In this post, I'm going to talk about the process Ethereum

(a dezentrale software plattform with the cryptocurrency ETH"

is going through to become Ethereum 2.0.

Ethereum under the leadership of Vitalik Buterin has come a long way since its inception in 2015.

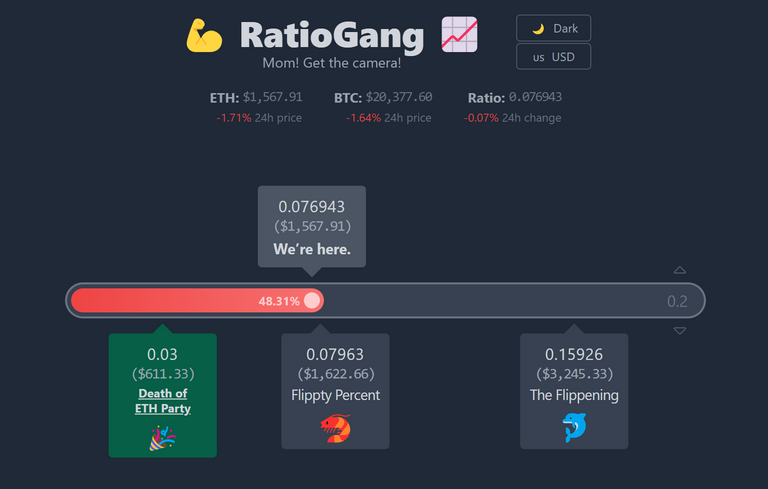

Many in the Ethereum community think that Ethereum could overtake Bitcoin in terms of market capitalization.

There are even websites where you can actively follow how fast Ethereum catches up with Bitcoin.

Ethereum had a few minor problems, which got bigger and bigger with the ever-increasing interest in the use of Ethereum.

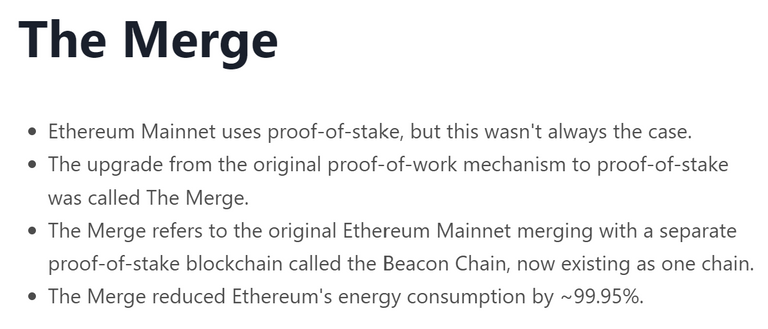

That's why we now have some updates for Ethereum including the merge, which already happened on 15.09.22.

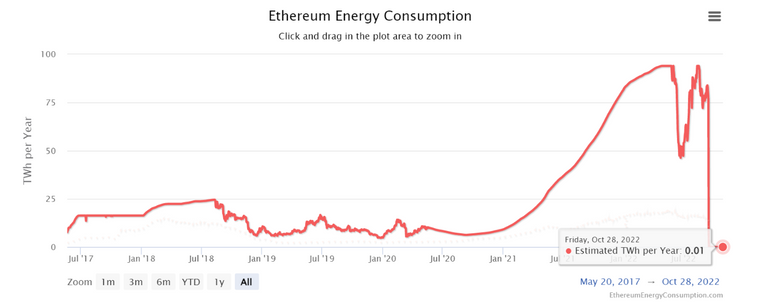

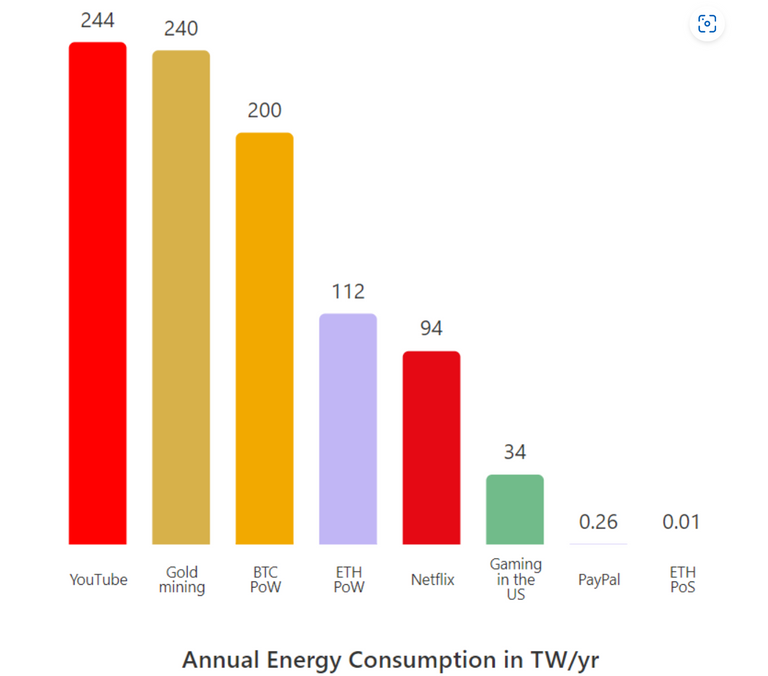

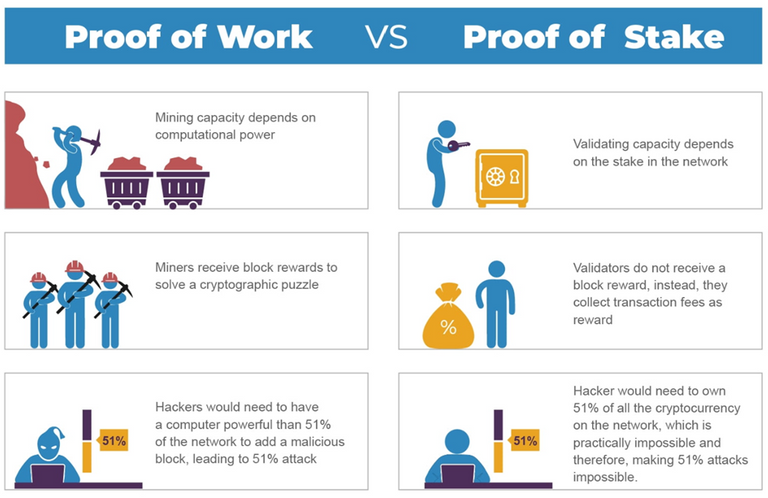

Since the merge, Ethereum is proof of stake and consumes 99% less electricity than before with proof of work.

-> PoW = Proof of Work / PoS = Proof of Stake

During the merge, Ethereum's old mainnet (PoW) merged with the new beacon chain (PoS). Thus, there were now two different ETH tokens.

All owners of Ethereum got a new token in addition to their Ethereum. They now had "Ethereum" and "Etherem PoW".

However, the "Etherem PoW" token lost drastically in value as it was sold off.

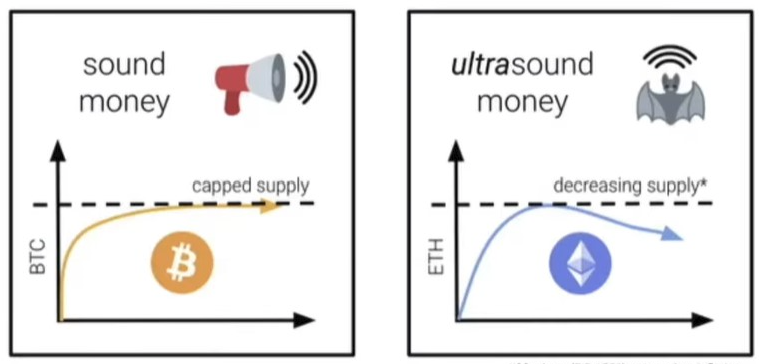

The merge also introduced that tokens would be burned with each transaction and Ethereum could become deflationary.

Deflation is the opposite of inflation and therefore positive for an asset.

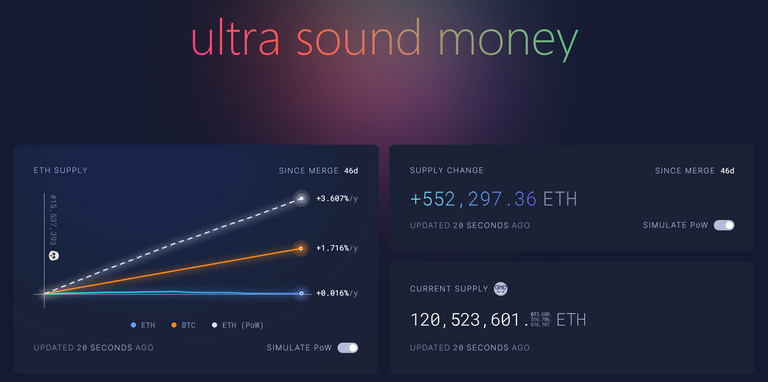

The current supply is higher than at the time of the merge because the burning of tokens does not yet exceed inflation, which will be the case with enough transactions.

There is a website that calculates how the number of tokens behaves and how the number would have behaved without the merge.

To further understand what benefits Ethereum has gained with the merge and which it has lost, we need to look at the difference between proof of work and proof of stake.

I have already discussed these in my post about Bitcoin mining.

-> In addition to proof of work and proof of stake, there are others, such as proof of history (Solana SOL), and proof of authority (Vetchain VET).

The Ethereum merge split the community a bit because many Bitcoin maximalists do not support the growth of Ethereum.

Some miners fear unemployment and the argument is also used that proof of work is much more decentralized than proof of stake.

But the further updates of Ethereum also solve other problems than energy consumption.

Here is the schedule that currently applies:

Dec 2020 (PHASE 0)

Launch of the beacon chain and implementation of the proof-of-stake mechanism on the Ethereum network.

Easy. mid 2021 (PHASE 1)

Implementation of shard chains.

(sharding is intended to improve scalability in the network)

Est. mid 2022 (PHASE 1.5)

Mergin of original Proof of Work Blockchain with Proof of Stake Blockchain.

Est. Late 2022 (PHASE 2)

Improvements to ether accounts, tansactions & smart contract execution.

Beyond

Increase Ethereum network functionality with more features & improvements.

These are the currently planned and partly already executed updates of Ethereum.

Currently we have PHASE 1.5 behind us and we will soon come to PHASE 2.

Often updates are delayed or postponed, because the updates must first be tested extremely well.

After all, Ethereum is the first to take such a step and this is also associated with many risks.

We still have a lot to go.

This is just the beginning.

Hopefully i was able to tell you something you didn't know yet.

Feel free to read my other posts:

-> https://ecency.com/crypto/@benjammann/crypto-and-defi-table-of

Bitcoin - did we see the bottom?

https://ecency.com/bitcoin/@benjammann/bitcoin-did-we-see-the

Bitcoin - misthoughts

https://ecency.com/bitcoin/@benjammann/bitcoin-misthoughts

Bitcoin – is the bear market over?

https://ecency.com/hive-138698/@benjammann/is-the-bear-market-over