including the potential funding requirements for Electroneum Ltd and the competitive nature of the markets they are taking on, I can certainly see ETN being an asset that both survives and thrives into the next market cycle.

Disclaimer: The author is a user of ETN amongst other crypto currencies. Investing or trading in crypto currencies involves significant risk. It is important to research and carefully assess any such investments. All the information presented in this article does not constitute financial advice or recommendations of any kind.

![]() By James Hunt (@humanjets)

By James Hunt (@humanjets)

Hi good post, you maybe are also interested to try out Steemeum, it's also a Proof of time miner app and community, maybe you want to help test it, we are in Beta.

Join us on discord:

https://discord.gg/yQMmmFw

Introduction post: https://steemit.com/android/@steemeum/introducing-steemeum-or-micro-mining-community

If you join use this code and make 1% more BE3B36