“A fixed money supply, or a supply altered only in accord with objective and calculable criteria, is a necessary condition to a meaningful just price of money.” – Bernard W. Dempsey, S.J. (1903-1960)

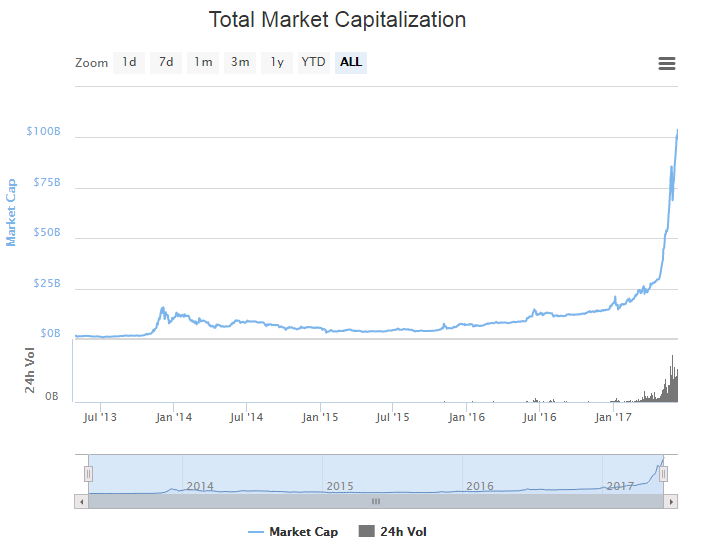

Magic internet money. That’s what insiders call cryptocurrencies. In January 2009, a computer program called Bitcoin appeared on the internet and is essentially a machine that prints money. On June 6, 2017, the day that the total cryptocurrency market broke $100 billion, the Bitcoin network produced $5.3 million in value for verified proofs-of-work on 151 mined blocks. That is roughly $222,560 every hour and $3709 every minute in payouts. Yet Bitcoin serves no government or institution. It has no agenda. It is only subject to the laws of its own computer code, which controls how its virtual currency is created and regimentally released into the world. Its code controls how users can exchange it and use it. These two simple principals combine to form a quasi-adept monetary policy, in essence making Bitcoin analogous to something like a central bank of the internet.

Cryptocurrencies like bitcoin are valuable because they possess many of the same qualities as their traditional fiat counterparts. The physical properties that define FIAT currencies include: divisibility, scarcity, portability, uniformity, durability, and acceptability. The Bitcoin network, like most cryptocurrencies, achieves all of these physical qualities in an equivalent digitized form. Rather than basing the price of a bitcoin on gold or silver, or using the perceived clout of a government to provide reassurances, cryptos have their price backed by mathematics and their value is directly linked to the utility people assign it. This allows cryptocurrencies to reach levels of value roughly analogous to the trust it creates in users. Human psychology, and consequently human control, is removed from the equation and the prices of cryptocurrencies are free to fluctuate purely off supply, demand, and the encoded predictability which creates them.

Economists would argue that market caps correlate to how many consumers are putting their resources into a company, or an idea that a company represents, and the perceived promise that idea holds for the future. ETHNews had the opportunity to speak with Dr. William Luther, assistant professor of economics at Kenyon College and adjunct scholar for the Cato Institute’s Center for Monetary and Financial Alternatives, who elaborated on the $100 billion milestone:

“As [cryptocurrency] market capitalization increases, we can be reasonably confident that [cryptocurrencies] are becoming more popular. It suggests more people are using [cryptocurrencies like] bitcoin or existing users are using [cryptocurrencies like] bitcoin more regularly. At the very least, it indicates that market participants expect bitcoin will become more popular. So a $100B market cap is certainly a good sign for bitcoin.”

With respect to cryptocurrencies, total market capitalization measures the worth of users’ faith and trust in cryptocurrencies as a whole. This milestone is thus a reasonable proxy for measuring user confidence in cryptocurrencies more so than measuring the direct value of cryptos relative to fiat. Yet, without the regulatory oversight and standards used to evaluate fiat markets, how can crypto market valuations tell us anything beyond what people think? Is there any concrete inference somewhere in the number $100 billion that will tell us where cryptos are going, or is $100 billion just a number people find comfort in? These are the types of concerns that lend themselves to speculation about cryptocurrency bubbles.

Dr. Luther told ETHNews:

“So-called bubbles are always easy to spot after the fact. And someone will always warn of a bubble when an asset’s price rises rapidly. But the reality is that we are not very good at identifying when an asset’s price exceeds its fundamental value – that is, what people would be willing to pay if they did not expect they would be able to offload the asset to some greater fool at a higher price in the future ... They are putting their money where their mouth is. Maybe they have paid too much. Maybe they have paid too little. We will not know for sure until the future unfolds. But our best guess is that the current price of [cryptocurrencies] reflects all available information on the current and future demand for [cryptocurrencies.] As such, today’s price is the best predictor of the future price. There is no good reason for thinking we are witnessing a [cryptocurrency] bubble.”

Although bitcoin’s popularity has created the modern cryptospace, it is not the first cryptocurrency and it certainly will not be the last. Indeed, it has taken the world almost a decade to separate bitcoin the currency from Bitcoin the technology. Once people understood how fundamentally groundbreaking the underlying blockchain technology is, it quickly became apparent how useful it would become in other arenas, let alone for empowering a new generation of cryptocurrencies. This ubiquitous adoption of the technology underpinning bitcoin is responsible for the rise of the cryptocurrency boom. Dr. Luther told ETHNews:

“It is hard to say whether the [cryptocurrency] network[s] will continue to grow. Interest in cryptocurrencies and confidence in the underlying blockchain technology seems to be growing. But bitcoin faces stiff competition from Ethereum – which did not even exist just two years ago. And other upstarts, some of which do not even exist [yet] today. Predicting the future is a difficult business. Who could have guessed in the late 1990s that Google, and not one of countless others, would become the dominant search engine? It is similar for cryptocurrencies today. We can see the emerging demand for cryptocurrencies, [executable distributed code contracts], and the blockchain technology more broadly.”

In the past few months, bitcoin’s market share, which had hovered around 80 percent for years, has fallen below 50 percent to Alternative cryptocurrencies like Ethereum. At the start of April, the market cap for cryptos as a whole was just over $25 billion. Since that time, these newcomers have pushed the ceiling over 300 percent higher, with Ether specifically growing roughly 440 percent. Venture capitalists like Fred Wilson from Union Square Ventures have gone so far as to predict that Ether will overtake bitcoin before 2018

While Bitcoin has the advantage of being the first big name in the cryptospace, it has a significantly limited utility. Bitcoin is a self-contained blockchain and as such it only performs computational processes for itself. This is in stark contrast to the Ethereum blockchain, which is Turing-complete and can run programs for a multitude of decentralized applications or solve any calculation given enough time and computational power. Ethereum also uses the Ghost protocol to increase its transaction time to 12 seconds, whereas Bitcoin’s blockchain propagates blocks every ten minutes. While new arrivals lack bitcoin’s first-mover advantage, they will be able to capitalize on time and experience. By utilizing novel ideas inspired by the first generation of cryptocurrencies, newcomers like Zcash, Ripple, and BAT are joining Ethereum at the front of a new class of cryptos with intrinsic value that is tied more tangibly to the real world.

Zcash is a direct progeny of Bitcoin in the sense that it solves one of Bitcoin’s most hated problems – publishing transactions for the public to view on its blockchain. Although this is a fundamental aspect of what helps to create the trusted nature of a blockchain, Zcash uses an advanced mathematical technique called a zero-knowledge proof to keep user transactions private. Transaction data is transcribed onto the blockchain but the senders, recipients, and amounts are kept secret. This zero-knowledge feature is selective in Zcash and can be toggled on and off.

Ripple also has great utility and is already gaining significant market share for its youth. Focusing on financial settlement, especially inter-bank transfers, has allowed Ripple to showcase the speed at which its distributed ledger can expedite financial transfers around the world. These savings can be passed on to Ripple’s customers in the form of monetary savings and time.

The Basic Attention Token (BAT) is based on the Ethereum blockchain, tracks where user attention goes, and provides rewards to publishers by tracking the amount of time a given user spends on a given website. People who use the Brave browser are protected from the prying eyes of advertisers by a proprietary algorithm called ANONIZE. Advertisements on the Brave browser are totally blocked by default. Users of the brave browser, as well as advertisers, both stand to gain from how BAT will revolutionize advertising. Moreover, as BAT moves into its next technology development cycle, its tokenizing of attention will also represent the best techno-social use case for destroying fraud.

Bitcoin created a micro-niche cryptomarket within the macro-space of the established international financial order. This rapid expansion of this space is represented by the growing market share of altcoins, mainly Ethereum. At their present rate of growth, cryptocurrencies as a whole will outpace companies like Apple, which has a market-cap of $774.99 billion, before the end of the year. Years from now, analysts may look back at 2017 and see the start of a massive cryptocurrency movement rather than a bubble. The gains from alt-coins is an encouraging sign for crypto-enthusiasts and the plethora of new use cases being explored is indicative of an ecosystem where healthy growth is driving the gains. But there still persists the idea that a bubble is waiting to pop.

Dr. Luther told ETHnews, with respect to crypto bubbles:

“One should keep in mind that a bursting bubble, or market correction, is a consequence, not a cause. It results when new information about an asset’s true value becomes available. If the price of [cryptocurrencies] were to fall rapidly, it would indicate that people have less faith in [their] future. But one should not expect the falling price to exacerbate that lack of faith, at least not among those in the [cryptocurrency] community. One might worry that a sharp correction would renew calls to regulate [cryptocurrency]. However, those efforts have been pretty modest in advanced countries like the United States to date. A few countries have attempted to ban cryptocurrencies. But most have largely welcomed the new technology with modest regulations designed to integrate it into the existing financial system. One might question the desirability of those regulations. Nonetheless, there seems to be little reason to believe governments would suddenly try to stamp out cryptocurrencies, should a market correction occur.”

This is a rapidly changing economy and there has never been a financial tool, asset, or currency where people could put their money directly into an emerging market with so much room for growth. The growth is so dynamic, and the markets fluctuate with such extreme volatility that many have come to see cryptocurrencies as too good to be true. But with returns so high, can any of us really afford to not care?