Coming from building a startup with VC funding and understanding the pitfalls of trying to raise money traditionally when I first heard the idea of token sales it seemed brilliant. It inherently solved many traditional problems a startup faced.

In the traditional funding world once you have your brilliant idea and have developed an MVP you need users, motivated users, who want to use your product and spread it so you can hit that hockey stick growth that every VC wants to see. In the VC world, finding dedicated users and funding were two separate challenges.

The first iteration of ICO fundraising was a pure system where you can raise money from early supporters who believe in the product you’re trying to create

Through ICO fundraising you can kill two birds with one stone. These early adopters would theoretically be very motivated spread your product around through word of mouth advertising because they not only love your product but have a financial incentive to help your product grow.

The Stone Age: Pure Token Sales (Beginning - Middle 2017)

In the beginning/middle of 2017 you had massive projects raise billions of dollars in pure token sales. These pure token sales didn’t have any bonus structures, pre-sales, or accredited investor rounds. Most followed the Kickstarter model of direct to consumer sales and because there was still no regulation or working knowledge of the legal systems around tokens causing many to inadvertently be security tokens.

For example, Monaco actually had it’s tokens backed by a pool of fees it’s collected and holders could burn tokens to access their proportional share of the fees collected thus far. They later had to change their system because of a better understanding of securities laws that grew in the space over that time.

In this time, massive amounts of money were raised: Aragon raised $25 million in 26 minutes in May, Bancor raised $153 million in June, and Status raised over $107 million in June as well.

Over time though the fundraising became more and more difficult for teams as more fraud spread through the system as people came to see token sales as easy money. This was fueled by teams becoming so rich in the process of simply doing a crowd sale and then minimal work was done on actually creating the projects afterward. Over time ICO speculators became the majority of participants and when they stopped seeing their constant returns the investment slowed even further.

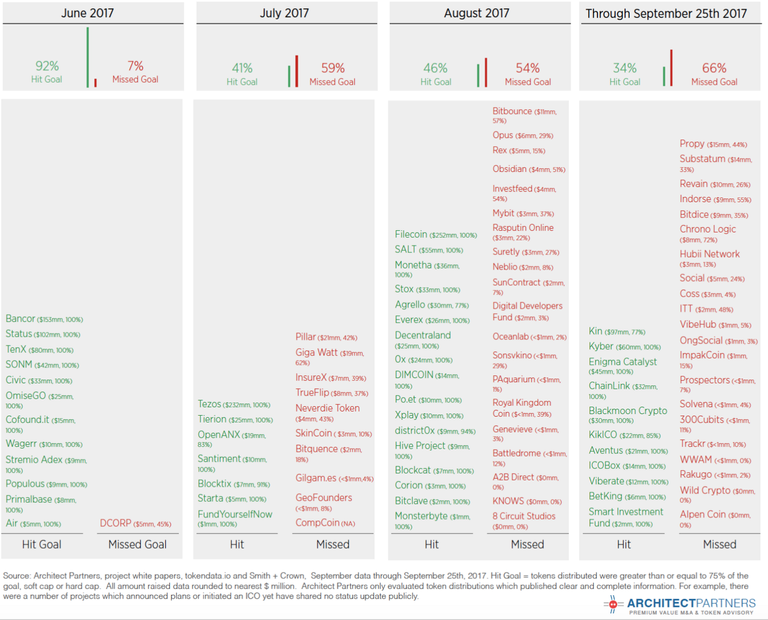

On average only 34% of companies reach their hard cap today compared to June 2017

Failure rates skyrocketed, leading to investors trying to seek ways to guarantee their success of their ICOs and VC’s were starting to get interested because of the easy liquidation and potential gains.

The Bronze Age: Hybrid Token Sales (End of 2017 - On going)

Starting in Q4 of 2017, token sales went from removing the VC and traditional accredited investors from the process to massively utilizing them as the failure rates of pure ICOs began to skyrocket. Token sales started doing massive pre-sale rounds, usually with only accredited investors, where they would offer deep discounts. Usually the funding would end up becoming 50% from accredited investors and 50% from standard crowd sale participants.

In some cases though there were failures in the crowd sale but ICO was still successful because of how large a pre-sale round was. For example, BLOCKv raised $20 million thorough a private round and intended to raise $20 million through an ICO but only ended up raising $2 million. In the end their raise was considered successful though because they still managed to take in $22 million.

These types of occurrences became the norm rather than an abnormality during this time and still continues to act like this today.

You also see major blockage of non-accredited US investors occurring because of increasing SEC crackdowns on ICOs. This protection is keeping these projects safe legally currently but it also blocks them from major markets. Many people are trying to explore options to open up sales to US investors though by following the current regulations that exist.

The Iron Age: Security Token Sales (Future)

While no one can predict the future, securities laws will most likely continue to become more prominent in the space and the entire environment could become regulated in the next few years. Venture funding and IPOs will continue to be disrupted by the ICO model but under more strict rules and regulations brought on by the SEC.

A few potential things will probably happen in the next few years:

A continuation of usage of SEC rules for crowd sale fundraising with many now exploring Reg A+ for smaller raises rather than just Reg D or Reg S because of the restrictions on retail investors and liquidity those two regulations force.

Specific regulation and classification of tokens and cryptocurrencies so they can be regulated by applicable organizations.

Creation of security tokens that mimic actual securities but are easily transferable and have beneficial blockchain properties. Allowing a more fluid system than the archaic brokerage system.

Security token specific exchanges being developed by the current major exchanges.

A potential for exchanges to be classified as security exchanges and have extreme regulation put on them in the US.

These new systems are trying to bring back the retail investors that the Hybrid Token sale model is giving a bad deal currently. It also should reduce fraud theoretically because of increased regulation. It will create barriers to entry though because blockchain teams will need initial funding to get over the process of registering their offering.

On the other hand everything could move offshore and the traditional tax havens of the world will continue just to do their job but now with cryptocurrencies being a major product.

No one knows.

Whatever happens though crowd sales have definitely changed the fundraising game entirely. Only the best projects are being funded and blockchain still has so many undiscovered use cases.

About the Author: Petros is a Blockchain Engineer at a growing ICO launching company Block 16. We are a full service blockchain agency that does token design, network syndication, marketing services and blockchain development. If you would like to reach out to me send an email to [email protected].