Institutional investors did not miss the bottom opportunity

As anyone who follows the market more or less knows, Bitcoin bought and sold at $ 46,500 on Monday dropped to $ 30,000 on Wednesday. It was trading at over $ 40,000 on Thursdays and Fridays, when it fell again after the news from China.

Different investor groups reacted in different ways during this movement, according to the compilations of Will Clemente of the Glassnode team. This week, we talked about how short-term investors made such a loss for the first time after March 2020.

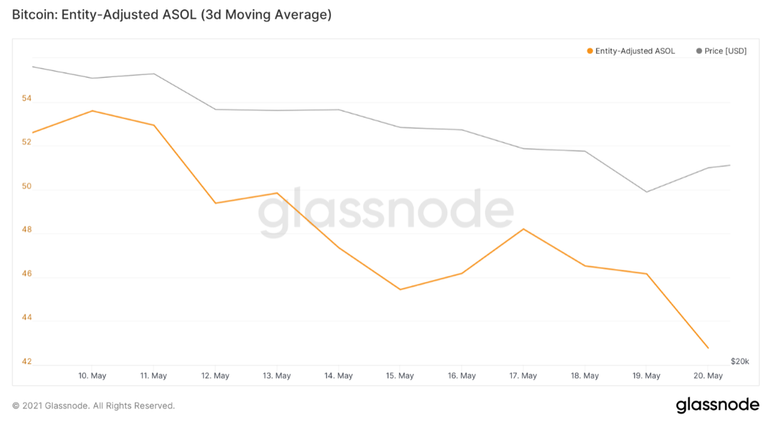

Clemente stated in the report published yesterday that the sales transactions in the market may have been made mostly by "young whales". This claim is based on the downward movement of the Average Spent Output Lifespan metric. In other words, the average age of Bitcoins that are put up for sale in the market has started to shrink.

Thanks to the Spent Output Age Bands metric, it is possible to get a slightly more specific date and say that the sales in the market were largely made by "investors who bought Bitcoin in the past few months".

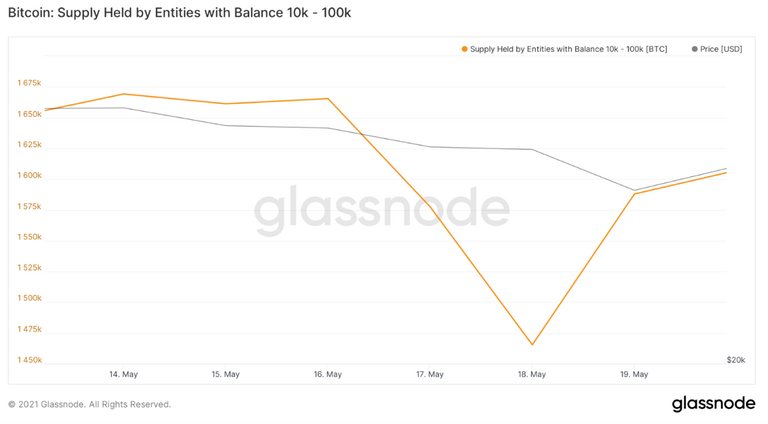

While some of the investors were selling, it was observed that investors who had between 10,000 and 100,000 Bitcoin in their wallet started to buy.

language

Glassnode's founders shared a different metric that could support this analysis. Apparently, transactions from wallets of OTC (over-the-counter) platforms began to proliferate. This data states, "Institutions are buying from the bottom heavily." interpreted as.

Although it may be daring to make an inference based on these data alone, it may be possible to comment with cautious statements: This week, many short-term investors who recently bought Bitcoin have taken the risk to sell even at a loss; Investors who are supposed to be institutional, on the other hand, "may be".

Vitalik Buterin: "The cryptocurrency market is in the bubble"

Ethereum founder Vitalik Buterin said in an interview with CNN Business this week that the cryptocurrency market, as it is today, is in a bubble. Buterin stated that "it is difficult to predict" when such bubbles will burst, and that it may take several months.

Ethereum, whose whitepaper was written by Buterin in 2013, came to life in 2015. Buterin, who reached the billionaire title for the first time as of this year, explained that “bubbles have been formed at least 3 times in the crypto money market so far and said“ The balloons are generally (bursting) because there is an event that reveals that technology is not sufficient yet ”.

Among the issues Buterin emphasized is the BTC-ETH relationship with Elon Musk. Musk; He was notorious for his social media posts, his statements on Saturday Night Live and generally for mobilizing the market with a single tweet. Buterin said that the market will start to act more consciously about this issue and said, "Elon's effect will not last forever." said.

Apart from its impact on the market, Musk and Buterin seem to agree at least on the impact of Bitcoin on the environment. Saying that bitcoin miners "consume huge amounts of resources", the name empathizes with those who are concerned about its impact on the environment.

According to Buterin, Bitcoin does not solve this energy problem, and if "continues to use whatever technology is today", it will "risk falling behind" different projects.

Ethereum is preparing to switch from the proof-of-work algorithm to the proof-of-stake algorithm. In this way, while an interruption of between 1,000 and 10,000 times is expected in energy consumption, Buterin explained it as follows:

"We will start to consume as much energy as a town, not as much as a mid-sized country."

News from China may not be FUD this time

There is a phrase called "China / Chinese FUD" that has been common in the crypto money market for years. The cryptocurrency market has either begun to rise or has already risen, a negative news comes from China about cryptocurrencies, at least in the short term, prices start to fall, and people blame the news from China. Examples of this happened in 2013, in 2017.

The reason why these news are called 'FUD' is that they are generally either about statements made by a low-middle-ranking government official, or the statement of an institution that does not have the authority to regulate alone, or in this way, something different. In short, a news that will not have a direct impact on the practices in the sector spreads all over the world. Of course, decisions taken in 2013 and 2017 are exceptions. But, for example, the statement made by three organizations in China this week that cryptocurrency transactions are prohibited was interpreted by many as "FUD".

Yesterday, Chinese Deputy Prime Minister Liu He announced that "strict measures will be taken" regarding Bitcoin mining and trading. The first reflex of some fanatics was to equate this news with others. But this time the news may differ from the previous ones. Why is that?

Messari Product Manager, Qiao Wang, openly called the news from 3 organizations in China this week as FUD. For yesterday's news, he says: “The news this time feels different because I don't remember any serious breakthrough in China before to take drastic action against mining. … China will take strict measures against mining and trading, not against on-chain transactions and owning (cryptocurrency). I think this is an important distinction. ”

The first comments from Dovey Wan, co-founder of Primitive Crypto, are as follows: “This news is more serious than the ordinary Chinese FUD because it can have tangible results. The order comes directly from the state department and is announced by the Deputy Prime Minister. The effects of a policy in China depends on who the order comes from and who declares the decision. "

Having said these, it should be noted that both names are bullish in the long run. According to Wang, if China bans cryptocurrency mining completely, people no longer say "China controls Bitcoin." "Most of the Bitcoin mining is done with coal in China." they will be able to say.

In such a case, "cards can be redistributed" in the mining sector, so to speak. Dovey Wan says that Bitcoin mining can thus become "much more decentralized" and that it will be bullish on behalf of the market.

More than 65% of the hash rate in Bitcoin is in China, according to the Cambridge Center for Alternative Finance.

Digital asset integration to banking software

Two companies in Switzerland, Temenos and Taurus, formed a partnership earlier this week. The aim is to provide banks with the opportunity to easily integrate all kinds of cryptocurrencies, tokenized assets and digital money.

Taurus, a blockchain company, recently received a license from the Financial Markets Supervisory Authority (FINMA) in Switzerland. There are many different digital assets on the platform established by the company, including DeFi products. Temenos, a banking software company, will be able to access this platform thanks to the partnership.

Why it's important: Taurus has different products such as CAPITAL (tokenization), PROTECT (hot / cold solutions for the storage of digital assets), EXPLORER (API-based connection with more than 10 blockchain protocols). Banks that are customers of Temenos will be able to access these products through Temenos MarketPlace and integrate them into their own services. In this way, they will be able to offer custody services for digital assets to their customers, manage tokenized assets and create them themselves.