Thee key to Donald Trump’s 2016 presidential campaign to “make America great again” lay in a simple strategy: Pillory the culprits making America un-great. Toward the top of Trump’s baddie list were currency manipulators. In particular, the “world champion” of currency manipulation,” as Trump called it, “cheating China.”

Currency manipulation is indeed a problem, and has cost the US countless jobs. But Trump, it turns out, had fingered the wrong perp. He should have been coderailing not against China—but against Singapore and Switzerland.

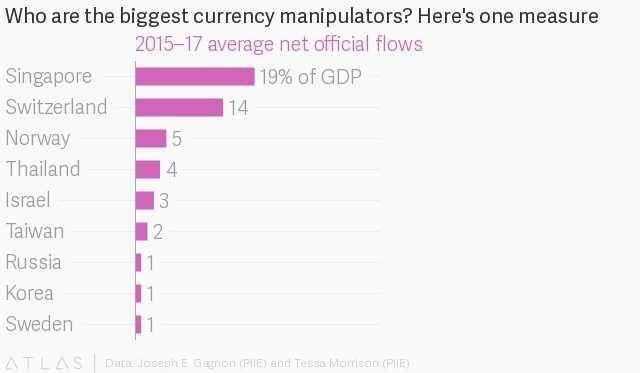

That’s based on new research by Joseph Gagnon and Tessa Morrison, economists at the Peterson Institute for International Economics.

“Although down from its peak about a decade ago, currency manipulation continues to occur,” they wrote. “In recent years the largest manipulators have been Singapore and Switzerland, with average annual purchases in 2016 and 2017 of about $90 billion and $80 billion, respectively.”

Taiwan and Israel are also consistent manipulators of late, with Korea, Sweden, Thailand, and Japan potential candidates as well.

What’s in it for all these currency manipulators? When Nation X buys assets from Nation Y, it suppresses the value of its own currency relative to Nation Y’s. That makes the exports from Nation X more competitive (and imports more expensive), boosting domestic export jobs. But it also hurts Nation Y by making their currencies pricier and exports more expensive, putting their laborers out of work. (Note that this happens even if Nation X and Y don’t actually trade with each other.)

To analyze currency manipulation, Gagnon and Morrison traced volumes of capital that flowed into excessive purchases of foreign-currency assets. Nations qualified as currency manipulators, according to PIIE’s standards, if they were at least upper-middle-income countries and met the following criteria:

Ran a current account surplus of more than 3% of GDP

Their net purchases of official foreign-currency assets worth more than 2% of GDP and exceeded 65% of oil exports minus production cost

Their holdings of foreign exchange reserves and other official foreign assets exceeded the value of three months’ imports

Held foreign exchange reserves and other official assets in excess of 100% of short-term foreign debt

China once indulged in such activities. But as growth has slowed, the central bank has actually been mostly doing the opposite—selling down dollars (or other foreign currencies)—to prop up the yuan’s value. (That said, Macao and Hong Kong, Chinese territories with their own currencies, continue to manipulate their currencies by maintaining a peg against the US dollar.)

Oil exporters, too, had long driven up the value of the dollar by buying up huge sums of American assets—a trend that falling oil prices and booming US oil production has stemmed.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://qz.com/1246588/the-biggest-currency-manipulators-of-2017-in-charts/

Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Robiul Dewan from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.