Moving Averages Technical Analysis

According to Wikipedia, a moving average is a calculation done to analyze data points by creating a series of averages of different subsets of the full data set. It can also be referred to as a moving mean or rolling mean and is a type of finite impulse response filter. Variations include: simple, and cumulative, or weighted forms

Basic Calculation:

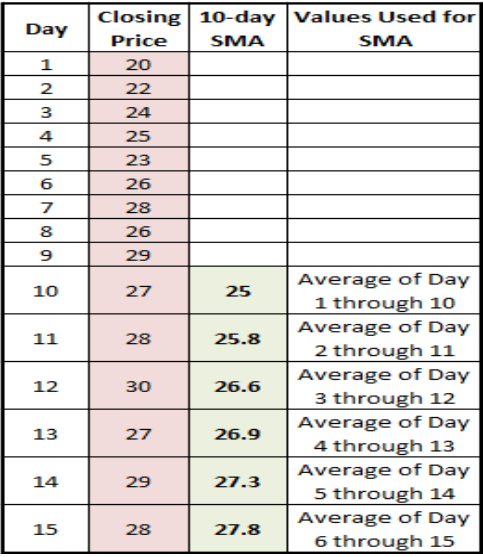

A moving average (MA) is calculated in different ways depending on its type. Let’s look at a simple moving average (SMA) of security with the following closing prices over 15 days:

Week 1 (5 days) – 20, 22, 24, 25, 23

Week 2 (5 days) – 26, 28, 26, 29, 27

Also, Week 3 (5 days) – 28, 30, 27, 29, 28

A 10-day moving average would average out the closing prices for the first 10 days as the first data point. The next data point would drop the earliest price, add the price on day 11 and take the average, and so on as shown below.

Why Use a Moving Average?

Moving averages help create a series of average values of different subsets of the full data set. A characteristic supplement to whenever arrangement understanding, a moving normal can smooth out the clamor of arbitrary anomalies and stress long haul patterns.

Specialized examiners and securities exchange dealers utilize moving midpoints in a colossal number of instruments, a significant number of which would not be conceivable without their application. Scarcely any pointers have been as solid.

The costs of securities and estimations of files are unstable and flighty, compelling brokers to search for any favorable position that empowers them to lessen hazard and improve the probability of benefit. The crucial suspicion of specialized investigation holds that past execution can educate future developments. Moving midpoints assume a focal job in the assurance of past value patterns.

How to Use Moving Averages?

A portion of the essential elements of a moving Average is to recognize patterns and inversions, measure the quality of a benefit’s energy and decide potential territories where an advantage will discover support or opposition. In this segment, we will call attention to how unique eras can screen energy and how moving midpoints can be gainful in deciding the arrangement of stop-misfortune orders.

Moreover, we will address a portion of the capacities and restrictions of moving midpoints that one ought to think about when utilizing them as a component of an exchanging procedure.

Trend

Moving averages identify the price trends of the commodity for traders who leverage trends in their trading strategies. As a lagging indicator, moving averages do not predict new trends but confirm trends once they are established.

Momentum

When the trader pays close attention to the time periods used in creating an average, valuable insights into different types of momentum is obtained. To find the short-term momentum of a commodity, the trader would look at the moving averages that focus on time periods of 20 days or less.

Medium termed momentum is gauged by observing moving averages with periods of 20 to 100 days. Any moving average consisting of periods greater than 100 days can be used to measure long termed momentum of a commodity.

A portion of the essential elements of a moving average is to recognize patterns and inversions, measure the quality of a benefit’s energy and decide potential territories where an advantage will discover support or opposition. In this segment, we will call attention to how unique eras can screen energy and how moving midpoints can be gainful in deciding the arrangement of stop-misfortune orders.

Moreover, we will address a portion of the capacities and restrictions of moving midpoints that one ought to think about when utilizing them as a component of an exchanging procedure.

Basing on the figure below strong upward momentum is conceived when shorter-term averages are located above longer termed ones. The two averages, however, must have a divergent. Meanwhile, when the shorter term average is below the long-term averages, downward momentum is realized. See the two charts below,

Support

Another regular utilization of moving midpoints is in deciding potential value underpins. It doesn’t take much involvement in managing moving midpoints to see that the falling cost of a benefit will frequently stop and invert bearing at indistinguishable dimension from an imperative normal.

For instance, on the diagram of Microsoft Corp. (MSFT) appeared in Figure 3, you can see that the 50-day and 75-day moving midpoints could prop up the cost on each pullback between late 2016 and February 2018. Numerous brokers will envision a bob off of major moving midpoints and will utilize other specialized markers as an affirmation of the normal move.

Get here detail info: How to Use Moving Averages?

Also read:

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

If you believe this is an error, please chat with us in the #cheetah-appeals channel in our discord.