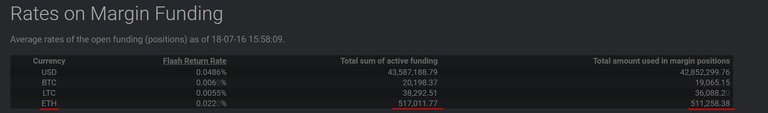

We all know Ethereum looks like it is a dead cat walking, but looking at BitFinex shorts we can see there is more than 500,000 BTC of margin used for shorts.

That is an amount so high the real market cap of the coin can't even sustain that. This means that there is too much liquidity pushing the price down than the real market behind it can provide, so it will go up to take that liquidity out of the market and then proceed down. Remember Ethereum might be dead, but hope of people in it is not. Hope is always the last thing that dies and in markets is the greatest force a market maker can use to eliminate participants and make biggest profits.

This is the outlook on a pretty high timeframe, we can see there are two important levels outlined in green as support and red as resistance. I think ETH established a range between this two lines and might continue to bounce around there for a while before going down again. The market has to shake bottom shorters and clean some liquidity. When people will forget they can make profit shorting Ethereum it will collapse very hard.

Wait for the water to enter the ship and then leave it.

how do you know that margin is used for shorts? Why not for longs?

Because ETH is used for shorting, BTC is used for longing.