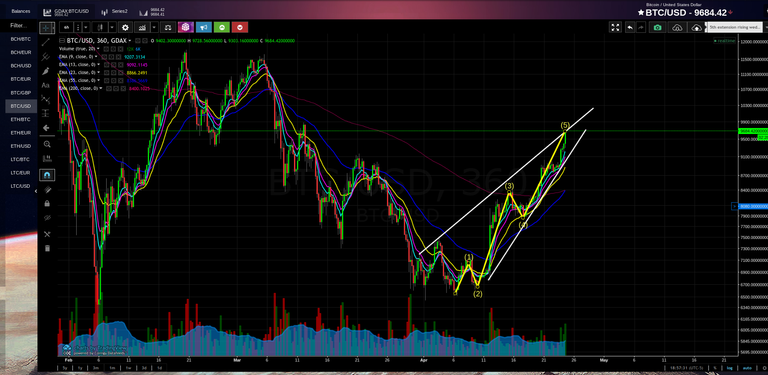

“In the 1930s, Ralph Nelson Elliott discovered that stock market prices trend and reverse in recognizable patterns. The patterns he discerned are repetitive in form but not necessarily in time or amplitude. Elliott isolated five such patterns, or “waves” that recur in market price data. He named, defined and illustrated these patterns and their variations. He then described how they link together to form larger versions of themselves, how they in turn link to form the same patterns of the next larger size, and so on, producing a structured progression. He called this phenomenon, The Wave Principle” (Elliott Wave Principle- Frost and Prechter)

Whats good everyone?! 5th wave extensions and suddenly it is starting to feel like 2017 again! In the image, we can see a rising wedge (bearish). Inside this wedge, we can see what is described in the “Elliott Wave Principle” as a fifth wave extension of a fifth wave extension (Super Bullish). Why is this important? Elliot waves help give us perspective on the markets general position and future outlook. How are you counting this?!