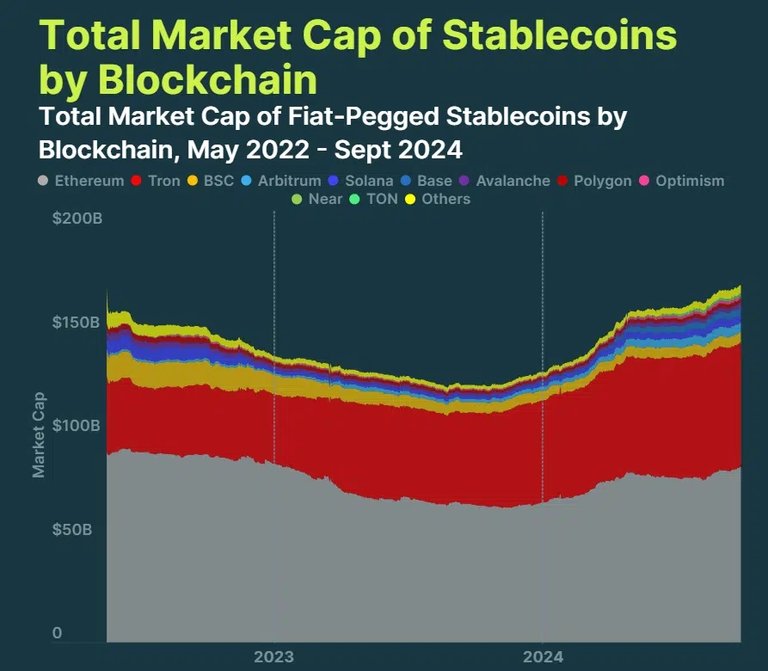

In a recent report, CoinGecko has highlighted a significant shift in the stablecoin market, with Ethereum and TRON emerging as the dominant players. Together, these two blockchain giants control an impressive 84% of the stablecoin market, valued at a combined $144.4 billion. This dominance underscores the growing reliance on these networks for stablecoin transactions and highlights their critical role in the broader cryptocurrency ecosystem.

Source CoinGecko

Ethereum: The Stablecoin Leader

Ethereum continues to lead the stablecoin market with a staggering $84.6 billion in value, representing 49.1% of the total market. This dominance is largely driven by the high demand for Tether (USDT) on the Ethereum blockchain. Tether, the world's largest stablecoin by market capitalization, has found a robust and scalable platform in Ethereum, enabling seamless transactions and widespread adoption.

The Ethereum network's success in the stablecoin market can be attributed to several factors. Firstly, its well-established infrastructure and extensive developer community have fostered innovation and trust. Secondly, Ethereum's ability to support smart contracts has allowed for the creation of complex financial instruments and decentralized applications (dApps), further enhancing its appeal to stablecoin issuers and users.

TRON: A Rising Star

TRON, with $59.8 billion in stablecoin value, accounts for 34.8% of the market, making it a formidable competitor to Ethereum. TRON's rapid ascent in the stablecoin market is also fueled by the popularity of Tether on its blockchain. TRON's lower transaction fees and faster processing times compared to Ethereum have made it an attractive alternative for users seeking efficient and cost-effective transactions.

The TRON network's focus on high scalability and throughput has enabled it to handle a significant volume of stablecoin transactions, further solidifying its position in the market. Additionally, TRON's strategic partnerships and aggressive marketing efforts have contributed to its growing user base and market share.

The Role of Tether

Tether's dominance on both Ethereum and TRON is a testament to its critical role in the stablecoin market. As the preferred stablecoin for many users and exchanges, Tether has leveraged the strengths of both blockchains to provide a reliable and efficient means of transferring value. Tether's ability to maintain a 1:1 peg with the US dollar has also instilled confidence among users, making it the stablecoin of choice for various applications, including trading, remittances, and decentralized finance (DeFi).

The Future of Stablecoins

The substantial market share held by Ethereum and TRON suggests that the stablecoin market will continue to grow on these platforms. As the demand for stablecoins increases, both networks are likely to see further innovation and development, enhancing their capabilities and appeal.

Ethereum's upcoming upgrades, including the transition to Ethereum 2.0, are expected to address scalability issues and reduce transaction costs, potentially strengthening its position in the stablecoin market. Similarly, TRON's continued focus on scalability and user experience is likely to attract more users and stablecoin issuers.

Final Thughts

The dominance of Ethereum and TRON in the stablecoin market reflects their critical role in the broader cryptocurrency ecosystem. With a combined market share of 84%, these blockchains are poised to continue driving growth and innovation in the stablecoin sector. As the market evolves, users can expect enhanced functionalities, increased efficiency, and new opportunities for leveraging stablecoins in various applications.

Thanks for being here! Upvotes and reblogs appreciated.

Thank you for using ECENCY