This week’s post is probably the last of my Ethereum’s case study. If you have reviewed my prior posts, I’ve tried to understand the 'What' is Ethereum (which took quite awhile, over 3 posts) and in certain ways, those posts also highlighted the 'Why' aspects of Ethereum as well. In this posts, I’m going to address the 'When' and 'How'. Specifically, 'When' to invest in Ethereum (price ranges) and 'How' (which exchanges).

Last week’s Summary:

• Ethereum was founded by four individuals.

• Ethereum’s true founder is Vitalik Buterin, who is the main person to really focus on if you want to follow the future of Ethereum.

• Ethereum’s other founders have gone on to do other things but Vitalik continues to promote, code and develop the Ethereum platform.

• Ethereum has a organization made of 150 companies that formed Enterprise Ethereum Alliance (EEA) which helps promote all things Ethereum as it applies to businesses that are considering its application to their business.

• EEA is truly a differentiator compared to other ICOs in there you have a consortium of fortune 500 companies that shape and influence how global business is done. Their influence can further Ethereum’s use in all businesses.

• Mining in Ethereum is dynamic and is being done similar to Bitcoin however as far as I can tell there isn’t cap on how much ETH can be mined (unlike Bitcoin which is capped at 23 million bitcoins)

Question: When should one look to invest in Ethereum? How should one go about investing in Ethereum?

This weeks Summary:

Ethereum’s recent price decline.

• Ethereum peaked as high as $1400 back in January 13 before it plunged down (like other ICOs)

• Ethereum dropped back down into the $800s the next few days after the high.

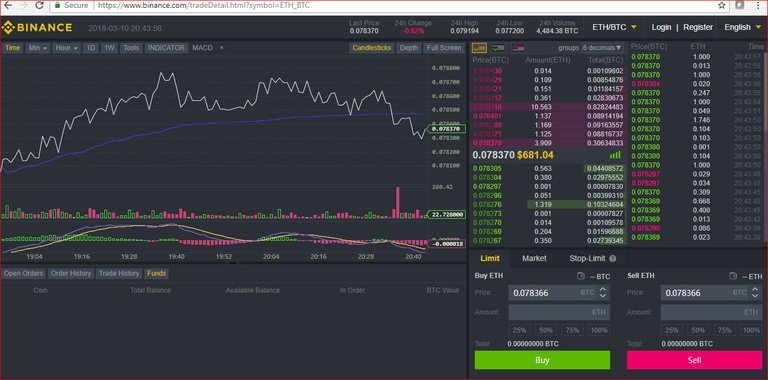

• Ethereum has declined since then and is currently in the $680s.

• Ethereum has been trading in tandem with other ICOs and Bitcoin, although at a more delayed and less decline. Nevertheless the correlation is relatively high/close to that of Bitcoin.

• What is driving Ethereum and other ICOs lower this week?

• There was several key events that happened this week that rocked a lot of ICOs

• On Wednesday, March 5th the SEC said crypto trading exchanges need to register with the federal agency.

• In addition, Japan's Financial Services Agency (FSA) suspended two exchange for a month out of security fears

• Lastly, news that Binance, the crypto exchange, might have been hacked, though markets recovered once the exchange allayed fears that funds were safe.

• “Regulatory news coming out of US and Japan may also have impacted cryptocurrencies again, but shouldn’t be cause for alarm. Cryptocurrencies are still in the early stages of development…and As the market grows, regulatory scrutiny is to be expected. Appropriate regulation should ultimately help promote best practice and afford protection to the consumer.” --- Key takeaway, this should be a none event as more money pours into the space, it is TOTALLY ACCEPTABLE that the Government play a role in regulating activities. To avoid Ponzi schemes and fraud…which will increase and pick up.

• As the market grows, regulatory scrutiny is to be expected.

Ethereum's price volatility has always been influenced by headline risk. But its important to recognize that Ethereum's main investors are in Asia (read below about ICO exchanges).

• Ethereum is currently still destined for great things, but the price action means that it won’t breakout on its own. Where Bitcoin goes, so will ETH’s future. Price range suggest that there is support around the 500-600 (low) range. If you see those numbers its probably wise to add to your positions.

Different Trading Exchanges

• It seems like there are multiple ways to trade Ethereum. Similar to Bitcoin, Ethereum is often quotes as a possible exchange between other ICOs…e.g. XRP/ETH, BTC/ETH etc.

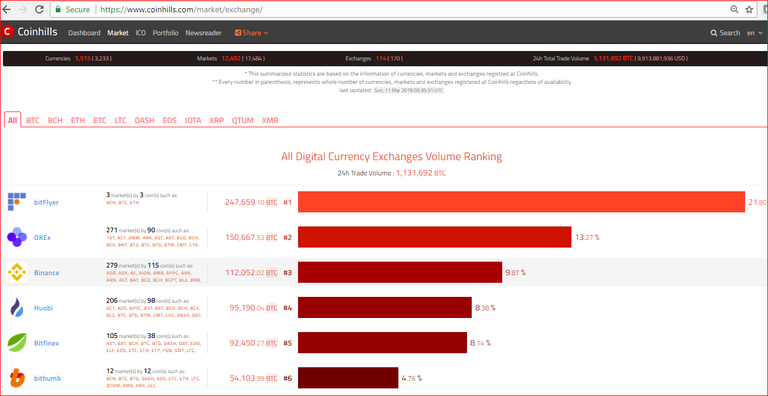

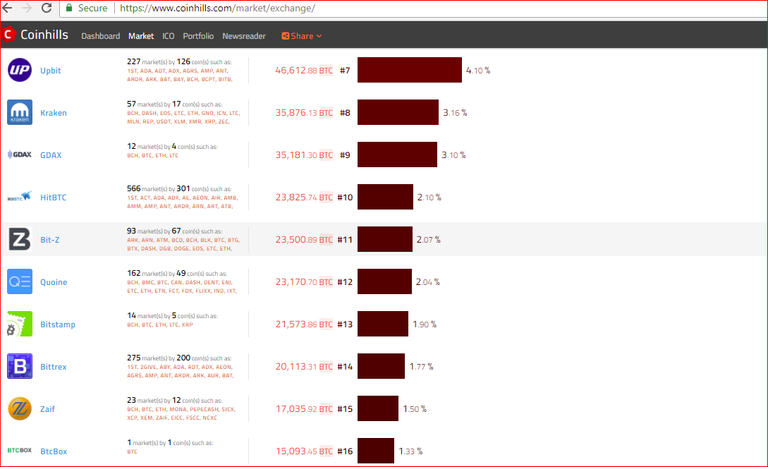

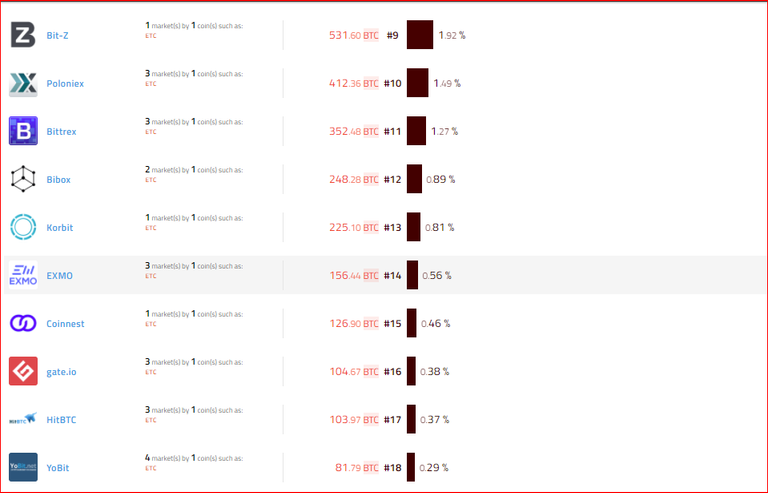

There is a great website that looks at all of the exchanges that trade ICOs. Its called Coinhills.com. See attached images of their exchange rankings.

• BitFlyer is the largest ICO exchange in the world, and the largest volume for Bitcoin. The exchange only trades BTC, ETH, and BCH (Bitcoin Cash).

• OKEX.com is the 2nd largest ICO exchange in the world. It has the largest volume trading amongst most of the various exchanges. The company is based out of HK.

• In my research, one of the things I’m concerned about is the potential hacks of various exchanges.

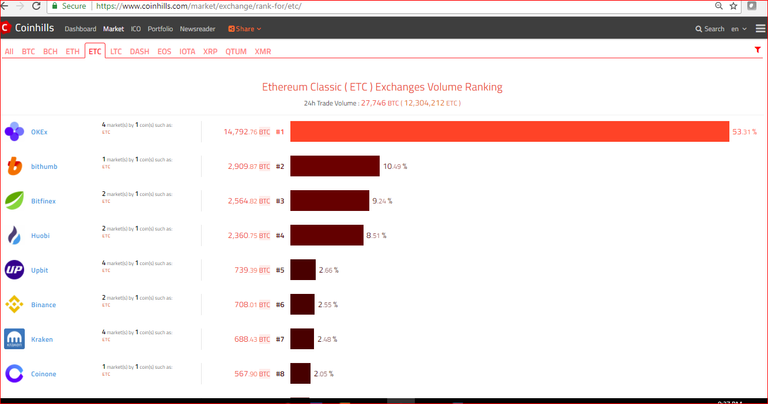

• OKEX is the largest volume trade of ETH. It owns 50% of the total ETH that is traded daily....CRAP...that's alot. And to clarify, OKEX is not US based (its HK based, which means most of the ETH investors ARE NOT US...BUT China / Asia. Keep that it mind!

- Interestingly, Bitfly doesn't show up in terms of ETH, it doesn’t even make the top 34 exchanges….which means if you’re trading ETH, don’t bother using this exchange. See below.

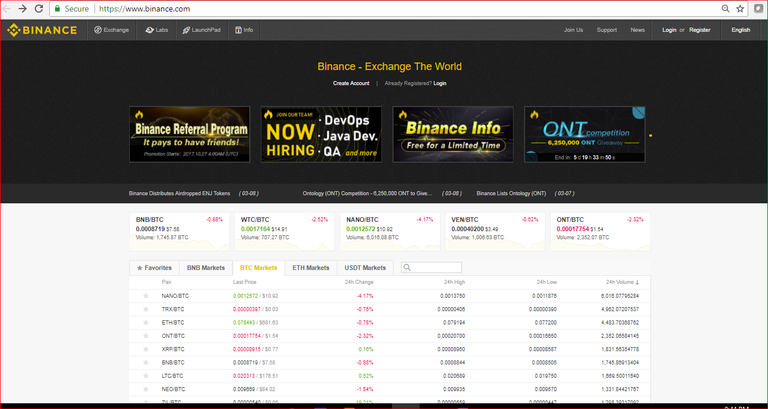

• Bianance.com is a very well known exchange (China based) and looks like it has lots of accounts and looks pretty sophisticated. It seems most of the major (and minor) ICOs are available to trade here. Unfortunately, it looks like it too could be susceptible to hacks.

• Binance has 233 potential ICOs that you can trade. Some of which are not even being traded but made ready if they do ( I guess).

• What I do like about Bianance is that it shows not only the market cap and the actual amount supplied but also the total max. Note I saw that the ETH circulated is also the max…which I’m not sure is correct. They did have Bitcoin at 16M circulated but 21M max, which is somewhat correct ( I was under the assumption that it was to supposed to be 23M max.

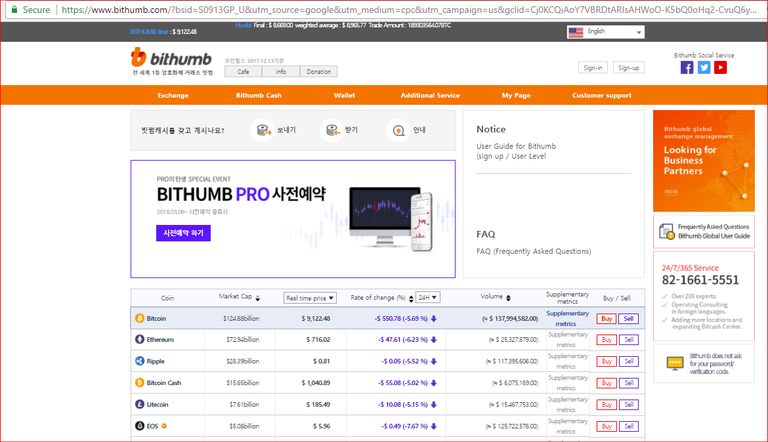

• BitThumb is a South Korean site. When you google, “where I can trade Ethereum” there are several ads that pop up at the very top. BitThumb is usually one of them. They are the 2nd largest exchange to trade ETH.

• At the end of the day, there are several different platforms that you can trade Ethereum. I would argue that if you are in the US, and you have a US account and you want some recourse if you get hacked, its unlikely you will get help if you go with a foreign exchange.

• You could argue that with the foreign exchange you have more volume, which can be easier for trading.

• Its important to recognize that Exchanges represent best liquidity not necessarily best security. See this one site called: coinhills.com that ranks all of the global ICO exchanges to see where each one trades. Notice that GDAX (Coinbase) is ranked 9th. Both Binance and BitThumb have more volume.

Key Takeaways:

• ETH is subject to headline risk, just like Bitcoin and other ICOs.

• Price action of ETH can be a opportunity to buy for those who believe in its business model and viability. There are great reasons to see that ETH is a long term success story.

If you are a day trader, and you need to make your monthly rent off ETH and other ICOs, you are in for a world of hurt over the next 12 months. Volatility is way too high...So becareful about sticking your life savings into this. And more importantly, remember to look at the long game...and DIVERSIFY...DIVERSIFY your portfolio (to include stocks and bonds as well as your ICOs).

• There are many exchanges that trade ETH, the largest being OKEX, which is a HK based company. BitThumb is a South Korean based exchange. And is the 2nd largest ETH by volume.

• But trading ETH on foreign exchange limits your rights and ability to mitigate (to what ever level you need to be comfortable with) risk.

• Exchanges are subject to Hacks.

• Might be good to spread your ETH trades across multiple places. And as some have suggested maybe move some to your Wallet (that is offline) and not accessible.

Follow Me @epan35

Reply (with a good comment) and Upvote and I'll return the favor! I need Feedback!

I like your post very much, go for my blog I'm new to this, I hope your support

Best of luck to you! And thanks for reading!

"there isn’t cap on how much ETH can be mined (unlike Bitcoin which is capped at 23 million bitcoins)"

thats a new info for me. How gullible I am !!

:(

you really love ETH :)

Not sure if I love them but I do "appreciate" them...does that count...its the non-committal version!

I thought the investors of eth mostly comes from US and European countries, I was wrong and surprised upon learning it from your post that the investors came from Asian countries. Nevertheless, investors must be careful in investing eth and be updated always the exchange rate in the market to avoid their investment from loss.

Wow. I really learnt a lot from the post. Nice write and powerful expression . Keep it up

ETH > BTC. I'm not selling and probably I'll never do this. 2019 will be the year of ETH and LTC for sure. Thx for the post!

Congratulations, what an exceptional analysis!!!

Well at least it's not as crooked as Steem.