(as in Untamed Potential)

Nowadays the term “startup” is thrown around quite a lot. Not understanding what this term means can have extremely negative consequences on the entrepreneurial ecosystem.

It also deeply affects the long-term success (read: survival) of the venture. I argue that a first-time entrepreneur must be able to clearly identify the nature of his/her own venture, before going into execution mode. Furthermore, considerable challenges arise when there is no clear alignment between investors, entrepreneur, owner, founder and/or inventor in what concerns the nature of the new venture.

Typical frameworks focus on segmenting startups according to their industry, target customer or technical domain. Notwithstanding, their informative value, these methods provide little to no insights in assessing ventures. Furthermore, they provide no added value in what concerns the clarification of the term “startup”, versus terms like “SME”, nor of its relation to lifestyle startups, social startups, etc.

There is no formal agreement on how to categorize different new ventures. After thorough desk research, I focused on creating a mutually exclusive and collectively exhaustive framework for classifying new ventures.

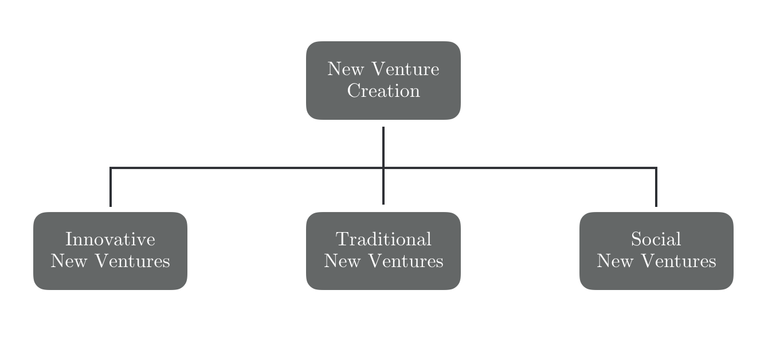

New Venture Creation

All people behind a new venture are trying to create something new and exciting (at least from their point of view). However, new ventures can differ greatly.

Powered by Hack & Hustle.

There are three distinct types of new ventures: Innovative, Traditional and Social New Ventures. The essence of any business is creating value and distributing it to customers.

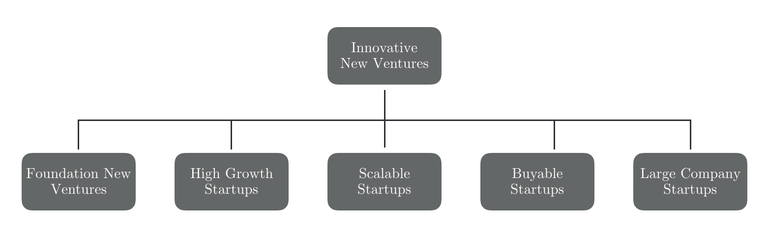

Innovative New Ventures

Innovation is implementing a new solution to a problem and creating value. Innovative new ventures bring new solutions (services or products) to market by creating or seizing opportunities.

After recognizing or creating this opportunity innovative new ventures offer new solutions that have significant value to their customers and usefulness that they would not have otherwise. Let’s read that again:

- Recognise or create opportunity

- New solutions

- Significant value to customers

- Value would not exist otherwise

There are several examples of companies like this. Google, Facebook, Twitter, all fall within this category. Despite popular belief and pressure within the ecosystem (mainly from investors), these ventures aren’t necessary started with an exit in mind.

Nevertheless, Innovative New Ventures can come in several different shapes.

Powered by Hack & Hustle.

Foundation New Ventures

A Foundation New Ventures is formed from R&D and may launch a new business area. These companies can grow a lot in the first 10 years of existence but may also go bankrupt relatively quick. It is very uncommon to see Foundation Companies go public. Furthermore, they tend to attract very little investor interest.

Foundation New Ventures are focused on creating new opportunities. Therefore, typically, they are trying to create a new solution, to solve a known or unknown need for new or existing customers.

An example of a Foundation New Venture is Prevail Therapeutics.

High Growth Startups

These ventures are focused on maximising profit and growth through innovation. This type of venture receives most investor interest. Also called Gazelles, these firms are extremely important for the economic development of a specific area. Interestingly enough, High Growth Startups may start, originally, as a Foundation Company.

High Growth Startups are focused on seizing opportunities. Therefore, typically, they are seizing an existing solution, to solve a known or unknown need for new or existing customers.

An example of a High Growth Startup is AngelList.

Scalable Startups

Despite having very humble beginnings, Scalable Startups aim high. Founders typically believe that their vision can change the world. The focus is on searching for a scalable and repeatable business model.

Although extremely famous, Scalable Startups make up a very small percentage of the different types of new ventures. However, because of their scalability, they attract a lot of (risk) capital and press. They focus on a simple but powerful concept and are recurrently looking for financial investors to raise capital and fund their search for a scalable business model.

Also called Silicon Valley-type Startups, these ventures tend to group in innovation clusters. Thus, the alternate naming.

Personally, I am extremely interested in Scalable Startups since many build these startups inefficiently. Scalable Startups are not smaller versions of large companies.

SCALABLE STARTUPS ARE TEMPORARY ORGANIZATIONS DESIGNED TO SEARCH FOR A SCALABLE AND REPEATABLE BUSINESS MODEL.

Once they find a scalable and repeatable business model, their focus shifts to rapid expansion (see High Growth Ventures above), which requires even more capital.Scalable Startups are focused on creating new opportunities. Therefore, typically, they are trying to create new solutions, to solve a known or unknown need for new or existing customers.An example of a Scalable Startup is Facebook.

Buyable Startups

Buyable Startups are designed to be quickly sold for large sums of money.

It is not uncommon for these ventures to avoid traditional venture capitalists and to search for other funding routes (crowdfunding being an example).

Unlike Scalable Startups, Buyable Ventures don’t necessarily search for a scalable and repeatable business model.

Buyable Ventures are focused on seizing opportunities. Therefore, typically, they are seizing an existing solution, to solve a known or unknown need for new or existing customers.

An example of a Buyable Startup is/was WhatsApp.

Large Company Startups

Large Company Startups are born from the need of large companies to be more disruptive in order to deal with changes in customer tastes, new technologies, legislation, new competitors, etc.

Traditionally, large companies grow through sustaining innovation. Where offering updated variants of existing solutions ensures growth. However, more and more, in order to ensure sustainable business growth, disruptive innovation is becoming a driver of success.

Existing businesses can do this by acquiring companies (see Buyable Ventures above) or attempt to build disruptive innovation differently (either by developing other Innovative New Ventures internally or by using other Corporate Innovation Tools). Large companies have an extremely hard time in creating and executing disruptive innovation due to their size and culture. Large Company Startups are focused on creating or seizing new opportunities.

Examples of Large Company Startups can be found within BCG Digital Ventures portfolio.

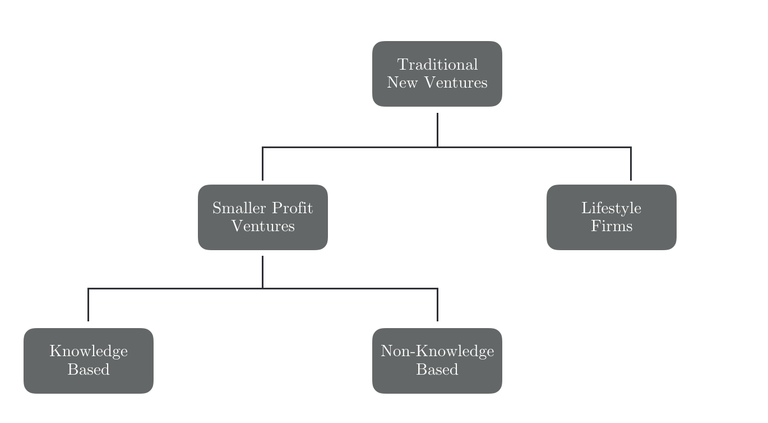

Traditional New Ventures

Nowadays many people are running or starting up Traditional Ventures. In fact, the economy of several countries is driven by these businesses (mostly in terms of employment).

Some argue that recent IPOs are Traditional Ventures that were “re-packaged” for scale, rather than true Innovative New Ventures.

Powered by Hack & Hustle.

Smaller Profit Ventures

Often referred to as Salary Substitute Firms, these are small businesses that allow the owners to make a “decent living”, typically giving up a level of income similar to what they would earn as an employee.

Examples are dry cleaners, convenience stores, restaurants, retail stores, and hairstyling salons, and also, small accounting firms, law firms, communication agencies, and so on.

These business owners work as hard as any other entrepreneur. Furthermore, they are extremely important in the economic development of their region. These small business owners create local jobs and represent a bigger share than entrepreneurs.

Salary Substitute Firms are focused on seizing existing opportunities. Therefore, typically, they are seizing an existing solution, to solve a known need for existing customers.

Smaller Profit Ventures should be further broken down into two categories (based on the type of skills required to undergo the venture):

- Knowledge-Based Smaller Profit Ventures

The nature of the ventures requires that founders developed skills from their knowledge on specific subjects, procedures and information. These skills are acquired through education, training and on the job experience. Founders are also required to use other skills, such as Transferable/Functional Skills and Personal Traits/Attitudes.

Based on our previous examples, these would be small accounting firms, law firms, communication agencies, and so on.

- Non-Knowledge Based Smaller Profit Ventures

These ventures do not require knowledge-based skills. Examples are dry cleaners, convenience stores, restaurants, retail stores, and hairstyling salons.

Lifestyle Firms

One may argue that these actually are a particular case of Smaller Profit Ventures. However, Lifestyle Firms are unique since they align with the owner’s personal interests or hobbies. These are quite often run out of one’s household. It is all about pursuing your passion and earning money through it.

Examples are surfers who own small surf shops and give surf lessons, people passionate about drawing opening animation companies, people with experience in sky jumping giving sky jumping training. Similarly, a coder or web designer who loves technology and takes jobs within innovative startups is somewhat of a lifestyle firm himself.

Lifestyle Firms are focused on seizing existing opportunities. Therefore, typically, they are seizing an existing solution, to solve a known need for existing customers.

Social New Ventures

Their goal is to make the world a better place. Unlike Scalable Startups (who believe their vision can change the world) Social New Ventures (aka Social Startups) do not search for a scalable and repeatable business model. Nor are they focused on market share and profits.

Social entrepreneurs are as passionate, if not more, as innovative entrepreneurs. Being driven by a powerful cause does not necessarily mean they are adverse to the idea of making a profit though.

However, the person behind a Social New Venture may also not be an entrepreneur. It all depends on the process behind this venture.

Given their nature, Social New Ventures are very difficult to categorize in terms of the type of need, solution and customers targeted. This is done best ad hoc.

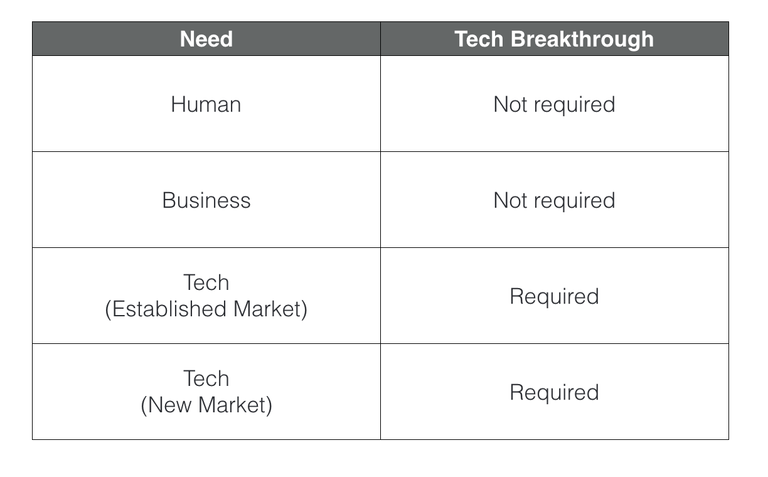

New Venture: Need + Solution

Any new venture is a combination of a relevant need and a feasible solution for it. Another interesting way to classify new ventures is based on the Need Solution binomial. This can actually complement the previous framework we just saw.

As you may have noticed, whilst classifying new ventures, I have made references to different types of needs and solutions. Furthermore, it is also important to understand if these solutions are being offered to new or existing customers.

Often the solution provided by a new venture must be new or adapted, however, it is not uncommon to come across situations where the need itself is new, unknown or even misunderstood. In these cases, clearly defining the need, is key to develop a solution for it.

As Gal Nachum argues, there are three types of needs (aka problems):

- Human Need

- Business Need

- Technical Need

Gal also states two different types of solutions:

- Technical Breakthrough

- Not a Technical Breakthrough

I prefer using this framework in parallel with the one I just provided for New Venture Creation. Even though some associations are quite easily made, it does not add value to merge these two into one single classification framework.

Powered by Hack & Hustle.

For example, a Foundation Company is clearly developing a solution for a technical need. However, scalable startups may develop a solution for a human need (Facebook), business need (Slack) or even a technical need (Stripe).

Nevertheless, understanding the type of need and solution to be explored is key in defining the type of new venture one starts.

UNDERSTAND THE NEED YOUR SOLVING AND HOW YOU’RE SOLVING IT.

So what?!

First and foremost, these frameworks are intended to help first-time entrepreneurs in kick-starting their own entrepreneurial process. At the end of the day, it helps in developing the capacity to critically evaluate all the information that is out there regarding startups, entrepreneurs and innovation.

Secondly, understanding these frameworks can help policymakers, businesses and government. Each type of new venture requires different ecosystems, education tools, economic incentives, incubators and capital. Until these players understand these differences it will be very difficult to foster innovation, jobs or economic development. For policymakers, businesses and governments, the first step is to methodically evaluate which path they want to develop.

Finally, I hope that this framework makes it clear that a healthy business environment and the economy has the structure to simultaneously support all these types of new ventures, to a certain extent (considering that prioritizing is key to gaining a competitive advantage). For later-stage entrepreneurs reading this, or if you are just interested, I also recommend two other frameworks that can help.

- Investor Pitch Archetypes by Meghan Kelly.

- Financial Structure Model by Preston Lee.

Did you learn anything new from this framework? Is there anything you would like me to further explore? I am looking forward to reading your comments!