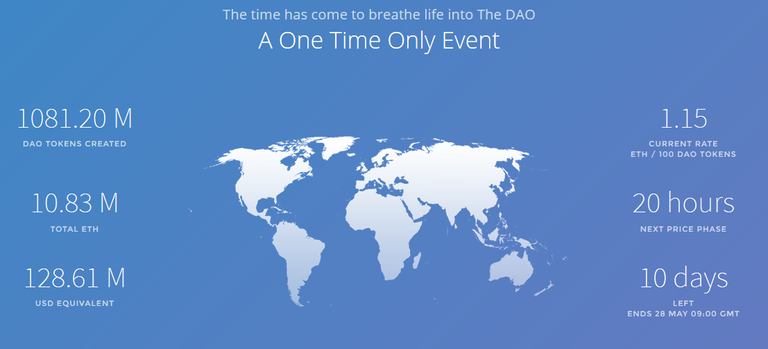

As I write this, the "The DAO" Ethereum address has 9,632,000 Ether in its contract, currently worth roughly $95 million USD. [Updated stats in pic below] Where do you see this headed? I was a balanced combination of skeptical and optimistic when I first read about this project. However I'm more skeptical now, I wonder if it will become a victim of its own success.

I'm sure Steven Tual and crew are very excited to collect a ton of money for their blockchain lock company and in a roundabout way have found themselves a very easy way to get investment. That is, if "The DAO" cooperates. I think it will. I also think "The DAO" might be a bit too cooperative with other companies or proposals that get sold as the best thing ever but fail to deliver. It's not hard to find plenty of examples of Kickstarters where some idea ended up raising a ton of funds with nothing to show for it. Overpromisers and scammers with slick marketing abilities must already be salivating at the potential of millions of dollars of value sitting there, waiting for some misguided DAO voters to part with their investment.

Notice how I refer to "The DAO" in quotes? I think it's unfortunate that they used such a generic name for this, implying it's the One DAO to Rule Them All. Now that it's gargantuan and still growing fast, this concept will live or die in this massive, unproven experiment where even little hiccups could be blown out of proportion by the media.

In the time it took to write this, "The DAO"'s account grew to 9,650,000 Ether.

Did you know that two letters out of the three in "DAO" have been initially proposed by the creator of BitShares and Steem? Did you also know that BitShares was the first profitable DAO (we call it DAC though) that has ever existed? Did you know that in contrast to "The DAO", that is mostly a VC firm for startups, with BitShares you can own a bank, an exchange and a payment providing?

People are so buzzed and easy to manipulate. It's beyond my understanding that the DAO has "raised" $100M (in fact it just locked away ETH worth $100M at current valuation) .. while BitShares has a total marketcap of <$10M. It's a weird world in which people give their money to those that make the most buzz.

In the current environment crypto funding only drives the price of the asset that is used for funding down (Bitcoin or Bitshares or Ether for example). The reason for this is very simple: The asset is in the hand of a few.

They were holding strong while other dumped. The price became stable or even climbed.

But now, they think, they do something good with their asset and want to buy another asset with it.

What happens next? The payed asset will get dumped by the receiver, because he can't use it directly yet. He only got it in order to use it for his company and the only way to USE it, is to dump it and use the money...

This can only change, if crypto is widely used so that payments in ether, bitcoin or bitshares don't have to be dumped in order to be used for payments.

maybe we must make some buzz too(?)

I am a tech guy and refuse to manipulate people with marketing and buzz. I'd rather help improve the ecosystem by providing service, tools and consultation.

We should merge Steem with Bitshares and Peerplays and create "the DAC"!

I disagree. They all serve different "markets" or audiences. People that

are interested in using BitShares shouldn't be forced to interpret

blocks full of STEEM posts and games.

Some useful features should still be assimilated into BitShares and

Peerplays, but it does make sense to have them on different chains for

scalability reasons.

The Super-DAC was a stupid idea IMHO. We learned it the hard way, but we

learned it finally.

@ xeroc... I was joking about merging Steem , Bitshares and Peerplays to create "THE DAC"..I just wanted to make fun of "THE DAO"...

Also read the an open letter to "the DAO" curators.

I think "the DAO" will face similar challenges as BitShares DAC did. 9,6 Mio soled Ether means probably hundred thousands of individual voters who have to decide how to best use these funds. The voting activity probably will be still around 30% as in any major election. It will be a very interesting experience for a new type of direct governance and decision finding. It is also very good for Slock.it giving them enough funds to develop their products without additional VC money.

Does "the DAO" pays out dividends or do investors only gain through value raise?

The DAO token is similar to a FEE BACKED ASSET in BitShares, just that the "fees" generated are from those companies that received funding from "the DAO". How much the companies (like slockit) receive and how much they share their profits with "theDAO" has to be aggreed upon by DAO holders. I heard of 5% of slockits profits to be payed back to DAO holders. Don't know how that works out though. If this happens by means of the ETH token, then you better just stayed in ETH :)

What will happen to ether price once the DAO decide to start cash out in usd? I think that buying the DAO and shorting ETH doesn't sound a bad idea..

Ok, that is interesting. So Slock.it just shares 5% of their total profits with "The DAO". Is "The DAO" a legal shareholder of Slock.it with 5% equity? How much money is Slock.it proposal asking for?

Are the paybacks another smart contract?

At the end, a DAO investment can take several years to really pay back any dividends. Quite an investment...

It would be too funny if THE DAO loses a big chunk of their evaluation with an ETH price drop. Wouldn´t be the first time for ETH to lose money through such a deal. The DAO has no option to hedge themselves against an ETH price drop.

It can enter a contract for difference assuming it can find millions of dollars of eth investors willing to leverage up.

Is the DAO unable to fund big projects?

Is there a difference a difference betwen DAO and BitShares fee backed asset? I can not understand why DAO got so much funds.

As far as I understand, "the DAO" is a VC firm that could potentially

invest in several "companies" while a Fee Backed asset is an

"investment" in a particular feature on the BitShares chain.

That said, "the DAO" is potentially more flexible than FBA from the

investors perspective while FBAs are more customized/specialized.

Happy to read a serious article about DAO.

We need serious article thanks the comunity !