I'm absolutely befuddled by the spectacular stall of the Mercury Protocol's ICO, which has raised a paltry 314 ETH in the past 24 hours as of 3:18 PST Friday, Oct 27th. This offers us a good chance to look at crowdsale structures and using blockchain explorers like etherscan.

First off, I bought into this ICO soon after it went live, and I want it to succeed. I don't intend to sell, and in fact am a user of Dust and hope to be an early adopter of Broadcast, the next Mercury Protocol supported app. This is not a hit piece.

In case you didn't follow the Mercury Protocol before, here's a quick synopsis on how the crowdsale was structured: the team whitelisted over 11,000 people the past few weeks, who sent their ID and an ETH address to the MP. Once you were whitelisted (basically ensuring you didn't live in NY, or China, or other jurisdictions they weren't selling to), you could buy a limited amount of the Global Messaging Token (GMT) for the first 8 hours of the crowdsale. The limit was calculated as such: $20,000,000 (hard cap) divided by number of whitelisted people. The Mercury team announced this cap would be 7 ETH. This gave everyone who was interested a fair and equal opportunity to buy GMT.

The next four hours of the sale, after the 7 ETH limit, raise the limit to 4x, to a maximum per-ETH-address purchase of 28 ETH. I watched closely to see if it would sell out here, and if it was looking like it would, I was going to buy more.[1]

Then, the sale went uncapped. Expectations were high (ok, my expectations were high) that some whales would scoop in and begin buying large chunks of GMT.

As we can see, that didn't happen

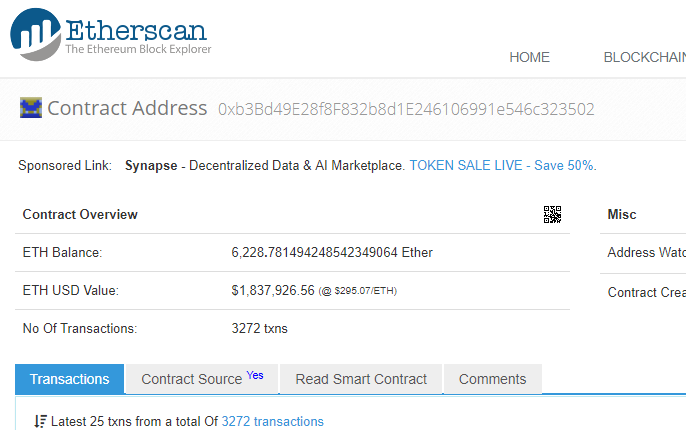

Instead, the sale stalled. It's about 50 some odd hours since the sale began, and the amount raised is only $1.8 million!

This is an ICO with a functioning app and a tech billionaire (Mark Cuban) behind it...and there's nobody buying! What's going on here?

Using Etherscan to Probe the Blockchain

Blockchain explorers are incredibly powerful tools that allow us to look up transactions on the blockchain and gather data. Everything that happens on the blockchain is locked into history and unable to be tampered with, which is really cool, but it's also publicly available, which is even cooler. So we can look right now at the crowdsale address of the GMT sale and look at all the transactions that took place.

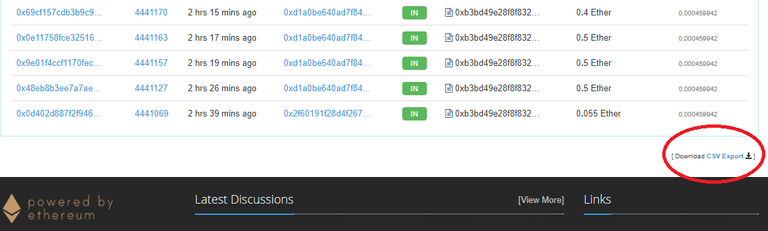

This is an incredibly helpful tool: CSV exports!

I downloaded the past 2000 transactions, which allowed me to easily use excel to find the past 24 hours and add up how much ETH has been donated since. As I said at the beginning of the article, it's only 314 (about $90,000).

Ether Delta

At the same time as GMT's token sale, Ether Delta began selling GMTs on the open market. This was possible as GMTs were immediately sent to investors upon purchase. This operated as something of a back door for people to buy in who were not approved (NY or China residents), and the price fluctuation on ED were watched very closely by arbitrageurs who could make quick ETH by immediately dumping GMT onto ED for a profit.

ED's GMT volume is $40,000 for the past 24 hours. That's a Dust notification at the top!

ED's volume is about 5% of total GMT volume over the past 24 hours, so I wouldn't consider that a real factor.

Is Momentum the Problem?

Mercury Protocol made a few choices that were designed to allow a large number of investors to buy in, which I really appreciated. I'm not sure it helped them, however, as ETH flowed in very slowly the first day of the sale.

Were casual onlookers unaware of the restrictions to the buy in for the first 8 hours?

Was the approximately 1000 individuals out of 11000 registered buying GMT a clear signal of disinterest to potential investors? This high level of transparency was a good move by the Mercury team, and I hope to see more crowdsales doing it this way, but I have to ask: did it contribute to the slowdown in buyers of GMT?

Why is a token with a working app, with an all start team backed by tech billionaire Mark Cuban (whom you can text in the app!) not able to raise even $2 million in a market that famously threw over $200 million at an untested married couple without a product a few months ago?

The market for ICOs certainly seems irrational at times. I think the Mercury team has made wise decisions in how they've approached this crowdsale, but the market disagrees so far. I can't help but think if this was one month ago the results would be different.

Is the age of the ICO done? Or is the upcoming Bitcoin hard fork keeping too much value in BTC, to the detriment ETH and alt coins?

I'd like to hear your thoughts!

[1] My gut tells me others were thinking the same thing, as I'm not a very original investor.

ICO party entering the hangover period.

So-called investors starting to realise that 98% of ICO raised funds are simply gone.

DotCom v. 3.0

I don't think it's nearly that simple. The 95-98% failure rate gospel is unproven and people need to stop saying that as if it's a fait accompli.

After the DAO hack last year, Plutus had a crowdsale and only raised about $1 million in ETH. It wasn't until November that Singular DTV had their crowdsale, which sold out very quickly!

ICOs were also unpopular earlier this year when ETH was making a giant run up. It took a while for people to stop buying ETH and start buying ERC20 tokens and ICOs, but many went stratospheric.

The instant 5-10x returns missing may be discouraging speculation, but that doesn't mean there still aren't great ERC20 tokens to buy.

It's not just Mercury. ICOs raised 800M in Sept, a record. Oct. projections are closer to $200M, a severe correction. This owes perhaps to lower performance from ICOs; if true, October's returns will be even lower (judging by TokenData) and I don't expect us to rebound to late-summer, early fall 2017 #'s anytime soon. Many of those throwing ICOs in Oct. have been surprised by lack of interest. The BTC fork is not helping with many investors staying locked in Bitcoin until Nov 16 (B2X). Yes the crypto-investor community is not the most rational and makes most decisions based on social proof. ICO's be warned: the old, build it (the ICO), and they will come is over. Crypto co's cannot take it for granted; like it or not, co's have to revisit their assumptions and redouble their marketing efforts.

"Yes the crypto-investor community is not the most rational and makes most decisions based on social proof."

I tend to agree with the first part, although with the big money coming in that is less philosophically aligned with the early adopters of bitcoin, we'll see more rational markets soon enough. The days when a small cadre of BTC maximalists can move markets from a few r/bitcoin posts (shadowbanning those who disagree) are coming to an end.

I think build it, and they will come is just starting in ICO world.

vitalik's post ultimate deterrent 😂

I missed it...what did he post?

He said that 90% of the token startups will fail. And the best response to that was: 90% of all startups fail.

Thanks for the explanation.

I am a huge Vitalik fan, but I disagree with him on this one, in part.

I think if one spends a little time filtering out the noise: scams, ill thought out startups, etc that one can get to a much better % of startups that won't fail.

We'll wait and see!

Here's a step by step guide to setting up a wallet and buying Mercury Protocol (GMT): https://getcrypto.info/mercury-protocol/