Oh... Yeah!

So yesterday I wrote a post bashing the idea of creating a bonding system on Hive. This is bound to ruffle a few feathers as there are some very high-profile users on Hive that strongly support the bonding system. In particular Taskmaster, TheyCallMeDan, and Starkerz are the ones who I've seen championing the idea over the months and years.

So my post yesterday could be interpreted as an insult and assault against these fine gentlemen but that is certainly not my intent, as I am a pretty big fan of all three of those guys. It's just this one particular pitch that I strongly disagree with thus far.

In any case Matt (Starkerz) left a pretty long comment on yesterday's blog and he mentioned the Eurodollar system once again, and like a lightbulb going off in my head I was like, "Oh yeah! I watched that video like six months ago that I was supposed to write a post on!"

The Vidya:

Eurodollar: Private Bank Money

So I only took a couple lines of notes on this 22 minute long video... and it's been so long since I've watched it I'm going to have to watch it again. Before I do that let me just say that my understanding of the Eurodollar system is middling at best. In fact perhaps "middling" is giving myself way too much credit. But you know there are people on Hive that think we can mimic this type of strategy to great effect, so it is perhaps worth getting more acquainted with the concept.

Timestamp 1:00: The stakes are high!

The Eurodollar is hidden from us, and like a blackhole it impacts everything around us.

2:20: Where did it come from?

No one really knows for sure.

The Eurodollar market was for years hidden from economists and other readers of the financial press by a remarkable "conspiracy of silence".

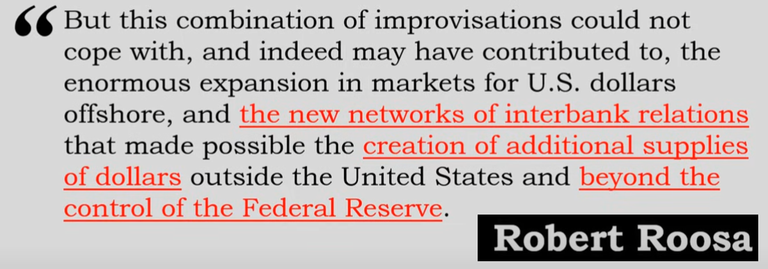

3:42: Classic Fractional reserve antics.

Federal Reserve Quote from 1960:

Since many European banks that obtain dollar deposits in this market redeposit these funds with other banks, the over-all volume of dollar interbank deposit claims outstanding abroad may well be a multiple of the amount [that we believe to be within this system].

4:20

Creating chains of liabilities in US dollar denominations

Creating a wholesale interbank network.

5:20

So already five minutes into this extremely dense 22 minute rampage we can see that the Eurodollar system is an insanely complicated network of banks in Europe who are basically borrowing and lending dollars without actually having the dollars. It would be like me buying a product from someone, say a used computer, and in return I give them a promise for $500. But then maybe I refurbish the computer and resell it for $600... but again I don't get dollars I get a promise for dollars.

These promises are as good as the real thing, so I pay off my $500 debt with the promise and the original seller can then use those promises somewhere else because this is a vast network that accepts the promises even though they aren't actually dollars and never will be. Dollars are simply how the value is measuring the promises in real time. The value of the promise doesn't come from the dollar itself, it comes from the reputation of the bank or institution borrowing/lending the money.

Thus there are a network of banks that trust each other enough to agree that these promises are just as good as the real thing. The collateral is giving them value, and that collateral could be reputation or secured by real estate or other liquidatable assets.

6:44

So it appears as though the way this network operates allows banks that would otherwise not be able to interact with foreign parties easily to nab good deals/rates across the world can now do so using the Eurodollar system. One example given being Japan creating and exporting a ton of cheap electronics for the world and they needed Eurodollar funding to do it because this was the path of least resistance within the financial sector.

So even as early as the 1960's this system was already global and being used in countries like Canada and Japan in order to get easy access to dollars that weren't actually dollars. Could this entire thing of happened because we were winding down the gold-standard and just printing money out of thin air? Seems likely. It also seems as though the Eurodollar could have played a significant roll in making the actual dollar the world reserve currency.

9:00

The Eurodollar system resembles more of a telecommunications network than what we would think of as a currency.

Now here's a truly interesting snippet...

Ledger money! Here in crypto land we know all about ledger money, do we not? Then isn't it interesting how crypto is basically the exact opposite of this. Ledger money on a bank ledger is a "fictional currency" considered to be "ghost money". Meanwhile decentralized ledger money on the blockchain is the hardest transparent currency as they come. It's information like this that continues to make me skeptical on topics like Hive bonds; why would we be trying to copy an inferior system from a time before the Internet existed?

But we aren't even half way done with the video!

This is an insane grind.

These banks do not have vaults full of bills; they have a ledger claim on another bank.

11:45

This quote is somewhat redundant but Milton Friedman is a super cool super smart economist (they are rare). Basically this just shows the realization of the United States coming to terms with the fact that these banks pretend to have dollars but rarely use or pay out actual dollars.

This video is intense

You must watch it if you haven't already.

Only 2 minutes.

13:20

It has NOTHING to do with pricing oil or commodities in any specific denomination.

It has NOTHING to do with the USG and it's mighty military.

Petrodollar DEBUNKED!

Yet again I see a super educated financial guru telling us that that dollar does not derive its value and world-reserve status from war and oil. I'm inclined to believe it as these things are all starting to make a little bit more sense to me. We've all seen the Bitcoin guys who love to say that fiat finances all war and the value of money is taken by force, but this is not the reality of the situation. Finance is way more complicated than the watered-down version we all get spoon-fed at the beginning of our crypto journey.

- It has to be widely available.

- It has to be widely accepted.

Wow! 16:40

So the real reason why the USD is the world reserve is because of the Eurodollar ledger system. Didn't see that one coming! Somebody else put us in charge... largely by accident. Crazy prospect when you think about it. Thus the USD could lose world reserve status if this system fails... which it eventually will. It's just a matter of time, and the Internet is already interconnected enough to bear the brunt of that fallout. What do we think it will be replaced with? Perhaps nothing and we'll have a financial Dark Age? Unlikely.

inb4 CBDC

A salute to to the Eurodollar:

We have to recognize that for a very long period of time [the Eurodollar system created] a period of unparalleled global prosperity humankind has never seen before.

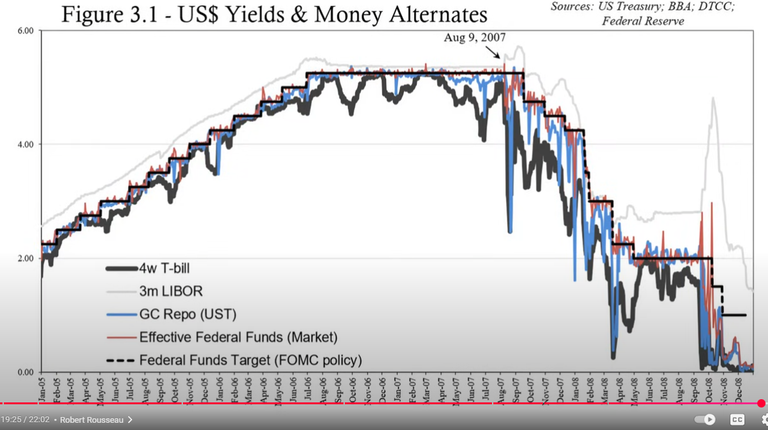

19:00: Nobody cared about the blackhole while it was working

Alan Greenspan has it covered with his interest rake hikes.

Since Aug 9th, 2007, the Eurodollar began to breakdown.

19:40

EVEN THOUGH THE EURODOLLAR'S MALFUNCTION HAS OPENED THE DOOR TO COMPETING MONETARY ARRANGEMENTS (CRYPTOCURRENCY / FIAT) AND OTHER COUNTRIES SETTING UP THEIR OWN BLOCKS... THE PROBLEM IS THEY CAN'T REPLICATE WHAT THE EURODOLLAR ACTUALLY DOES.

And after everything we just learned about this system... doesn't that make sense?

We can not replicate a network of worldwide banks that accept a reserve currency.

This thing took decades to come to fruition.

This is why when people on Hive try to tell me we're going to do bonds and reboot the Eurodollar system I get very confused as to the prospect of what appears to be a fantastic pipe dream.

- It has to be widely available.

- It has to be widely accepted.

If this was even remotely true for Hive the token would already be valued over $1000.

Hell make it $10000. That's only a $4T market cap. It barely flips BTC.

Those are the numbers we're dealing with.

In those respects no one has even come CLOSE to matching the capabilities on an even MALFUNCTIONING Eurodollar system.

Analysis

The Eurodollar system allowed the world to transact and issue money around the world as if the Internet had already existed as far back as the 1950's. It was an old-school communications network that transacted value very efficiently using centralized ledger technology. Today it still exists but it should be no surprise that this system is currently on the brink of collapse considering modern technology and the state of the European economy.

World Reserve Currency and Dollar Milkshake Theory start making a whole lot more sense when we realize that banks are running around agreeing to lend and owe in dollars when they don't actually have any dollars. Of course: the value of USD going up relative to other fiat currencies would cripple a system like this because it forces the lenders to pay back more than they thought they would owe. This is why deflation within a debt-based system is so dangerous.

Honestly after watching this video it makes me WAY more bullish on networks like Thorchain's Rune because that is actually a decentralized system that is trying to connect these ecosystems together and accomplish what the Eurodollar accomplished (massive amounts of permissionless interconnected liquidity pools)... except it's superior in nature because we can just swap the assets directly instead of all trying to use the same fake asset printed out of thin air and patched together with sticks and glue like they had to do before the internet existed.

Now more than ever: the idea of copying a centralized ledger system such as the Eurodollar is a hard-no from my end. To even pitch the idea like it's an option is overconfident at best. It is a mathematical networking impossibility within the current habitat. We should not be moving forward as if USD is going to continue to be a stable unit of value. The entire reason we are here is that we know this is not the case. Building things like bonds on Hive is a derivative of a derivative of a derivative. USD is a derivative of centralized trust within legacy finance. HBD is a derivative of USD. And bonds would be a derivative of HBD. That is not how we create a next generation financial system. That's a clusterfuck recipe for disaster.

The overriding point stands: Why do we care about the Eurodollar? Because the Eurodollar... whether we can see it or not... whether we appreciate it or not... whether we even acknowledge it or not...

that is our money.

Doing the work my friend.

Keep charging the battery. The world has already changed, they just don't know it yet.

I think Jeff is a doomer.

But he sure explains eurodollars well. Surely @edicted is missing some nuance re:

Oh whoops! We corrupted a young republic into a war hegemon, what a happy accident!

Good work though because none of this will change your conclusion.

The BALLS on those guys. The Eurodollar banks essentially counterfeiting US dollars on such a massive scale. I feel cucked, actually. I need to shoot somebody. But, it turns out I'm actually glad they did it, because I didn't love that whore dollar anyway. She just made me (relatively) rich, is all.

Also, I would love to see that last chart continued with the Ruble on it. There was a while there (after 2022) the Ruble was outperforming the dollar. Those days are gone, but it would be interesting to compare it to the other currencies' performance and the dollar.

Well, pegged to it, anyway. I've been feeling more uneasy about that as Hive rose in value recently. I lost money from my measly 15% on HBD savings, for one, but it made me think about what happens when HBD has lower value than Hive, even becomes a tiny, fractional value of Hive. It still works as a commercial currency because, as the eurodollar shows, everyone can do business in dollars they understand the value of. So, I relaxed and await the moonshot. Carry on.

Thanks!

I remember reading about this system here on Hive sometimes around the last cycle. I think either you or Task was writing about it. Very interesting.

was def task I barely understand it even now

Lol!

Very good information for those of us who do not know about the subject.

Thank you very much, @edicted

This makes us think that we at @Hive are on the right track....