Why Bitcoin price will not reach $1 million? This is not a very complicated question but a lot of people still hope that BTC will be worth that much quite soon. In this short video I summarized the reasons it will be quite complicated for BTC to be worth that much. Please, do not assume that I hate Bitcoin or anything like that. I simply want to put my 2 rubles into discussion.

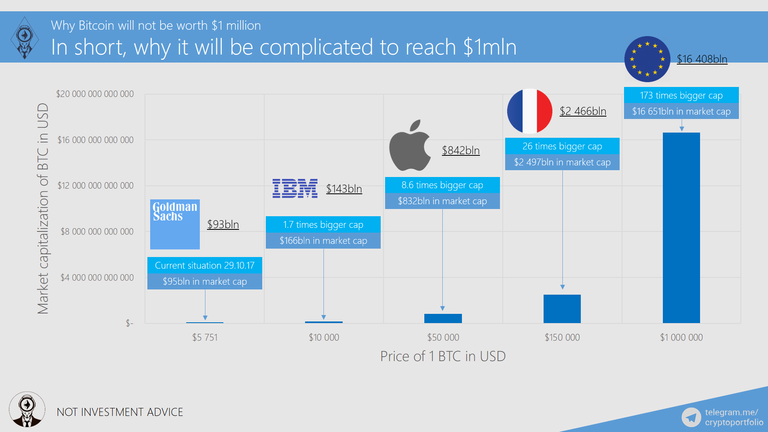

Here it is. I made this graph to show you the importance of capitalization. Why is it important? Higher the price of a given asset, higher the capitalization. And it is extremely hard to grow from $100bln to $16 trillion without strong fundamentals or mass adoption. On this graph, I showed how big capitalization of Bitcoin should be to reach certain price targets. I gave examples of $10 000 for 1 BTC, $50 000, $150 000, and $1 000 000. Also, to make this presentation more interesting I decided to add a comparison. I know that we shouldn’t compare stocks or gross domestic products of countries to cryptocurrencies, but I still did it simply to give you some perspective on how huge market cap of Bitcoin can be if it reaches certain price targets.

$5 751 is our current situation as of 29th of October 2017. As you know, there are 16mln bitcoins in circulation and this number is going to grow to 21mln at some point. By multiplying current number of BTCs in circulation by current price, we get $95bln of Bitcoin market cap. This number is close to the valuation of one of the biggest investment banks in the world, Goldman Sachs, $93bln.

$10 000 is going to be the price of Bitcoin if its capitalization almost doubles in size to $166bln. This market cap is comparable to current IBM valuation, $143bln.

$50 000 is the future price of one Bitcoin if its market capitalization grows to the size of Apple company. The market cap will be $832bln and the current Apple market cap is $842bln.

$150 000 for 1 BTC is going to take place when Bitcoin market cap will be 26 times bigger than its current valuation. By then, it will reach $2.5 trillion and will be comparable to GDP of France.

Finally, when 1 Bitcoin will be worth $1 000 000, it will have valuation which is over 173 times bigger than current BTC market cap. It will be over $16 trillion. You can compare it to the whole money supply of US or GDP of European Union.

On this slide. I would like to show you my 4 reasons on why Bitcoin will not be worth as much as $1 million. Again, I do think that Bitcoin will be worth a lot, I simply do not expect that 1 BTC could reach $1 million in near 10-15 years. Of course, if no hyperinflation of USD happens =).

I. Whole Eurozone/USA must use Bitcoin as a currency for it to reach $1mln. Bitcoin is a currency and should be valued as such. Even though, I expect Bitcoin to absorb value of other assets. How probable is it that Bitcoin will be used by such a huge amount of people? Time will show

II. Remember that Bitcoin is not the only option. There is going to be fierce competition for the 1 place. Why can’t ether become the currency all the people around the world will use? Ethereum is already used much intensively than Bitcoin, you simply have to take a look at the number of daily transactions of each blockchain. To be honest, I think that Ethereum has more chances at becoming such a highly valued asset.

III. Governments will not give up monetary policy that easy. Monetary policy is an important part of government control of our lives, there is going to be a long-lasting struggle before lawmakers give up and allow cryptocurrency to take its deserved place in our economies.

IV. Finally, technical limitations of Bitcoin will obstruct the BTC mass adoption. Forks, transaction speed, miners, governance problems…

Good article.

Ethereum isn't capped like Bitcoin, and nobody knows what the emission curve will look like once Casper is activated the Ethereum goes into POS. There, at this point and time, it is very unlike for Ethereum to catch up to Bitcoin. Secondly, in 2 years, the reward per blocks will be halved once again, so that is another major event that will drastically affect incoming supply from miners on exchanges.

Not to mention the growing number of Bitcoin ATMs around the world. No other altcoins have that kind of infrastructure.

The conditions for bitcoin to reach at least $25k a piece are there, not so much for the other alts.

Good points. However, we are seeing exponential adoption of the Ethereum protocol. As Dan mentioned ETH transactional volume is exploding. To be fair its not just ETH. There's several alts making incredible upgrades to their core protocols to bring crypto into the masses with "unlimited on chain scaling". Ones that stand out are NEO and Dash from my opinion. Both have governance built in and self funding mechanics to improve core protocols over time, which is going to be incredibly important for survival in future. For example, Dash has about $30 million in funds to work with per year at current price levels. As the Dash DAO builds out core infrastructure foundational products like Evolution, price can exponentially increase into a self feeding loop, marketing machine, development machine, PR machine to truly bring crypto to masses in places like Africa or Venezuela. The problem with Bitcoin is governance, core developers, lack of progress, not user friendly and the increasingly heavy alt competition for payments and store of value. Bitcoin has one use case "store of value" while ETH will have 1000's. Within 6 months we'll know how many ETH will be in existence. The number is around $105 million supply with inflation less than 2% a year (less than BTC). Once Casper is release I read their be 0% inflation. Validators will earn around 5%-10% per year. Bitcoin will likely reach $25K but ETH will con't to outperform YoY and eventually surpass BTC sometime in 2018. I predict more blocksize wars, lack of progress in Bitcoin core protocol and problems with Lightening Network. Meanwhile, Alts are rapidly developing for mainstream use cases. Sub penny on chain fees, second block times, more alt pairing (Binance, Bittrex is/has added every ETH pair, built user savings accounts, buyer protection functions, user names not numbers, APIs for quick merchant integration, built in discounts right in app with map, web wallets and the list goes on and on. Collateralized mining, low energy algos to spread decentralization of mining. 10's of thousands of smart nodes. The list just keeps going on and on. In 2 more years (2020) this space will look completely different than what it does right now. A historic snapshot from last year this time proves that. The competition is going to be absolutely insane into next year with the interface moment the most critical time in blockchains history as the masses decided which coins are most useful for them. My bet its not going to be Bitcoin much as people think today b/c many of the same problems you see today with Bitcoin will still be there. To a certain group of people Bitcoin may still be the idealogical choice but to the masses this is not important. Masses look for features, convenience, user call lines or if Grandma sends all here money to wrong address what happens? I just don't see Bitcoin addressing these problems like Alts will. Like so many technologies in past it was not the pioneer that made it in the end but the settlers that came after. Saw the mistakes of Pioneers and made key improvements. I think something similar will happen to Bitcoin.

Good points.

The anon alts like DASH will come under gov. attack at some point, so I'm not bothering with those at the moment. ETH is the only real alternative to BTC, but also remember, ETH can be indirectly attacked by an attack on the leader himself, Vitalik. Bitcoin doesn't have this issue as everything is spread out and there isn't a central point of failure.

And unless Ethereum is capped like Bitcoin, it will not function as a store of value.

ETH can be anon too with zksnarks. Every new coin I am seeing at the moment has privacy built in as a feature. Regulators will control the fringes like we see today in US exchanges but the private crypto currencies I believe will only expand. Its interesting to watch b/c most people would assume Governments would be more against crypto from the start. However, since crypto currencies are globally neutral and not national currency the State is much less concerned about them. Take for example, Venezuela where crypto currencies are beginning to spread the fastest the people don't really have a choice b/c the Bolivar is devaluing so fast and dollars are not accessible. If it was another nation state currency like Euros or dollars gov't seems to take a much harder approach than to crypto. What seems likely to happen is that some countries try and ban it while some legalize it, forcing the others to eventually embrace it.

Nice article, great points. Even if Bitcoin reaches around gold's market cap it would only be worth around 350,000.

Ethereum is not set as a store of value! Also, the number of Ether will increase over time without any limit set on the protocol.

I'm getting fed up with your ETH vs BTC bullshit.

You're an obvious ETH fanboy, "Why ETH price will be HUGE" What a meaningless statement to make.

I don't want to listen to your why BTC isn't going to 1m$ ... 1 000 000$/BTC is a random arbitrary assumption not many people care about,,, Click-bait title!

BTW I funded about 400$ to your previous video on Steem and asked you 3 times to contact me on telegram. @transisto

Have a good day.