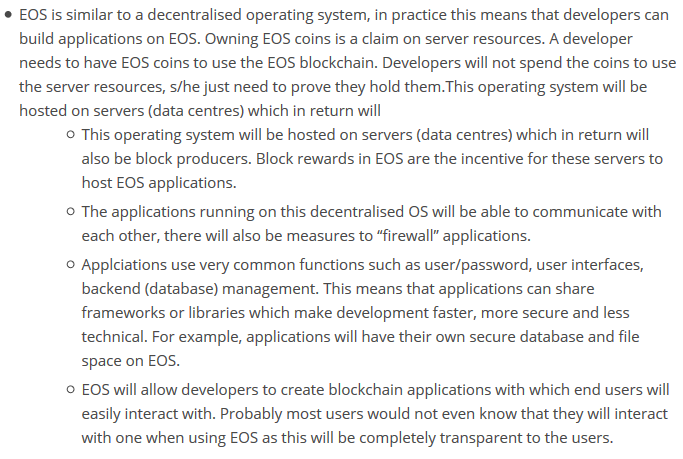

I've seen a few people on twitter and steemit undervaluing EOS based on the 1 Billion token supply and possible* 5% yearly inflation, which is the wrong way to analyze the future market cap for EOS because it doesn't consider the growth of the market.

Link: https://www.investitin.com/eos-ico-review-eos-good-investment/

Let's address inflation, how much does EOS supply grow over 10 years with 5% inflation? 1.05 to the 10th power = 1.6288 Billion tokens, 62% growth over 10 years. 1.62x, that's the worst case scenario because 5% is the maximum amount, it may in reality be lower.

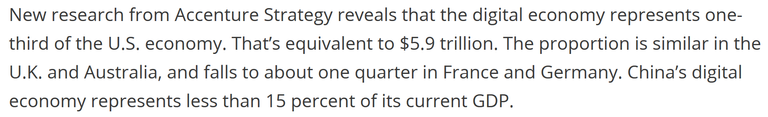

1. One way to value EOS is by asking what is the size of the digital economy:

Link: https://www.recode.net/2016/1/19/11588928/three-myths-about-the-digital-economy

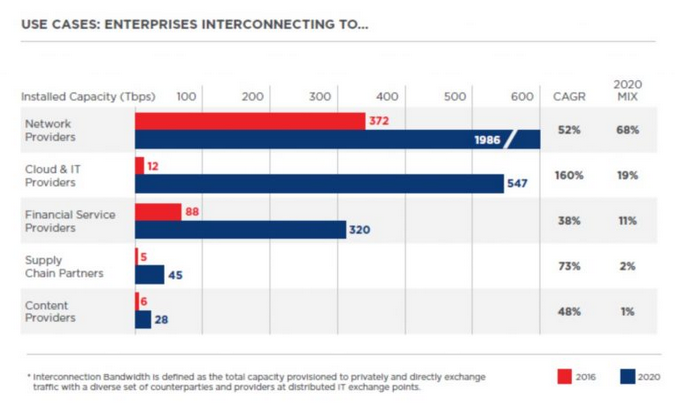

2. A second way to value EOS is by looking at estimated bandwidth growth ... Bandwidth is estimated to grow from 483 to 2926 tbps over 4 years from 2016 to 2020, that's MASSIVE growth.

Link: https://data-economy.com/digital-enriches-global-economy/

3. A third way to value EOS is by asking what's the current market cap for the top publicly traded companies in the data storage/streaming market? The top social media/advertising/streaming companies are worth Trillions (Google, Facebook, Microsoft, Apple, Netflix, Alibaba, Snapchat, Twitter, Dropbox etc).

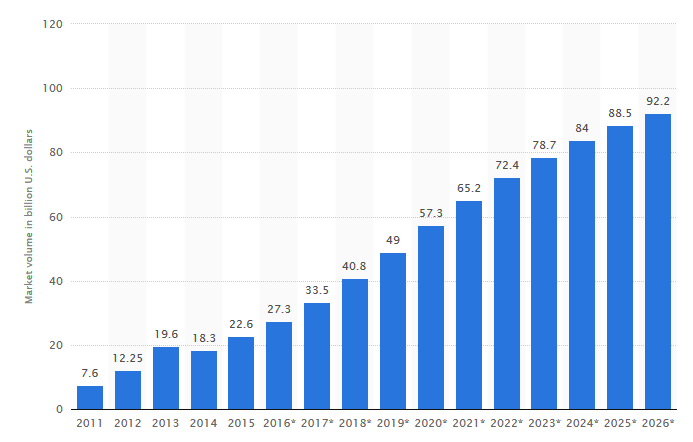

4. A fourth way to value EOS is is by asking what is the Big Data forecast? Here's a Forecast of Big Data market size, based on revenue, from 2011 to 2026 (in billion U.S. dollars)

Link: https://www.statista.com/statistics/254266/global-big-data-market-forecast/

5. A fifth way to value EOS is how much data is created?

Very good analysis! Upvoted and resteemed...

There is no question eos will be around top of the market, but how low it will go before that