Crypto Mastermind summary:

-

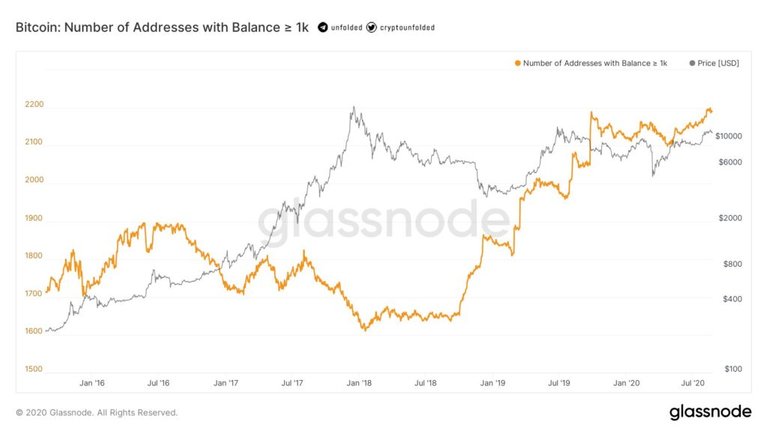

The number of "BTC-whales" is at a new all-time-high, surpassing the levels of September 2019.

-

According to the blockchain data platform Glassnode, there are currently about 2,200 Bitcoin-addresses with a quantity of at least 1,000 BTC.

-

More and more investors are turning to Bitcoin as an alternative to traditional markets. Increased demand combined with limited supply due to BTC-whale accumulation would lead to a price increase.

The blockchain data platform Glassnode published a post on Twitter on August 23, 2020 after the number of addresses of BTC-whales reached 2,200. The number of whale-adresses has thus risen to a new record high. This indicates an increased interest in Bitcoin by wealthy investors. More and more institutional investors seem to be withdrawing their Bitcoin from the exchanges. Instead, they seem to assume a long-term development of a bull market and maybe decide, to hold Bitcoin.

The number of BTC-whales continues to increase – during reduced supply

In the crypto area, entities that possess a large number of the respective cryptocurrency are usually called „whales“. A Bitcoin-whale would therefore be, for example, an individual or an institution, that owns more than 1,000 BTC. That corresponds converted up-to-date approx. to a value of 11.7 million $.

The following article by Glassnode on Twitter shows the development of the number of Bitcoin holders who own more than 1,000 BTC:

"Bitcoin addresses with balances over 1,000 $BTC (~$11m) hits a new record high, a trend that signifies accumulation.“

Since Bitcoin passed the $10,000 mark, this number has grown rapidly once again. The last high was around 2,184 adresses at the end of September 2019. According to BitInfoCharts, the total number of Bitcoin on addresses over 1,000 BTC was over 7,868,000, which at the current rate is over 92 billion $.

This movement indicates an accumulation of the BTC-whales. When these whales accumulate, the available amount of circulating BTC is inevitably reduced. Increased demand by the masses for Bitcoin would thus lead to an increase in price, since the amount of Bitcoin is limited. Furthermore, the Bitcoin halvings reduce the inflation rate of the BTC. This would due to the lower supply also lead to a higher price if the demand remained the same or would increase. If more whales continue to accumulate, this will dampen any downward trend. Because those who really do own large amounts of Bitcoin will multiply it while retail investors sell.

Cryptocurrencies as an alternative for investors to traditional markets

Particularly since the Corona crisis more and more investors, retail and institutional, seem to get attention on Bitcoin and cryptocurrencies. Many see an alternative in the crypto market to the traditional markets and also a security in relation to the crisis-ridden banking-system.

For example, George Ball, former chairman of Prudential Securities and now CEO of Anders Morris Harris, said in an interview with Reuters:

„I've never said this before, and I've always been a blockchain, cryptocurrency, Bitcoin opponent. But if you look right now, the government can't stimulate the markets forever. The liquidity flood will end. ... And so Bitcoin or another cryptocurrency becomes a very attractive either long term, I want to make a safe haven for my money or a short-term speculative bet.“

More and more investment companies are currently turning to Bitcoin and other cryptocurrencies. Also the inflow of funds into crypto investment funds such as Grayscale increased massively in the last weeks. Regardless of possible incalculable external influences, the accumulation of BTC-whales can be described as fundamentally bullish for Bitcoin.

Posted from Crypto Mastermind Go to the original article

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #appeals channel in our discord.

Congratulations @cmm-official! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board And compare to others on the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: