Most people under the age of 35 don't give a toss about pensions, why should they? It's years off and most of the old people they encounter seem to have a few quid. Everything's going to be fine.....Right??.....WRONG!

The golden age of pensions died with the banking crisis in 2008, some might say before. Private pensions, for the most part are nothing but a giant scam to rob you blind and by the time you reach what you think is retirement age (65) you'll be expected to work another 10 years in order to receive what will most likely be a pittance.

First lets look at private pensions.... How much do you think you'll need to live on per year??? £10,000, £20,000 or £40,000.

Well the rough guide for how big you pension pot needs to be is. Pot = Annual pension x 30.

So if you think you'll need a modest £20,000 a year in retirement you need to have saved £600,000 by the time you come to retire. This equates to saving £15,000 a year for 40 years. Compounding will help somewhat but you'll still need to save a massive amount every month. Basically unless you work in the public sector you're screwed.

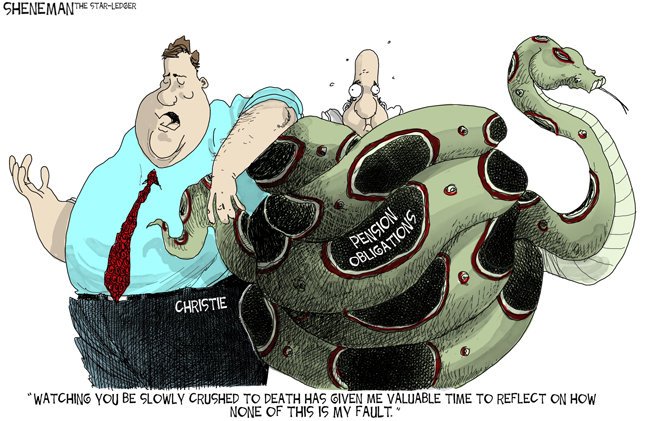

Now all those teachers and police men will now be saying.... Phew... Thank god I've got my cushy public funded pension. Well to be perfectly honest, their is a high probability that you're screwed too. Since 2008 the government has stepped in, creating many jobs to fill the void left by the private sector, most of these are useless admin/H&S/HR type roles which only reduce the efficiency of government, however fast forward 20 or 30 years and you've got a massive unfunded pension liability. Over the coming years expect those promised benefits to be greatly reduced. By the time you retire your pension benefits will be worth much less than what you though it would be.

So for 99% of people, private pensions will not provide nearly enough for you in your old age. But at least you're going to pick up the state pension?.... We'll see.

The state pension is currently £160 per week or £8300 per year, hardly a fortune but a nice top up to complement your final salary private pension. However, fast forward 20 or 30 years and it is highly likely that the state pension will be a) vastly reduced in real terms b) not start until you're 75 and c) be heavily means tested. For most working age people your national insurance contributions are a complete scam. The whole system is a total Ponzi scheme which works as such.

Current pensions are paid using the national insurance contributions of working age people. As people started to live longer the system was about to collapse. To ensure the Ponzi scheme could continue vast numbers of young eastern Europeans were allowed to come to the UK to work, the tax that they paid ensure that the system could continue. Pensioners where bailed out whilst the young got shafted by lower wages, higher housing costs, poorer public services, etc, etc. If we project forward to a time where the current (artificially large) working population starts to reach retirement age, what is going to happen..?? I think it's plain to see that the benefits that are going to be paid out will not be as generous as the current system (and I'm being nice here).

The BBC are already promoting this line. Which means that it's already has been decided what will happen.

Although the state pension is hard to live on alone, to buy an equivalent index-linked income from an insurance company would cost more than £250,000. Investment platform Hargreaves Lansdown estimates that to save that much would require £300 a month for 40 years.

Can we afford to give all workers a pension that generous?

So we're all screwed then?

Well, Yes and No. If you choose to ignore the problem and hope it will go away, which is most people, you can expect to spend your final years in poverty waiting to die. However, you can chose to do something about the situation yourself. Personally for me (and everyone is different) there are three things I am/going to do 1. ) Make sure you own your own home, in retirement rent will financially cripple you. 2. ) Buy properties and rent them out, these will provide a nice nest egg for your later years 3. ) Buy some bitcoin and never sell, this is pretty risky but there is a good chance one bitcoin could be worth a small fortune by the time you decide to retire.

Hope you enjoyed my post, feel free to comment, folllow, upvote etc.

-WetWipe