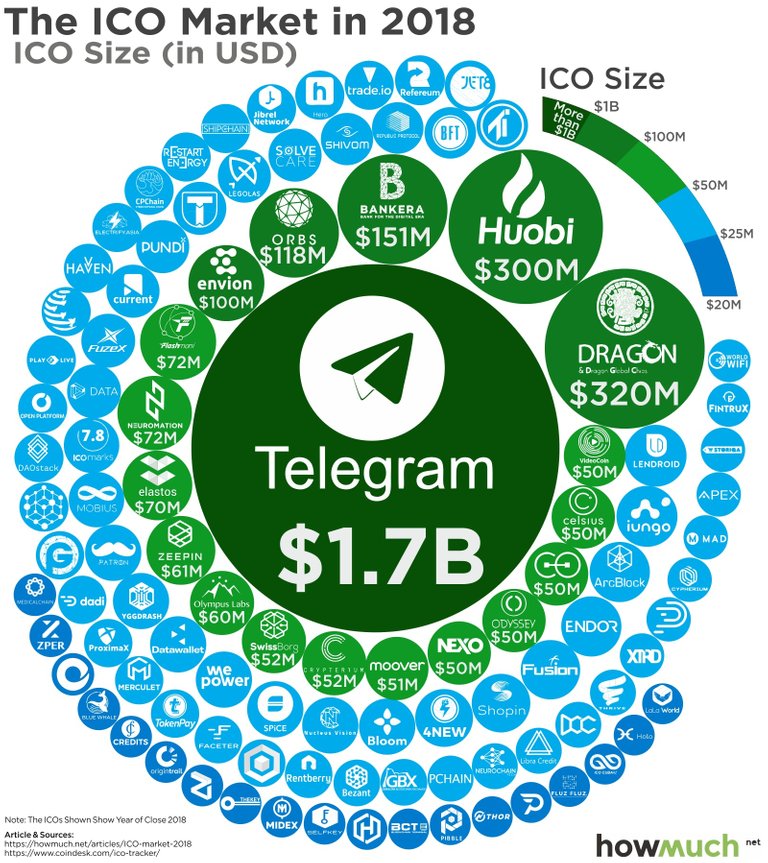

It’s been eye-opening to see how much crypto money has gone into token sales. Over $5 billion in 2017 and already over $6 billion in 2018.

Despite the incredible numbers, most people who are in this space understand that money has largely dried up and the number of projects that are raising a lot of money have significantly slowed. Furthermore the SEC and regulatory bodies around the world seem to be tightening up and have started to take actions against organizations that may have issued tokens that are considered securities. Many organizations are planning to issue ‘security tokens’ and others are too fearful to issue any tokens at all. Some people have even declared utility tokens dead.

Is there any way we can conduct a token sale legally?

Recently I’ve come across an idea of attracting capital that could revolutionize the way ICOs and token sales are done in the future. And it’s fully legal. (Disclaimer: I’m not a lawyer)

So what’s the secret? Well there is the well known test called the Howey Test that the SEC and the courts use to determine whether or not a company has issued securities. Here are the four conditions that all have to be met to be considered a security:

- Investment of money

- In a common enterprise

- With an expectation of profit

- To be derived solely from the efforts of others

The new way of conducting a token sale accepts the first three conditions. You can invest money in a common enterprise with the expectation of profits. HOWEVER, the last and final point is the key. The profit is NOT ‘derived SOLELY from the efforts of OTHERS..’

And what form of organization would allow this?

The answer… drum roll please…………….. is forming…. PARTNERSHIPS!

Legally theory behind partnerships

The following article should validate what I wrote above: https://scholarlycommons.law.wlu.edu/cgi/viewcontent.cgi?referer=https://www.google.com/&httpsredir=1&article=1520&context=wlulr

No federal courts in the US have concluded that an investment in a partnership has been considered a security contract. So why does this work legally? First when you’re in a partnership, your partners will participate in the operations of a business. Hence partners aren’t considered passive investors and are relying on themselves to successfully execute the business. If securities laws are meant to protect investors, it would not make sense for partners to need protection from investing in themselves or falsely promoting a project to themselves either.

Partners don’t rely on a board of directors or any other fiduciary to direct the company. It’s only when people have to rely solely on others in an organization when some obligation is owed to them. For a corporate company shareholders are separate from the board of directors & executives who are fiduciaries and custodians of money, assets and responsible for operations. This separation is the very reason why there is liability protection for shareholders in corporations and why the liability of the business falls on the intangible business entity itself. (At least that’s the theory behind corporate personhood and its liability protection for shareholders) The company as a separate entity is then responsible to conform to securities regulation when selling to people who are not involved in the business.

The Liability Problem

Most people who have been in business or have gotten any advice about legal formation from anyone with experience will hear all the horror stories that come with partnerships. A big downside to partnerships is that each partner is legally personally liable for every other partner. For example when one partner takes a large loan for the business and is unable to pay it back, other partners are personally obligated to pay it back and each partner can become bankrupt. Partners could even secretly embezzle money from the company from the loans they take on for the business. Furthermore, there are other business liabilities that could ruin a business and bankrupt partners financially. However blockchains can significantly mitigate many of these liability problems.

- Blockchain systems are typically asset-based and debt is rarely used.

- All money would be escrowed in a smart contract to minimize embezzlement.

- Blockchains are radically transparent and no one can recklessly take actions on behalf of a company without most of the partners noticing.

- Blockchain voting systems in DAOs/DACs allow partners to easily control the flow of money.

- If your personal money is in crypto, it’s really hard for any creditor to get it regardless of your partnership liability.

Here are some other considerations:

- Companies can purchase liability insurance for partners in the appropriate industry

- If real harm is done, there is a moral obligation and liability to pay back a customer

- Liability concerns are mostly for rich people. ICOs allow non-millionaires to participate.

- If you’re rich and concerned.. You can create a corporation or LLC to be a partner in the general partnership and protect yourself.

Partnerships and the blockchain

Partnership interests are much like equity in a corporation. Partners can buy & sell partnership interest tokens and issue more tokens to new partners who join. The partnership should have the same liquidity with partnership tokens as it would have with any other token traded on exchanges. The partnership can create a token sale to attract a vast number of new partners and that would effectively be an ICO. Even better the partnership can use a traditional fundraising model that begins with seed & angel rounds between $50-$250k instead of $100+million that could destroy incentives and lead to wasteful operations. The partnership can start with small partners who can join with tens of thousands of dollars before finding bigger partners with hundreds of thousands or millions of dollars in crypto. In the crypto world, investors seem inherently more likely to be active participants in the ecosystem. Furthermore partners should be able to actively vote and take form as a decentralized autonomous organization (DAO) so they can contribute to the operations as well as influence the direction of the company.

Conclusion

Will partnerships on the blockchains be the wave of the future? I think so… you?

Hi Sida

Posted using Partiko Messaging

Congratulations @steemrollin! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Hi!!! @steemrollin. I'm Mr.Salmon. Did you already move to Singapore? Me & all my team SCT were verry happy to meet you in Steemfest4!!

Congratulations @steemrollin! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @steemrollin! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!