Crypto Mastermind summary:

-

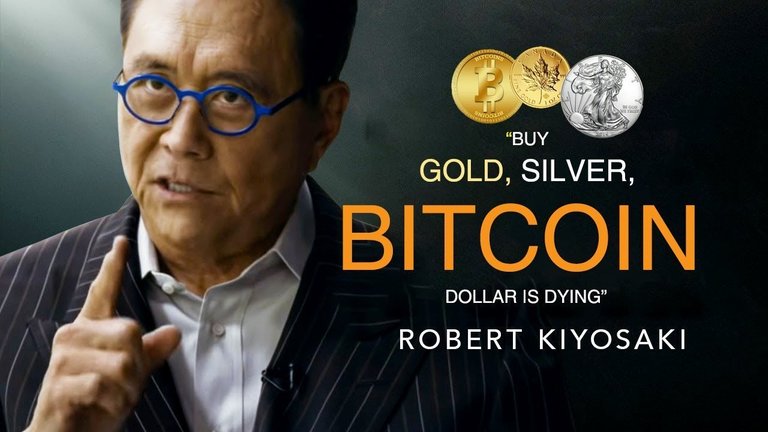

"Rich Dad, Poor Dad"-author Robert Kiyosaki warns of a potential imminent banking collapse and another stock market crash

-

He himself sees Bitcoin, silver and gold as a hedge against the coming loss of value due to inflation and advocates the absence of counterparty risk.

-

Irrespective of the possible occurrence of Kiyosaki's forecasts, many analysts are fundamentally more and more convinced of Bitcoin.

Robert Kiyosaki, the author of the bestseller "Rich Dad, Poor Dad", recently tweeted out his concern about the current global economic situation. He is convinced, that a major banking crisis is imminent and that people have little time left to protect themselves. Since the beginning of the Corona crisis, he has been predicting an imminent collapse of the banking and fiat currency system. He sees gold, silver and Bitcoin as safe assets.

The warning signs for a potentially impending crisis are increasing

On Aug. 21st 2020 Robert Kiyosaki published the following tweet:

„WHY BUFFET is OUT OF BANKS . Banks bankrupt. MAJOR BANKING CRISIS COMING FAST. Fed & Treasury to take over banking system? Fed and Treasury "helicopter fake money" direct to people to avoid mass rioting? Not a time to "Think about it." How much gold, silver, Bitcoin do you have?“

He assumes that the stock markets are currently only artificially held and that the "FED helicopter money" is causing massive economic damage. In addition to a collapse of the banking sector, he expects a crash on the stock market "which will be bigger than in March 2020".

The debt of the US Federal Reserve Bank, whose USD 7 trillion mark has again been exceeded, is remarkable. This points to a 'loose monetary policy' of the FED, which wants to support the stock market. In recent months, it has been possible to see that the American stock index S&P-500 correlates with the FED's rate of indebtedness.

Kiyosaki also sees Warren Buffet's sale of all his bank shares as a sign that things are getting serious. According to him, one should invest in gold, silver and Bitcoin, as there is no counterparty risk here. Counterparty risk is defined as the inability of the counterparty to meet a contractual obligation. For example, if the interest or principal on a loan cannot be paid. He sees this risk with shares and bonds but not with investments such as gold, silver or Bitcoin. On 17.08.2020 he wrote about this on Twitter:

"WHY I buy gold, silver, Bitcoin? Three words: No Counterparty Risk. Stocks, Bonds, Business, Real Estate all have Counterparty Risk. Gold, Silver, Bitcoin are money. They do not depend on people to be money. I own Gold, Silver Bitcoin in case I need to run from human insanity."

Bitcoin is gaining fundamental interest

While the S&P-500 is holding questionably steady with the combined debt of the central banks, assets such as gold or Bitcoin have already performed well. Institutional investors like MicroStrategy are currently showing increasing confidence in Bitcoin and other cryptocurrencies. Even though it is currently unclear whether Robert Kiyosaki's forecasts will come true, many analysts are fundamentally more and more convinced of Bitcoin.

Raoul Pal, CEO of Real Vision and Wall Street veteran, was very positive about Bitcoin. According to him, it is the best investment in recent years:

"In fact, only one asset has offset the growth of the G4 balance sheet. It's not stocks, not bonds, not commodities, not loans, not precious metals and not miners. Only one asset has massively outperformed the G4 balance sheet over almost every time horizon: Yes, Bitcoin. My conviction values at Bitcoin are rising every day. I am already irresponsible Long. I think now that maybe it's not even worth having another asset as a long-term asset allocation, but that's a story for another day."

Especially since the Corona crisis, with the bailouts of central banks and governments, massive inflation has become increasingly likely. In order to escape the subsequent devaluation of savings, limited forms of investment such as Bitcoin may well be a possible alternative.

Posted from Crypto Mastermind Go to the original article

Warning! This user is on our black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #appeals channel in our discord.