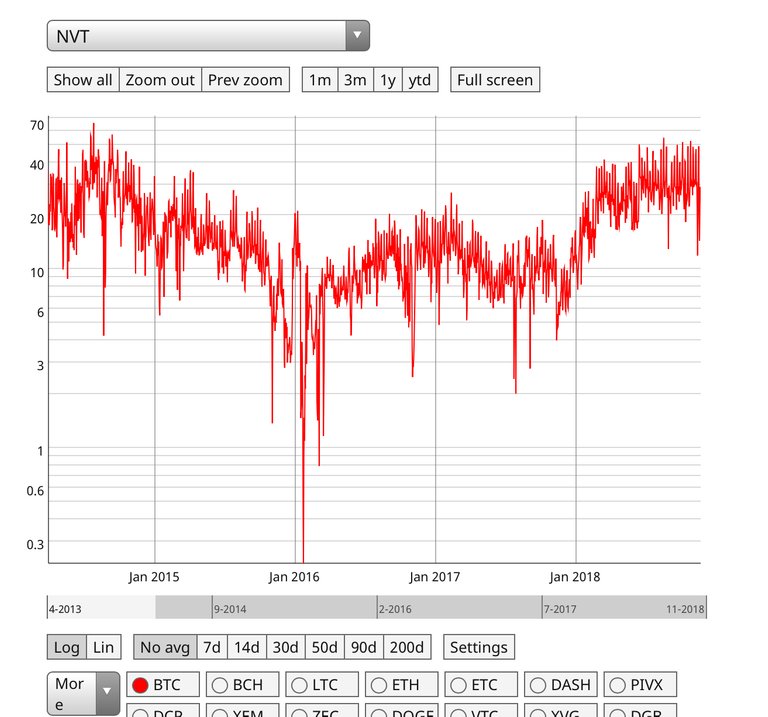

In a previous post on valuing BTC I mentioned it would need to get below a NVT ratio of 20 (~80m market cap) to give investors a greater return prospect. The market cap is currently $75B, so now what?

At this point if you are looking to invest in the crypto space and you already own BTC you need to look into XRP since it has started to outperform. The leader of ripple (one of the founders of XRP) has repeatedly compared BTC to Napster. I am not sure if he will be correct and it is to early for anyone to make that call. But having exposure to non-mining crypto assets seems prudent especially when they are outperforming BTC.

The market is effectively saying this crypto style will be the future, so having exposure here is prudent. The thing I don’t understand about XRP is why it is a deflationary asset. People will not want to use it to move money if they think it will be worth more in the future. An inflationary coin like stellar seems to be a better supply structure if you want to be the world's largest money mover.

Along with taking a small position in XRP, I am accumulating shares in a holding company (Fairfax India) that buys assets in India. India has a great macro outlook and a business friendly leader. The company was started by Fairfax Financial which has a long history of performing ethically and creating good returns. So far they have grown BV per share at a CAGR over 10% but the stock is selling at a discount to BV. Seems like a no brainer investment for the emotionally stable investor.

Congratulations @owinvestments! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!