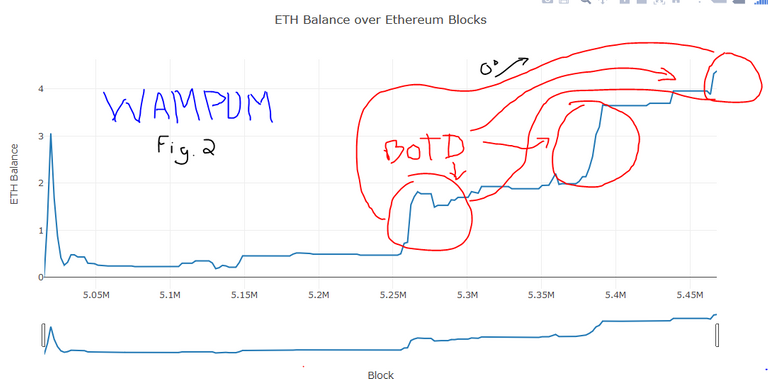

Geometric analysis reveals that the angle θ in Fig. 2 is given by θ = π + 2arcsin/R−rR +r. As such, the fractional coverages are given by F = 12 + 1 /π arcsin/R−rR +r/, and f = 12 − 1 π arcsin R−rR +r.

1.2.2 BOTD Shaft Length As with girth, the technical analysis for variation in BOTD shaft length differs between the two scenarios we consider. Let L be the length of the longer shaft (strong hand) and be the length of the shorter shaft (weak hand). In the shaft-to-shaft setting, we assume that an Etherstock holders hand will always be in contact with both BOTD shafts. This is true provided that the difference in shaft lengths does not exceed the width of the stock holders hand. Under this assumption, the cross-sectional geometry of Fig. 2 remains fixed throughout the BOTD action and the temporal fraction for both individuals is f-t = 1.

In the tip-to-tip setting, however, the stock holder is only making contact with one of the members at any moment. Clearly, more time will be spent grasping the longer shaft: call its fraction of the total jerk F, and the shorter shaft’s fraction f.

Since the total amount of time during a buy-of-the-day jerk is split between the shafts, F + f = 1. The tip-to-tip dependence of F and f on L and is complicated, and depends heavily on the stock holders’s jerking technique (fast or slow). For a stockholder who jerks at a constant velocity with near-instantaneous change in direction at the base of each shaft, F and f will be proportioned according to LL+ and L +, and more time will be spent on the longer shaft. For a buyer with a bursty jerk motion that slows at the base of each shaft, the fractional breakdown will be even regardless of relative BOTD shaft lengths. We assume the former, as it appears to be closer to optimal stock technique when the end goal is rapid dividend gratification.

Haha love etherstocks. All the pumps end up great! This article is hilarious

Lol nice vertical growth.

;)

heheheh Wangpum