Hi friends,

The forum is open!

More and more people are talking about the inevitable end of this historic bull market. I have a number of friends who, seemingly every day, are going more and more to cash. Those with very large portfolios are buying large amounts of insurance. Question for everyone -- Does this feel like a top to you?

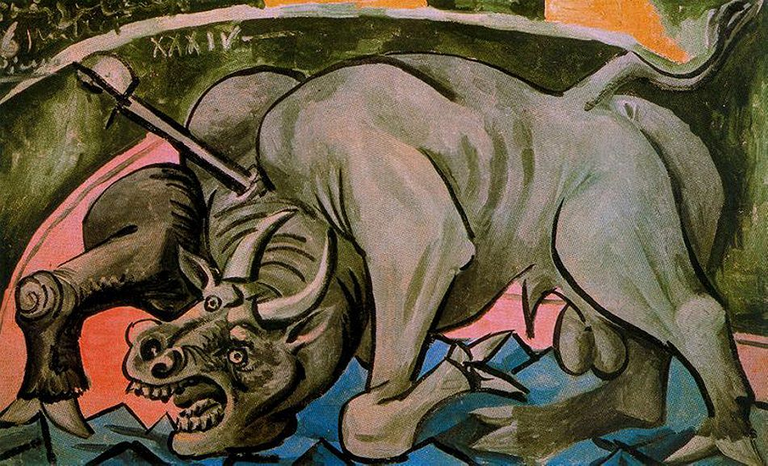

[The Dying Bull, by Pablo Picasso, 1934]

Objective 1: I'm searching for an answer among fellow investors, market observers, macro- and micro-analysts, and those who overhear others talking about this subject. If you have an opinion and/or observation, let us know.

Objective 2: Let's figure out how Steem and cryptos more generally figure into this moment and trend in the overall market.

I am going to post a series of articles on this theme, to see if we can reach consensus. Please resteem, so that we can get this conversation going :0

Submission #1

A Few Big Stocks Don't Tell the Whole Market Story

[Ben Carlson, Bloomberg, May 24, 2017]

Investors should also look at the number of equities that advance versus those that decline.

"Investors are becoming increasingly worried that a few stocks seem to be driving the returns in the S&P 500 this year. Apple is up more than 33 percent in 2017. Facebook and Amazon shares are both up around 28 percent. It’s estimated that these three companies account for almost one-third of the gain in the S&P 500.

The worry is that, with the gains so concentrated in so few names, the market rally is getting long in the tooth. The problem with this argument is that this is how it usually works with market-cap weighted indexes -- very few names account for the majority of the gains.

The Advance-Decline 1995-2000

S&P 500 versus market breadth since 2013:

There have been divergences in this time but, for the most part, the advance-decline line has tracked the stock market during the most recent rally."

Full story here -- https://www.bloomberg.com/view/articles/2017-05-24/a-few-big-stocks-don-t-tell-the-whole-market-story