Rich Dad, Poor Dad is a story of Robert Kiyosaki. He had two dads.

One Dad had a PH.D. while the other one didn’t even finish high school. Although both dads earn a significant amount of money, poor Dad always struggled while rich Dad (the high school undergrad) was on his way to becoming one of the richest men in Hawaii. They both supported education but poor Dad focused on studying a career and rich Dad focused on studying money. Poor Dad died struggling financially and rich Dad died as one of the richest men in Hawaii. If you weren’t born with rich parents you can still become wealthy by using the principles from this book.

The first principle is: “The rich don't work for money."

Let’s look at a typical employee. He spends every hour of everyday working for money. He's dissatisfied with life and can't understand why he can never seem to get ahead. On the other hand, we have another employee who’s making just the same amount of money as the first one. The biggest difference is that he spends most of his time and money buying assets to add to his collection of properties that generate income. Both of these guys make the same amount but the typical employee spends money on his bills and spends whatever is left to have fun. Saving in a bank isn’t fun at all so any attempt to do that ends in failure. Is this situation more familiar to you? The one who spends money on assets soon earns extra income and becomes much wealthier.

The second principle is: “Financial Literacy”

If you want to get rich, it's not about how much money you make but it's about how much money you keep. The rich don’t trade time for money. Instead, they acquire assets that generate money even on their own. Intelligence solves problems and produces money. Money without intelligence is money soon done. Did you know that rich people acquire assets while the poor in the middle class acquire liabilities? Assets can make you become wealthy if you understand the difference between an asset and a liability. An asset is something that brings money into your pocket. A liability is something that takes money away from your pocket. Just about anything can be an asset or a liability depending on how it is used and the outcome.

For example, a vacation trip can only become an asset or investment if it actually strengthens your family relationships, renews your motivation and allows you to discuss your future plans in order to steer your life into the right direction. Some people work only to enjoy vacations. Some people take a vacation in order to “recharge” and perform better later on. In another example, a house is usually a liability because of monthly payments and/or maintenance expenses. The same house, when rented out generates income and therefore becomes an asset. This simple principle is not (or rarely) taught in schools. Therefore, financial literacy was not acquired by many, early on in life.

The third principle from the book is: “Mind your own business.”

To sum it up, The book is telling you that the rich focus on your assets what everyone else focuses on the income statements. To follow this principle, you need to build and maintain a strong group of assets. I could be a piece of real estate, a website, or anything that produces positive cash flow for you every single month.

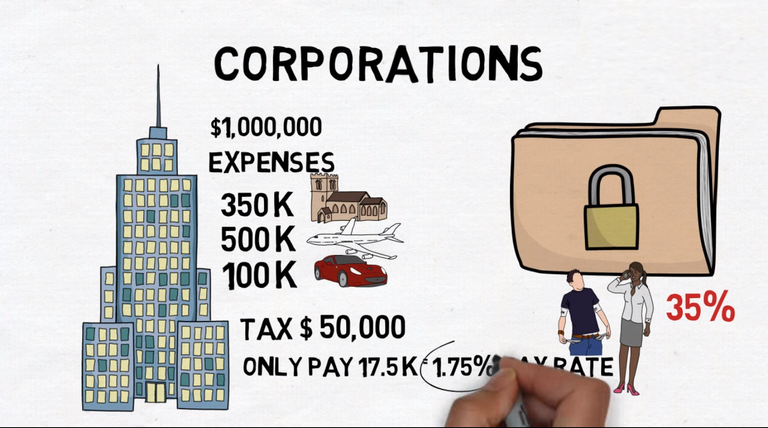

The fourth principle is: “The power of corporations.”

Many people don't know that corporations are one of the biggest secrets of the rich and serve as a smarter way to play the game of life. The rich use corporations to take advantage of legal tax loopholes and protect their money. If you already have a business and making a decent amount of money, you need to consider setting up a corporation. To get rich, the book says that you need to train your financial IQ, which is comprised of your knowledge across several broad subjects. To increase your financial IQ, you must increase your knowledge in the areas of accounting, investing, understanding markets, and the law. Accounting is for reading and understanding numbers. Investing is for using your money to make more money. Understanding markets is about the law of supply and demand. Understanding the law involves knowing how to keep more of your money legally. Although these subjects are all discussed in detail at school, many people still don't have a clue on how simple the application could be. to get started, simply look at all your purchases and classify them as assets or liabilities. The rest will be legalities and technicalities that you will need to learn to continue growing your assets.

Many people think about big buildings and thousands of employees when they hear the word “corporation”. The truth is, a corporation is at least, initially, a bunch of papers in a folder! -Yes. The biggest advantage of a corporation is it is taxed based on its “net income”, while employees get taxed from their “gross income”, Net income means, after paying bills and all expenses. To put it simply, employees get money after the “blood donation”. Corporations “donate” to the government in the form of taxes after spending their money within the context of the corporation. -Whatever is left gets taxed. In contrast, for an employee without financial knowledge, whatever is left is taken home to pay bills, ending up with zero savings. That’s how a secretary might pay a higher percentage in taxes than the owner of the corporation that she works for!

We have three more principles to discuss.

The fifth principle from the book is: “The rich invent money.” -Please stay tuned so I can share with you my personal point of view as well.

Please upvote, resteem and follow me, thank you.

Well done ..

The important thing is that you work ,Who works deserves

Great post

My brother recently learned about these principles and he thought my camera was a liability. He criticized my purchase but when I told him about Steemit and my photography blog, I was able to convince hin that it's an asset. It's also a good starting point to classify even what you already have and convert some liability into assets by using them differently.

This platform is expensive to build but as you can see, it's a big asset for those involved in making it. Spending time and money on your posts is really a good investment.

Great review... Thank you!

Just some additional thoughts i learnt from one of his other books;

"I rather work hard to build an asset than work hard for a job" Robert Kiyosaki

something i also found interesting is the definition of the types of assets...prior to reading this book, assets to me was just something that you have that will gain you some more money in the future. The example of owning a piece of land was the eye opener, because once you sell the land it's ownership changes therefore making it a one-time income!!!

The assets include;

*Personal development,

*circle of friends who share your dreams and values

*the power of your own network. e.t.c.

This leads to the financial intelligence (financial literacy)

financial literacy is the tool needed to transform your 'salary' into a residual income, so you can create financial freedom and time freedom

ONLY YOUR INVESTMENT can keep you going even after all the onions, amnesty, traveling, active salaries have left you drenched.

Excerpts from _"The Business of the 21st Century" by Robert Kiyosaki"

Thank you for sharing these! Robert Kiyosaki already has a number of books available on the web. As an added example from him, his books work as his assets because they generate income as well.

Yes...exactly. The 'I-quadrant' mentality!

cheers.

i really enjoyed your writing... i liked about you that you also care about your family.👍

Thank you.

I want to become a rich dad and the cheapest asset I am into right now is cryptocurrency investing. Since we are the early adaptors the appreciation of cryptocurrency will give some good figure in the future. Sure, risk is big. Really big.

Right. It's not for shallow stomachs/pockets and weak hands. The bigger the risk, the bigger the potential rewards too. Some think it's easy but it's not only money one needs. We have to learn many things or just rely on being lucky.

rich dad poor dad book.gif)

i really.enjoyed.your writing

I have read his books and seen him speak several times in different types of settings. I don't agree with all of what he says but his way of redefining what society has been fed is very important.

Yes! I love this book so much! By far one of the best I have ever read. Learned so much from it, and totally changed the way I viewed the world!

Whilst I agree with most of his book, what he doesn't push, and in my opinion should - is how we don't teach kids all this IN SCHOOL. We should at least be offering them monthly lessons and financial awareness and preferably financial independence ! I wish he'd promote that.

I have this book on my shelf but hadn't read it yet. Should surely give it a try.