Hello, welcome to this series of articles related to financial education; I started this series of posts about financial education a few days ago with this article: Empirical financial education / The beginning in which I announced that my next publication would be about compound interest and here we are to talk a little about this exciting topic.

Image by Canva

I do not intend with this series of articles to set myself up as a master of finance and try to make people follow my advice, rather, I intend to share my experience while I educate myself financially and learn the basics of finance, then I do not rule out that my writings can serve as guidance for some who start and can take some tips to apply in their personal finances.

So I want to share with you this wonderful journey I have started towards financial freedom, and the first thing I must do is to educate myself in the most basic management of personal finances and then go climbing, so you can witness the growth of someone who started completely from scratch and was able to generate and multiply their finances to change the history of his family.

Compound interest

💲 Your Money Making Money! 💰 Sound Good? and to be honest it wasn't something that caught my attention or that I was interested in, maybe because I always thought I didn't have the resources to try something like this.After that brief introduction I will go into the subject sharing with you my experience, the first time I read about the concept of compound interest I did it through a publication written in this Blockchain by the friend @roleerob who wrote as follows:

This year I decided to educate myself, and convinced myself to try it from scratch, and here I am, maybe one day this story of overcoming will be talked about.

Image by Pixabay

My definition of compound interest:

If I have to define compound interest I will do it this way: It is the process by which, the invested capital is generating interest, which in turn generate interest, thus achieving that such capital grows exponentially, applying a constant reinvestment cycle every certain period of time.

Compound interest, in my opinion, is the most effective way to make your investment capital grow, logically, certain conditions apply.

As you will understand I am using the word investment capital intentionally, since compound interest can be practiced with a savings fund where you receive a certain percentage of interest for your money, whether it is 3, 5, 10 or 20%, the interest generated by those savings can be capitalized weekly, monthly or annually according to the offer of the bank or the investment fund where you put your capital.

"Warrent Buffet was asked, what is the secret to winning at investing? And the popular investor and CEO of Berkshire Hathaway, replied: the key is compound interest."

I particularly think that compound interest works in large and small, and the secret of it all must be the discipline of the investor, plus some things that I will mention later, so if you invest $100 in a small business of Bread and it generates about $30, that is 30% profit in a week, and you apply compound interest to that capital plus what is generated, the following week you would be investing $130.

If you reinvest the capital plus the profit generated, that is $130 and continue to generate 30% profit on the investment you would have to invest the following week $169; logically there are other variables that influence but basically it has the same effect as with a fixed interest on a capital, but this way you can appreciate the “magic” of compound interest.

It is best to invest in the world's most representative stock index and simply wait for compound interest to work its magic:

Warrent Buffet

Image by Pixabay

Simple example of compound interest:

| Data for calculations | Explanations | ||

|---|---|---|---|

| Initial capital | $1,000 | Also called its main | |

| Percentage of Profit | 20 % | Also called the interest rate or rate of return. | |

| How often do you calculate interest | Once a year | Also called the composite frequency | |

| Amount after the first year | $1,200 | The amount with which it started, plus the 20% 0.2 x $1,000 = $200 ($1,000 + $200 = $1,200) | |

| Amount after second year | $1,440 | The amount with which it started, plus the 20%, 0.2 x $1,200 = $240 ($1,200 + $240 = $1,440) |

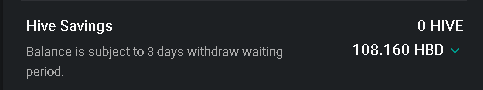

This simple example is based on the interest that generates having savings in HBD in the Blockchain HIVE, one of the best interests that are in the market right now, and that I personally would recommend if someone is interested in starting a savings system that generates passive earnings I think it is good to invest in HBD and put them in savings for a few years and you will see how your money grows exponentially, even more because you can capitalize your interest monthly, which enhances much more the “magic” of compound interest.

General considerations

There is no doubt that compound interest is a very effective way to make your capital grow, but it is necessary to take into account some tips, whether you make some kind of investment in a business or put your money in a savings fund, for this reason I want to share some information that I have read and that I consider relevant when applying compound interest.

You must take into account:

- Time is a very important factor when applying compound interest, therefore you must make sure that the money you are going to invest in this, is money that you will not have to use so soon or need to cover your basic needs, since the magic of compound interest is enhanced with the passage of time 5 years, 10 years, 20 years or 30 years, as you deem appropriate.

- Having basic needs covered and being debt free would be an ideal condition to apply compound interest to your capital, since experts advise that if you are going to start a business or any type of investment, it would be best to have a base, so that urgent needs do not stop the growth of your investment.

- A good friend of mine taught me that we must learn to control the “temptation” for immediate satisfaction and wait the necessary time to enjoy the fruit of our efforts; it is important to abstain from any type of celebration while we are focused on making our money grow, wedding anniversary, vacations, birthdays among others, we must be aware that there will be a next time.

- Being disciplined is essential in any process, my good friend mentioned before left me this phrase: “Plan your work. Work your plan!” So I think it is necessary to focus on elaborating a medium or long term plan and work on it in a disciplined way, adjusting to everything established in that plan.

Image by Pixabay

Compound interest from my personal experience

If Albert Einstein's phrase has the potential it states when he says: “Compound interest is the most powerful force in the universe”, then compound interest will introduce a substantial change in my economy, and in the economy of those who apply it in the next five to ten years, and although my experience in relation to it is too little to exhibit results, I will show what I started this year from scratch, in the Blockchain Hive with my savings plan.

It all started at the end of last year and the beginning of this one when a friend in his willingness to educate me financially guided me to the Saturday Savers community where I began to read and learn from the experience of the members of the community with their savings and investment plans, it was there that I felt motivated to start a savings plan designed by @eddie-earner called the 365 day challenge and consists of saving a penny every day for 365 days, using a mechanism that gradually increases your investment but that does not become so complicated for those who decide to try it.

You can read about the challenge in this Publication

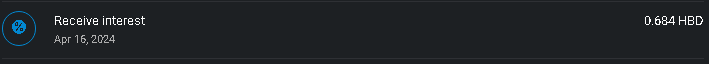

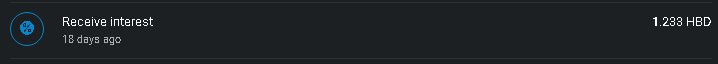

So I started a challenge that I took as a way to discipline myself and create the habit of saving, something I had never been able to do until now, in the development of this challenge I began to experience in a mild way the magic of compound interest and what I am going to show you are the interests that I have been capitalizing with very few resources invested but that are experiencing growth.

Starting with a penny, today I have 108,160 HBD, even though I am a little behind with my savings plan, however, I have capitalized the interests in four opportunities observing how the magic of compound interest does its work increasing my capital as time goes by.

In conclusion...

To conclude and not to make this publication so long, I will close with this wise phrase: “Plan your work. Work your plan!” I will continue to focus on my plan as circumstances allow me, in this case that we are healthy, and there is no emergency that alters the plan and makes me get off course, then I will find out where I will be and what is the effect on my economy of this wonder called compound interest.

That's all for now in this financial education class, I hope to continue sharing with you my personal experience on my way to financial freedom and success; in my next publication I will be talking about saving, to continue sharing my experience and learning about this exciting world of finances.

Posted Using InLeo Alpha

Congratulations @gerjer! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking