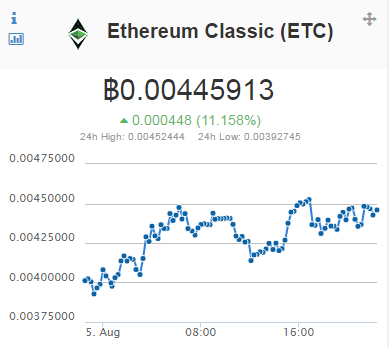

It seems like the new kid on the block "Ethereum Classic" has fallen back somewhat, from an high of approximately 0.0056 btc, a few days ago to now over night to about 0.004 btc ending the day of approximately 0.0045 btc.

At the same time the King is slowly recovering from a low of $548 to just under $30 to currently trading at $576, but still struggling to make it back to its former value of a week or so ago, before the $77 million dollar worth of the coins stolen in Hong Kong exchange Bitfinex .

However its the battle against the ethereums is the battle to watch. Who is winning it hard to tell. Some kind of tag-of-war taking place between the two.

We have now seen Ethereum (ETH) fighting back, putting Classic (ETC) in its place. ETC grown to a value 33% of ETH the other day, now force to shrink to approximately 23% of ETH. Although the ETH chart shows falling off again.

Steem at the same time is steady, but still trading much lower than a few days ago. Will steem join this battle for the top, are will we see the excitement that was here in the community just fade away? Let us hope not.

The battle continues across the exchanges.

I upvote U

Ethereum (ETH) is clearly winning the battle over Ethereum Classic (ETC).

The above link is the most important graph when regarding ETC/ETH. The hash rate ratio and price ratio rise and fall together. At it's peak, an ETC coin was worth roughly 45% of an ETH coin (not pictured on the graph I linked because that updates every 30 minutes, but at one point in that interval it reached .45), but this was mostly due to hype, and the hash rate during that time was more than 10% lower, so the price was untenable.http://slacknation.github.io/medium/13/13.html

The price and hash rate graph does seem to be offset somewhat, sort of similar to how a sine curve and cosine curve reach peaks and valleys at differences of pi/2. This is explained because miners and investors are working based on economics. Miners see the price rise and change what they are mining, while investors see the hash rate low, consider the position untenable and sell. Then the graphs reverse. As of this moment, the hash rate ratio is 19.42% while the price ratio is 23.64%, meaning we can expect the hash rate ratio to rise and the price ratio to fall.

Now, if you notice, the overall trend of the graph is downwards. This is mostly due to two things:

Interest in ETC will probably always exist, but over time it will decrease, especially when combined with the fact that ETC will have to do its own hard fork down the road when dealing with Proof-of-Work to Proof-of-Stake switches (or in the altnernative case, a hard fork will need to be done to defuse the difficulty bomb)

vote up this post https://steemit.com/languagetags/@leprechaun/use-iso-language-tags-for-steemit-is-multilingual and I'll vote up yours.