Honeywell International Inc. is a technology and manufacturing company. The Company operates through four segments: Aerospace, Home and Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. Honeywell (ticker:HON) is currently sitting at $165, rising 1.97% after the release of fourth quarter earnings. Honeywell (HON) reported a top and bottom line beat with its fourth-quarter result as revenue of $10.84 billion topped the consensus of $10.75. In an era of rapid growth of artificial intelligence (AI), Honeywell looks to be a must buy.

Aerospace revenue for Honeywell was up to $3.9 billion. This growth was mainly driven by air transportation, repair, overhaul activities, and sales of spares in business aviation. Honeywell's Home and building technologies (HBT) revenue was $2.6 billion. Consumer confidence has increased remarkably this quarter, so an increase of 5% in consumer goods has led to higher than expected returns for Honeywell within HBT. Moreover, both Safety and productivity solutions (SPS) and Performance materials and technologies (PMT) revenue increased by 12% and 9% respectively.

Looking forward to next quarter, management at Honeywell are expecting revenue to increase from 4% to 6%. Another interesting note, management also expects earnings per share to increase 9% to 13% to $1.87 to $1.93 with segment margins up 30 to 60 basis points to 19.1% to 19.4%.

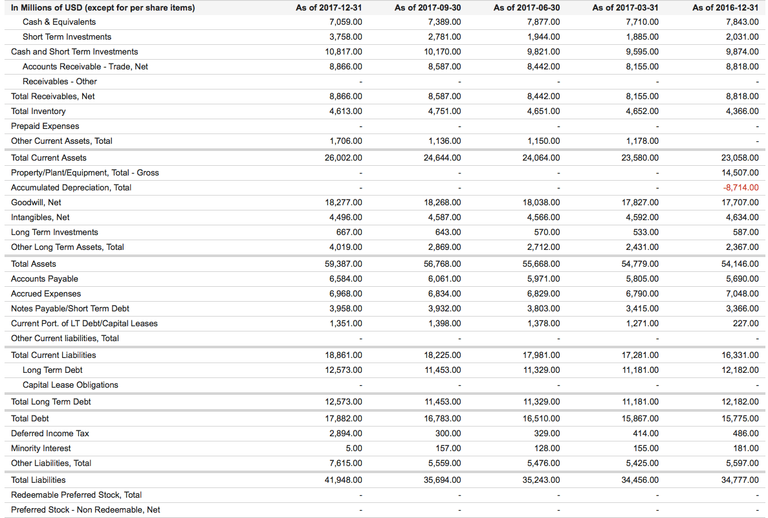

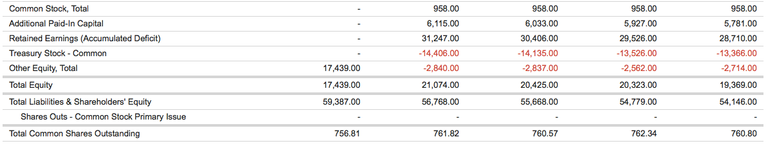

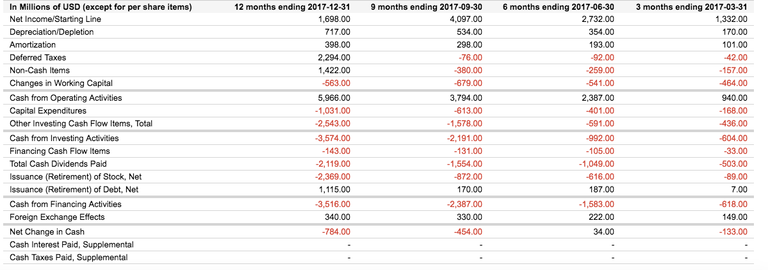

Below are the very healthy balance sheets and cash flow statements for Honeywell. According to these financials, Honeywell looks like a must buy for 2018.

Balance Sheet

Cash Flow

Congratulations @crl37! You received a personal award!

Click here to view your Board

Congratulations @crl37! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!