Most of us are dreaming to be rich or wealthy someday which is really a good thing. Because if that happened, we can help more people esp. our loveones and friends.

But the questions are: what are you doing today to attain that dream of becoming wealthy someday? Have you set your goals already? one year, five years, ten year from now? Have you set all the necessary steps and plans to attain that goal?

These are just some of the questions that we need to answer and do the necessary actions to start whatever goals and plans that we have laid upon to be wealthy someday.

If you want to be wealthy, you can ask those rich people, the tycoons in our society (Philippines) on how they achieved their status today such as Henry Sy of SM Group of Companies, Lucio Tan (PNB-Allied Bank, PAL, ETON), John Gokongwei (URC, Robinson's, Cebu Pacific), Andrew Tan (Megaworld, Resort World, McDonald's) and etc, and one of their answers will be on how to budget or manage their money or finances when they were starting up and up to this very moment.

Several years ago, my previous company sponsored a Financial Literacy and Personality Development Marathon Seminars for all of its employees, batch by batch. I was on the third batch then.

I really like the seminars and learned a lot especially when it comes to "budgeting principles" or as per one of my mentors "money management principles" and I want to share those to you in this post.

Let's discuss first:

What is a budget?

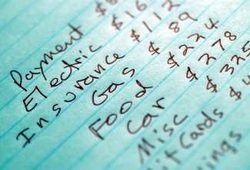

A budget is a plan that balances income and expenses. Very simple meaning. You just balance your income and expenses.

But, sad to say, many Filipinos or shall we say most people really don't plan or failed to plan especially when it comes to finances.

To help you gain additional knowledge about budgeting, below are the powerful money management principles that you can use in your everyday life.

You are very lucky because you will get and learn them for FREE. It will cost you more than a thousand pesos if you will attend Financial Seminars just to learn these principles. Enjoy reading!

Money Management or Budgeting Principle #1: Piso 'Yan Principle (Dollar Principle)

This principle really affected my everyday life when it comes to buying something. I really want to maximize the worth of a 'Piso' (One Philippine Peso - 1 Php). A 'Piso' difference really matters to me. You can't see me just buying anything without checking the quality of the item if its really worth it or else I won't buy it and just wait for its SALE.

After the holidays, most of the business establishments are on SALE, you can now buy the dress or shirts that you like in low low prices. But beware, before you buy, make sure you will use it at least once or twice a week. If its not, you are just wasting your money.

Another example is when it comes to sending SMS or text to anybody. I make sure I write all important messages or questions in just one SMS. Unfortunately, most of the time, the recipient will reply without answering any of my questions. :(

The goodnews nowadays are, most of the TELCOs are giving unlimited call & text which is good for us. We can choose whatever plan that we like to maximize that value of our 'Piso'.

For me, my budget for a month is only P200. I do have 4hours of call and 1000 sms to other networks. I am not endorsing the company that is offering this TU200 plan. :-)

Money Management or Budgeting Principle #2: Kurot 'Pinch' Principle

This principle reminds me of an old saying "Kung maliit ang kumot, matutong mamaluktot" (learn to bend if you have small blanket). The wisdom on this principle is very profound when it comes to finances.

To explain this, I want to tell a story.

There are three ladies who want to buy a new cellphone with a pricetag of P8,000.00. The first lady has P50,000.00 on her savings account. So, she can afford the cellphone and its like just a pinch or 'kurot' from her savings account.

The second lady has P8,000.00 in her savings account. And she can also afford it but nothing will remain in her savings account. It's already a 'dakot' from her savings.

Now the third lady has no savings at all but she also wants the cellphone. What do you think she will do? Of course, she will get the cellphone via loan from anybody, worse case from Bumbay with 20% interest!

Money Management or Budgeting Principle #3: 70-20-10 Principle

The 70-20-10 principle states that:

- 70% is allocated for living expenses (rent, food, clothing, etc)

- 20% is allocated for savings (retirement, investment, emergency fund, etc)

- 10% is allocated for tithes

How do you implement this principle into your life?

Supposing you are earning P25,000.00 a month. The 70% of it is P17,500.00. This will be your budget for food, rent, clothing and others. you must live within this budget in a month.

Now, the 20% of P25,000.00 is P5,000.00. This will be your automatic savings that you can use your investments, retirements, debt repayment, etc. If you want to be wealthy, you must save 20% of your monthly income.

Now, the 10% of P25,000.00 is P2,500.00. This will be your Tithes. You can give it to your Church if you are a Christian, if not, you can donate it to any charitable institutions that you like.

If you are a Christian, you should do tithing. Remember what the Lord said:

“Bring the whole tithe into the storehouse that there may be food in my house. ‘Test me in this,’ says the LORD Almighty, ‘and see if I will not throw open the floodgates of heaven and pour out so much blessing that there will not be room enough to store it.’” (Malachi 3:10)

May these principles help and guide your financial situations. Whatever circumstances you are in, whether you have small monthly income, the good thing is, you MUST DECIDE that starting today, you will follow these principles.

You know what, your DECISION today, will definitely change your future!

May God be Praise!

Joemz

I upvoted You

Great article @joemz!

Upvote for you!

Thanks a lot @cozyone123!