Interest Rate Swaps (Money Markets)

Relationship between extremely volatile interbank rates and interest rate swaps

Toxic combination

Swaps are derivatives. ( 3 types of derivatives: option, future and swap )

Swaps can only be traded by institutionals.

Interest rate swaps + their notional amount = (418 trillion $, ...€, etc.)

Dexia's real bankruptcy (2008) was 1 interest rate swap

http://www.bis.org/statistics/derstats.htm?m=6%7C32%7C71=6%7C32%7C71 (swaps)

http://www.bis.org/statistics/d7.pdf

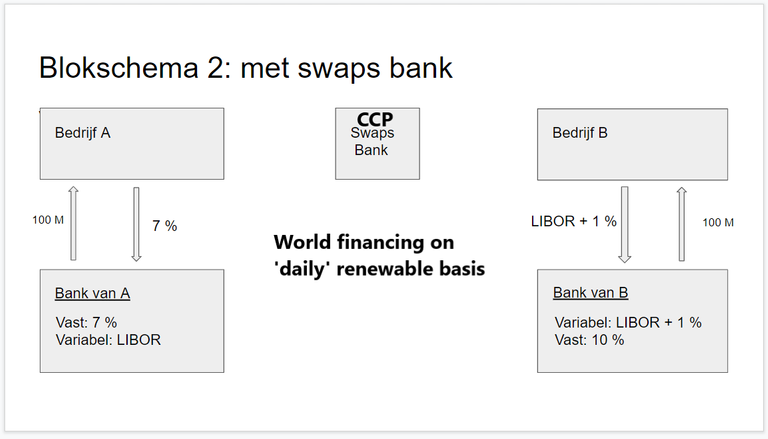

°Swapping fixed interest (months) for a variable interest (daily) is the core business for C.C.P.- banks. (They collect financial ‘money market’ security’s (banks loaning eachother) Asset Backed Security’s (A.B.S.) , made by a process called ‘securitization’ (the heart of Shadow Banking) , these are loans (packed) so the interest on this package is payed out on fixed dates to the owners of these 'structured product' , then these ABS flow to the CP market and are used as Asset Backed Commercial Paper = ABCP). This is the biggest market of all and it dominates the Money Markets and Money markets ALWAYS dominate the financial fiat system. All kinds of ABS (fixed income security's) can be used. But as history repeats always , when loans are made to people who cannot afford this and will default on their payments , then their is no interest payed and these 'structured products' (bonds actually) will 'dry up' and devaluate in price. This is (going to be) a big problem when their is stagflation or even 'little' inflation. https://www.zerohedge.com/news/2019-07-19/junk-bond-bubble-pictures-deflation-next. ° You can dig out this channel for : securitization , synthetic derivatives and much more. https://www.youtube.com/results?search_query=paddy+hirsch

In spoken language : A commercial bank lends money to a CCP in the morning (on daily basis), these CCP collects many loans from many banks , wraps it up , lend out again on daily basis. At the end of the day , gets the amount back with interest , pays the commercial bank bank with their interest and the interest surplus is for the CCP-bank. Only ‘A creditrating’ compagny’s can trade the Commercial Paper Market. (More or less but this is essentialy how World Financing is done , loans are renewed and only interest is payed ‘see Dexia’)

Principle

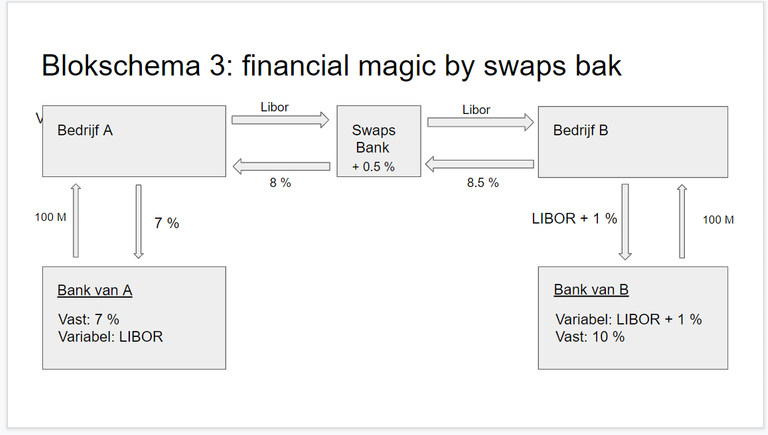

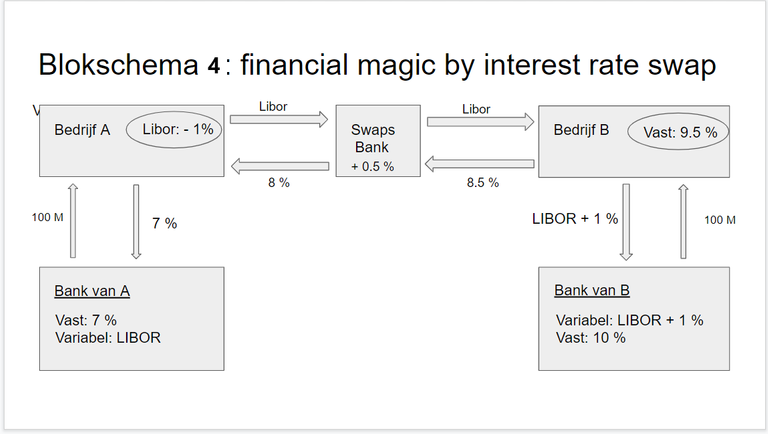

Swap from fixed to variable interest rates.

(Fixed-fixed, variable-variable should also be possible, I think, as long as there is a large enough difference (profitable) in interest between the interest rates to be swapped) Variable interest rate is the interbank rate, usually Libor. But also Euribor, Tibor, Kibor etc. can.

Fixed interest rate is always higher than variable. Same as hypo loan.

The party that expects a rise in the interest rate is long in the swap.

The party expecting a fall in interest rates is short in the swap. (variable)

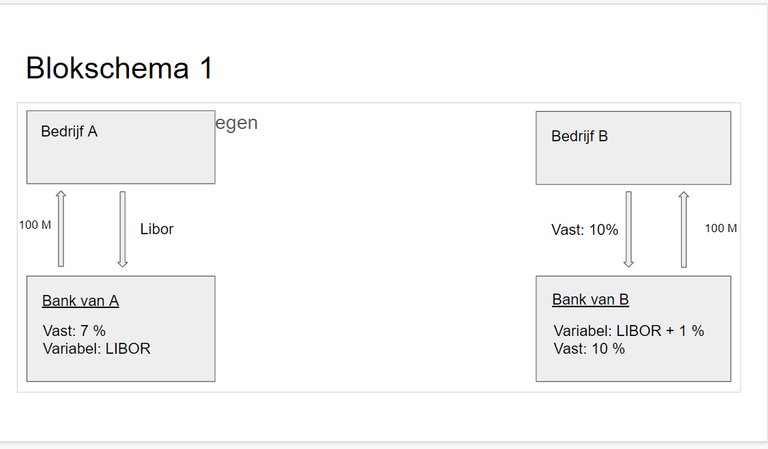

Example Interest Rate Swap

Condition: The loans are both the same size / high enough.

(Therefore only VIP players)

There is an interest rate difference between the two parties (party vs counterparty).

Purpose: swap fixed rate with variable rate and vice versa

Example from here:

Company A (credit rating A)

wants a loan of 100 million at a variable interest rate (LIBOR)

Bank of A borrows company A at variable interest rate equal to Libor.

Or at a fixed rate equal to 7%.

Company B (credit rating B) wants a loan of 100 million at a fixed interest rate.

Bank B borrows company B at a fixed rate of 10%.

Or at a variable interest rate equal to Libor +1%.

Pro’s :

These financial products push down overall ‘interest rates’

Mortgage interest rates etc. should become cheaper.

Contra’s :

- The illusion of a credit rating:

Creditworthiness is partly swapped here.

A sells his A rating to B for a premium.

B pays the ...

The creditworthiness of A is affected by this.

A credit rating of a company / country in short a party depends on their counterparties. Credit ratings do not mean anything. - Toxic

Interest rate swaps can handle any calm change.

They are settled every ... weeks/month(s).

However, an extremely rapid rise in interbank interest rates between two settlements is deadly for the variable payer. (See credit crisis 2008, crisis of confidence between banks, interbank interest rate on a number of days up to 20%, Dexia financed long-term mutual loans,...? with short-term loans (by means of an interest rate swap!), result: immediate bankruptcy).

Failure of the variable party is therefore perfectly normal.

In case of failure, this party can no longer repay the loan (notional amount).

//The Overnight Indexed Swap - Libor rate is a crazy financial combination of a variable rate (fixed by a daily price) and the same variable rate (continuously) variable in the day (OIS/libor spread). If it moves heavily, then something is wrong in a very short period of time (both libor or another interbancaire rate , so it’s a libor ‘derivated’ tool).

Danger Zone

This extreme increase was the case with the credit crisis in 2008.

A market of +500 trillion $ started to falter.

An amount greater than all the goods and services of the whole earth.

Total implosion of the monetary system.

This was the real danger of the crisis (no cds,cdo,...). Hidden from everyone , spotted by nobody.

Reality that far exceeds the fantasy.

Monitor the interbank rate (libor) + (OIS/libor spread). As simple as that. :-)

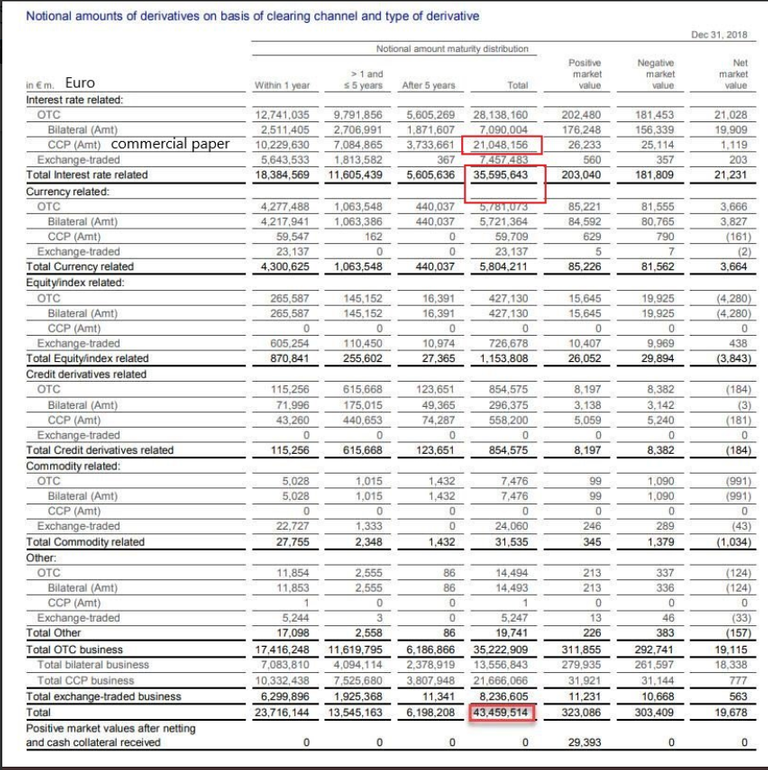

This is a derivatives list of Deutsche Bank :

WATCH MONEY MARKETS , they run the show ....

(fear eyes , nervousity explained ...)

Congratulations @stadsmanneke! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!