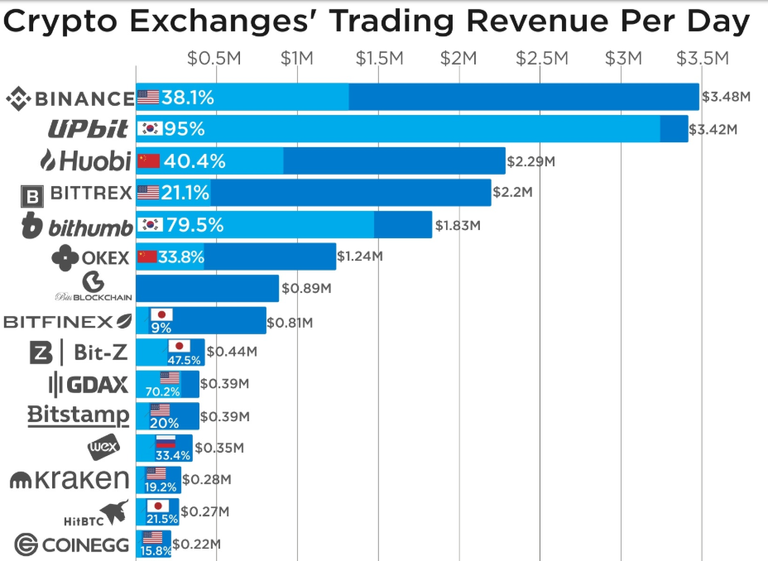

Seeing how well crypto exchanges have performed in the last couple of years sparked a great deal of interest within the industry, and people are looking into easy ways to start crypto exchanges. There are still copious jurisdictions that are in a high demand for an all-in-one exchange such as GCC and South America. Don’t get me started on the revenue that these top-tier exchanges are generating.

As could be seen in the table, Asian exchanges are blossoming as the regulation is more partial opening a window of opportunity for “not-fully-regulated-but-also-not-illegal” businesses to use the disruptive technology and gain momentum. Realistically, without a proper due diligence on the jurisdiction in demand, your crypto exchange would falter. The key lies in exploring the unplumbed grey area and targeting the users whose current solution does not meet their criteria and perhaps areas in which the solution is not yet presented. Once you settle in and users start pouring in — the monetization will definitely come!

As famed investor Peter Lynch said, “During the Gold Rush, most would-be miners lost money, but people who sold them picks, shovels, tents and blue-jeans made a nice profit.” In the gold rush that is the cryptocurrency boom, one might compare the manufacturer of picks and shovels to the owners and operators of crypto exchanges. In this article, we will cover just that — finding an easiest way of getting an exchange up and running while paying an attention to features, solutions providers, pricing, and the very process.

Components requisite for launching an exchange

Before you even think about the launch date, there are various tasks that need to be handled and streamlined so as to make the endmost product prestigious-looking and inviting.

Payment processing — integrating user account system which will enable your users to sign-up, maintain a balance, deposit and withdraw crypto assets, obtain bonuses, and place buy and sell orders is being conducted by the respective payment solution provider — SpectroCoin, PayCoiner, and CoinPayments being the most renowned.

Match/Trade engine — software which is used to match buy orders (bids) with sell orders (offers). This is the most essential part of the exchange as it allows users to trade amongst themselves and for some; it is the only reason for the registration. Similarly, trade engine empowers each fiat-crypto-fiat transaction to be executed for both the buyer and the seller.

UX/UI — developing state-of-the-art platform with self-explanatory steps for registration, trading, and any user-oriented actions takes a lot of time and effort. UI — people are prone to select exchanges which are clean and sharp design-wise (avoid creating a mishmash of a UI). Give a chance to your users to switch between advanced and basic facets as more devoted users may require special attention.

Scalability — determine the capacity of blockchain in processing transactions through the network. More enhanced scalable protocols can cater to more transactions and activity in the network without suffering from network stress. As more and more users join in, without a proper scaling solution your exchange will stagnate.

Security — not being technical-savvy is not an excuse. Hiring a third-party security audit providers to peruse smart contracts loopholes should be scheduled at least bi-monthly. The fact is that more than 30% of all the projects ever launched in the blockchain sphere were a target of some sort of hacking attempts. This caused a mayhem in which more than 2 billion USD have been taken. My advice — don’t increase the percentage and stay safe. Don’t get me started on KYC, AML, 2FA integration and the like…

Jurisdiction/Legal — make sure to do your due diligence before you launch an exchange. Currently, there are multifarious jurisdictions in which operating a crypto exchange is altogether banned. Malta was amongst the first countries to regulate DLT and its parliament enacted the bills into law. Crypto exchanges were amongst the industries which benefited the most out of this deal, as the VFA (Virtual Financial Act) finally enabled their legal operation.

Worthy mentions:

Balance of each user needs to be fully tracked in order to keep their wallet synced with a database such as MySQL or MongoDB.

Keep your bank account from getting closed as the banks are becoming more wary about crypto operations and tackling a federal law can be tricky.

The fact that crypto is now becoming mainstream and other blockchain-derived businesses are tightly linked to exchanges such as iGaming operators (launching tokens to be listed on your exchange), decentralized applications (who also have native tokens), crypto traders (who are always on the hunt for better maker and taker fees), e-commerce (using your platform to exchange assets), making your platform crucial for their operations.

Easier said than done, right? The process of actually launching a crypto exchange single-handedly seems long and tedious. It can happen that by the time you complete all the necessary actions, some other exchange may have emerged and take over your users. Stay calm, we’ve got you covered!

We have handpicked just the right software providers so that your dream exchange can be launched in a matter of weeks, days even! All the aforementioned components are included in the offers proposed by the exchange software providers and the end white label is tailor-made to your preferences.

Start a crypto exchange with Shifts turnkey solution

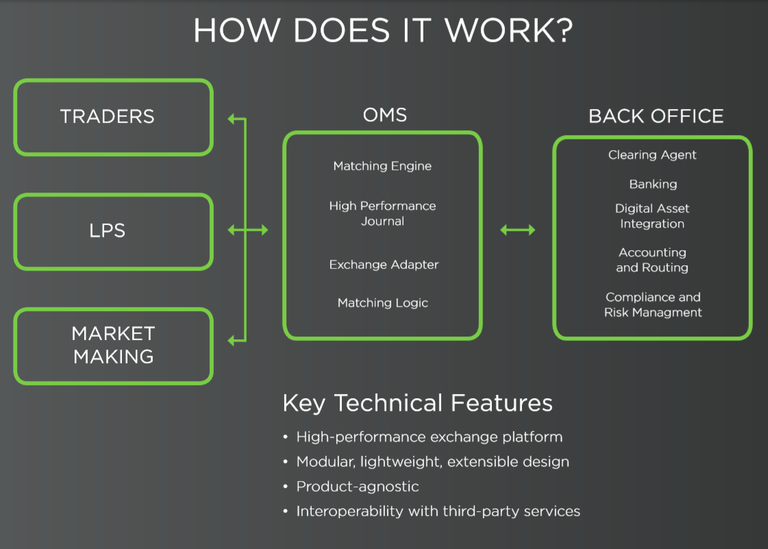

Shift’s platform provides a turn-key solution to launch your own crypto exchange featuring proprietary trading technology, proven legal & compliance solutions, aggregated liquidity and 24 hour support. It offers an unparalleled trading experience coupled with a variety of back-end solutions. Implementation and launch are configured by their experienced team in accordance to your predilections. The backend is designed for the operator to have complete control of the platform through an administrative dashboard.

People behind ShiftMarkets are saying that it takes no longer than 6 weeks for the exchange to be up and running.

Shift’s white label solution includes:

1. Variety of front and back-end solutions

2. Real-time trading of crypto assets

3. Multiple blockchain integrations to facilitate deposits and withdrawals

4. Full Order Management System

5. Dedicated wallet nodes

6. Matching engines

7. Back office

8. Flexible liquidity

9. 24/7 support

To top it all off, their UI and UX are on par with the latest blockchain trends positioning a clean layout which has a straightforward instructions for the newcomers. Similarly, advanced traders will have an insight into more cutting-edge features they are already accustomed to.

Key features:

Non-stop trading availability — resilient ecosystem allows around-the-clock trading.

Immediate settlement — all trades are occurring in real-time, that is, instantaneously across all instruments.

Order management system — Highly intuitive OMS tackles all order requests and forwards updates about completions and order status updates.

API-derived ecosystem –custom-made APIs enable easy integration across variety of services: KYC, 2FA, Bank integration, Withdrawal/Deposit, etc.

Payment Gateway — Shift’s strongest asset. It features 50+ cryptocurrencies; E-commerce plugin; Instant conversion to fiat; Payment button; and Point of Sale App (PoS).

ShiftMarkets have successfully launched over 80 cryptocurrency exchanges and over 100 brokerages since their launch.

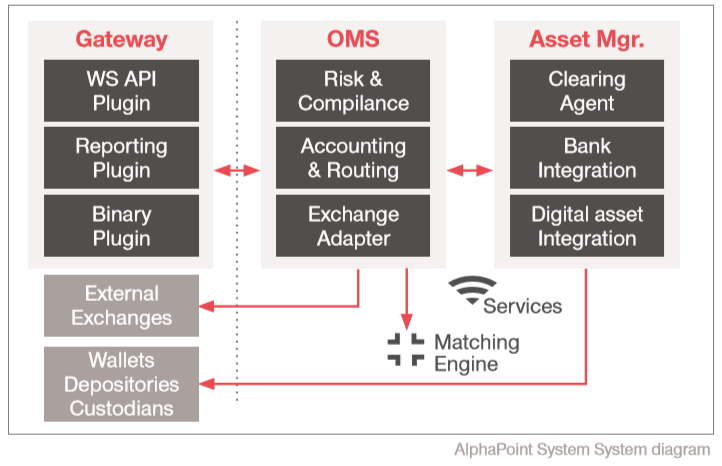

Launch a digital asset exchange with AlphaPoint

AlphaPoint’s platform enables exchanges to scale along with their customers from day one. The underlying software is appealing to both market’s savviest entrants and the inexperienced novices. Its white labels provide safe and firm backend solution which shelters all digital exchange information by employing layered security protocols for all assets. The platform empowers exchange operators, asset holders, broker-dealers, token-issuers, and custodians to expand their revenue models, augment liquidity, and streamline their business operations.

Building your brand with AlphaPoint ensures quality, versatility, and scalability whilst having an absolute input in what’s being done. The launch can be handled in less than a month, during which exchange operators can handpick the frontend toolset, choose preferred liquidity solution so as to obtain higher volume, and choose all digital currencies. What is even more exhilarating is that AlphaPoint’s matching engine which can execute up to 1 million transactions per second.

AlphaPoint’s white label includes:

1. Payment gateway

2. OMS

3. Asset manager

4. UX and UI customization

5. Matching engine

6. Firm risk management with support for KYC, AML and 2FA.

7. Full-scope frontend and backend resources

8. Facet support

9. Customizable trading instruments such as margin lending, futures, and swaps

10. Hosting solution secured by biometrics

The demand to launch, trade, and obtain digital assets — proprietary tokens incorporating financial instruments, loyalty points and digital currencies — has increased drastically over the past years, generating series of converging exchange ecosystems. AlphaPoint has assembled a protocol for enterprises drawn to the idea of launching and operating a first-class exchange. In addition, AlphaPoint also provides clear guidelines on how digital asset market works; what technology powers exchanges; which prerequisites are mandatory for businesses to get started; and ultimately which aspects mustn’t be overlooked in terms of exchange’s performance.

One-stop solution for your exchange software — Espay

Espay is a dominant exchange software provider who aims at helping operators take a deep dive in the exchange sphere. What makes Espay stand out are its solutions divided in 2 types:

Centralized exchange — enables centralized trading of digital assets with full-scale trading instruments combined with an ample of backend features. Fully tailor-made solutions allow customers to determine trading rules as well as opt-in for a fitting payment gateway either for fiat or crypto. White label bring various key attributes to the table:

1. Digital wallets — Multicurrency wallet supporting each integrated currency on your trading platform.

2. Liquidity management— surge your flow of users at the exchange.

3. Matching engine — Espay’s matching engine can support various order types every second.

4. Modular ecosystem — plugins ecosystem allow smooth and seamless course of KYC/AML, authentication, reporting and other services

5. Admin panel — insight into in-depth analytics, alert settings, notifications, risk monitoring, etc.

6. Full escrow management — stay informed about blockchain security protocols and upsurge quality of information with escrow and accuracy.

There are 3 different types of centralized exchange that Espay offers: White Label; Standard; and Enterprise and they all have different beneficial features:

White label — Customized brand; Merchant APIs; Multicurrency wallets; permanent support, etc.

Standard — Customized UI & UX; APIs configuration; Currency setup; 1 year customer support, etc.

Enterprise — Hybrid; Android & IOS Apps; Hot and cold wallets; Admin panel; AI tools; Source code changes, etc.

Decentralized exchange (DEX) — provides unparalleled security and anonymity. Non-custodial ecosystem bestows plentiful security precautions in order to avoid fraudulent activities.

1. Scalability and flow — as the users start piling up, Espay will provide sought-after scalability solution in order to streamline the trading flow.

2. High performance — wider focus on trading platform with multicurrency trading option rather than heavy development as well as infrastructure

3. Safety — cutting-edge security measures employed in data protection

Pricing

Now that you have cards put on the table, it’s on you to decide if you are going to take the solo approach, or trusting the experienced providers who are already well-equipped with knowledge, expertise, and experience.

It’s good to have in mind that software providers have different fees for integration, setup, and trading. On average, they would charge as following:

Integration fee — free to $20k depending on the deal; — Configuration, customization, branding, training

Monthly fee + support — $10k to $15k USD — Exchange platform product, Backoffice, CRM, Reporting, Bridge, Liquidity, Trade engine, Support services, etc

Volume fee — 0.1% to 0.3%

Out-of-scope development requirements — $150 — $1k depending on the task

New token integration/listing — $5k to $10k — Per token/blockchain implementation (legal + technology+ operations)

You have to take into consideration that some software providers take security deposits in order to make sure that you are going to respect your part of the deal.

Coda

We understand that the aforementioned data may be hard to absorb and is intricate. CoinPoint is here to make your process of starting an exchange seamless and streamlined with full accordance to your specifications. Being there from day one, we will consult and guide you on making the right decisions in terms of features, design, marketing, and development. Generating decentralized social media buzz, content marketing, influencer marketing, business development, affiliate marketing, FinTech SEO, education and media management will all in unison contribute to the immediate snowballing of the platform.

CoinPoint has been in the business since 2013 and through the years we have gone through different crypto periods, each special in its own way, and what is more importantly, we learned a lot from it. Once we had the sufficient knowledge, we started orchestrating business development, marketing campaigns, and content marketing for the exchanges which back then were small enterprises but afterwards grew into crypto conglomerates — Kraken, gate.io, and blockchain.info to name a few.