Chinese Translation provided by

Korean Translation provided by @eoswtz @indend007

This article is co-writtenDawn 4.0 announcement made by Block.One on 5/4/18. The content contained herein is subject to change as the EOS.IO software is developed. by @EOSNewYork and @EOSnation and is based on the recent

Don’t worry, Mr. Hobbes. We haven’t missed a thing.

Marginal Costs

In economics, marginal cost is the cost of producing one additional unit of a product or service. In the latest EOS.IO release, Dawn 4.0, Block.One has introduced mechanisms to offset the cost of block production and trend the marginal cost of securing and validating the network toward zero. This important and eloquent solution cannot be understated. Let us explain…

Today, one can send a picture across the internet and have it propagate to millions, even billions, of users. Besides the cost of a phone and data plan purchase, the act of sending the picture costs the user fractions of one cent. The user can effectively perform the action itself for near zero marginal cost, and we could even reasonably say it was “free”.

The costs of transmitting information on blockchain networks can vary. Depending on the economic model and incentive structure, these costs can be relatively high. These costs, usually in the form of inflation and transaction fees, are transferred directly onto the users who have no choice but to accept them. Blockchain use cases, like an Internet-of-Things, are rendered unobtainable by these fees.

RAM Allocation Model

The recent announcement of EOS.IO Dawn 4.0 describes a new RAM allocation model which introduces the possibility for RAM itself to be a speculative vehicle. In order to avoid this, Block.One is imposing a 1% fee on all purchases of RAM. Please note that this is a fee for trading RAM only and is not the same as a “transaction fee”. All transactions on EOS are still fee-less.

Now that there is a RAM market, speculators may want to trade RAM price-volatility for profit. The EOS.IO system contract makes RAM non-transferrable and charges a 1% fee on trades. The result of this fee is to offset the natural inflation of tokens by taking them out of the market.

These tokens are removed from circulation and are effectively destroyed.

Offsetting the Cost of Block Production

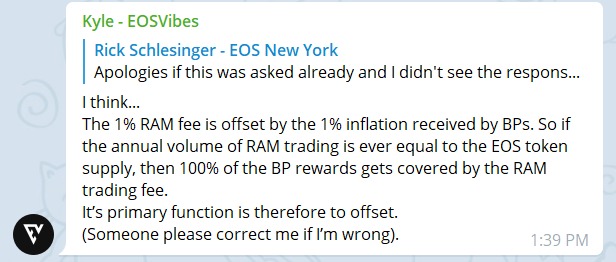

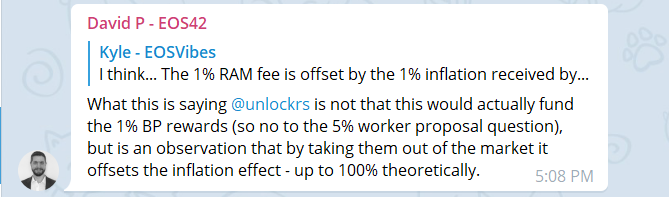

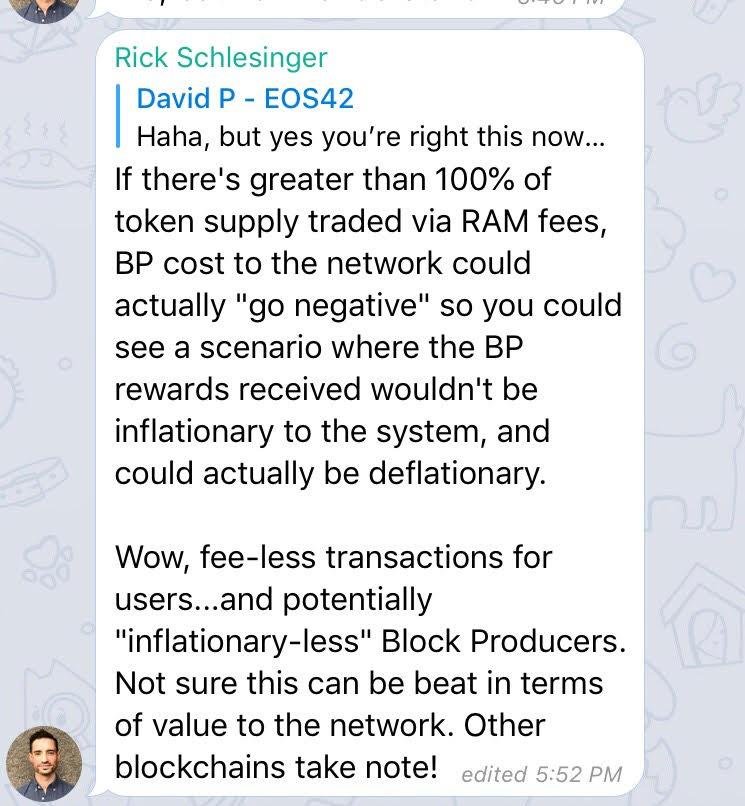

On the other hand, we have 1% of total token supply going to block producers in the form of rewards. The block reward, or any incentive to secure a public blockchain, is a necessity. If there isn’t some form of incentive for network validators then there is no network. While the cost of validating blocks to the user is minimal, they are still costs. But what if we could offset those costs? The 1% fee for RAM attempts to do just that.

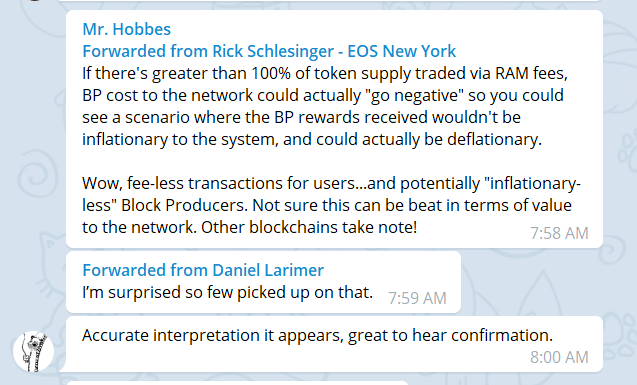

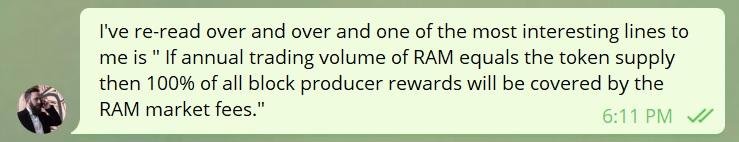

If [the] annual trading volume of RAM equals the token supply then 100% of all block producer rewards will be covered by the RAM market fees.

What Dan is essentially saying here is that as the number of RAM trades increases, the fees incurred could not only equal the 1% block producer reward but possibly exceed it. This reduces overall inflation and as the network grows, the marginal cost of block production trends toward zero.

Uncharted Economic Territory

We are witnessing the first glimpses of what a zero marginal cost network may look like. This great EOS experiment isn’t going to just deliver free transactions for its users, but it will also help propel our understanding of zero marginal cost economics.

Full disclosure: we cannot predict the future. Things are moving quickly as we approach Launch Day. We think this is an elegant economic solution, but in practice it may function very differently. But we hope that this explanation will help spark conversations on the topic of marginal costs and how EOS can impact the way we conduct commerce.

This post was co-authored by @EOSNation and @EOSNewYork and inspired by conversations that were held in Telegram with @EOS42 and @EOSVibes in an effort to understand the new Market-Based RAM Allocation Model of EOS.IO Dawn 4.0. Please join the discussion and let us know your thoughts on the new economic model.

EOS New York is a block producer candidate for the EOS.IO Blockchain

This could potentially address the pressure on BPs to lower inflation for token holders, edging out the already small margins that are estimated to be made from BP operations. Lots of criticism has come in the last few months on BPs wanting to drive up inflation to the maximum 5%, while token holders perceive that percentage to devalue the price. This approach creates a balance so both BPs can be fairly compensated for their time while token holders and investors won't fear inflation would slowly drive down the value of the token. It could actually create price stability over time as well, which is good for dApps. Everyone is happy!

You really have to give it @dan, he is always a step ahead of whatever the current debate is and is able to make brilliant adjustments that address these types of concerns so EOS is equitable for all parties.

Dan’s the man! Eos is so interesting.

Holy crap this is awesome! EOS is absolutely trucking with so many new innovative concepts.

Even me, a skeptic, has to admit that EOS may be the future of blockchain

This is a beautiful mechanism. The market demand for RAM volume could also serve as a good foundation for adjusting BP reward %. Instead of guesstimating 1% or 5%, we rely on the invisible hand of market to guide us.

When the whole process is done and dusted u believe in the EOS project, we did our bit to promote the project here in Lagos, Nigeria... Closely following anything related to EOS.