The mobile payments industry is one of the quickest growing fintech markets. In some countries like China, the UK and Sweden using phones have already become a more popular financial tool than traditional banks. In this article, we will explore, what are the benefits of using a mobile wallet and why you should become part of financial evolution right now.

What is a mobile wallet?

Image courtesy of India Today.

Mobile wallet is just like your traditional wallet, except, it’s digital and in your phone. It’s an app that you can connect your credit card or bank account details and use it to make digital payments and transactions. Modern mobile wallets provide a multitude of ways to make digital payments and are capable to replace e-banking in its current form.

We will talk about all the ways how you can make transactions with mobile wallets later in the article.

History of mobile wallets

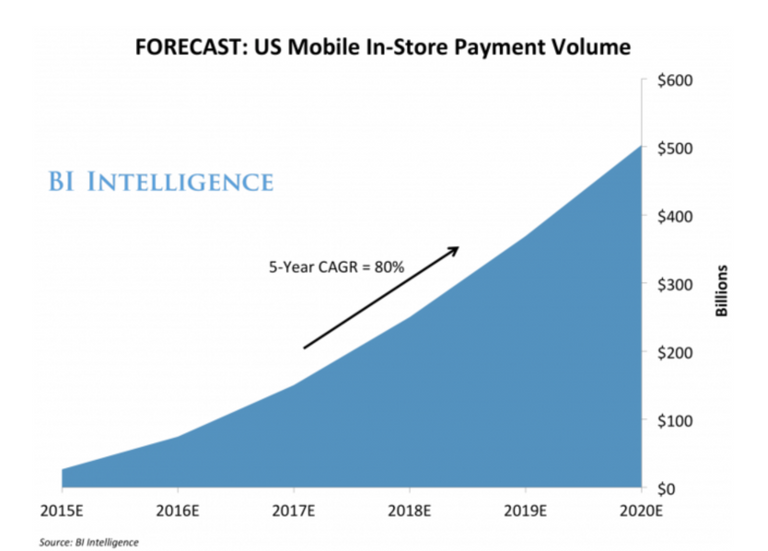

The first-ever use of a mobile wallet was made possible by Coca Cola. The company introduced a limited number of vending machines that allowed to buy drinks with text messages all the way back in 1997. Although, pretty far from the way the mobile wallet user experience is today, this invention is regarded as the first example of mobile wallet use.Bootstrap by the example of Coca Cola, other companies started playing around with the idea of using mobile devices for payments. Not far after, people were able to use their mobile phones to buy movie tickets and order food. By 2003 over 93 million mobile device users were taking advantage of mobile payments in their everyday lives.The trend of using mobile devices for payments kept gaining traction and by 2011 major companies began to get into the mix. This is when Google released their popular own mobile wallet solution named Google Wallet. Although this app had many limitations and payments were accepted by a very limited number of vendors the applications and user experience were revolutionary. With more adoption and more payment options, mobile wallets could now replace the traditional ones. Soon after Apple also saw the potential of the industry and developed their answer to Google’s product. In 2013, Apple Pay was announced. Supercharged with money-as-text-messages transfer option and NFC technology, Apple managed to broaden the possibilities made available with mobile wallets.The popularity of mobile payments solutions can not be denied, as according to statistics mobile payments volume worldwide is going to reach to $503 billion by 2020.

Image courtesy of Business Insider

Adoption of mobile wallets

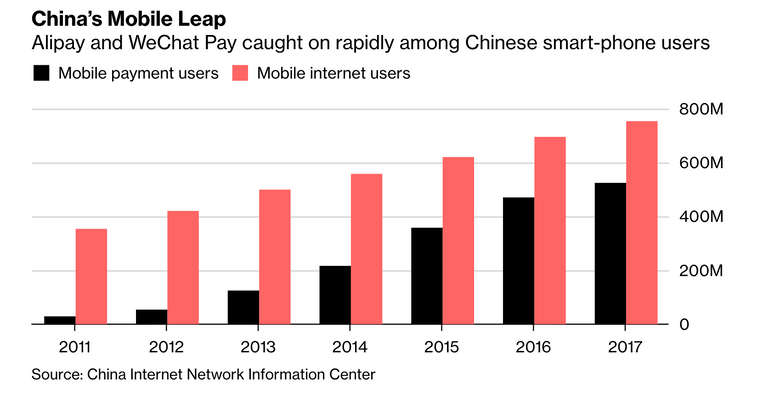

It should be noted that the popularity of mobile payments is not rising the same in all countries. Some nations are going cashless much faster than others, and one of the frontrunners in the mobile wallet industry is definitely China. The wild popularity of mobile payments in China should be largely contributed to two corporate giants: Tencent Holding Ltd.’s WeChat and Alipay, part of Zhejiang Ant Small & Micro Financial Group, which is an affiliate of online retailer Alibaba Group Holding Ltd.At one point in 2017, Alipay processed 256,000 transactions in one second, which surpassed the busiest hours of the worldwide Visa network by a whopping 10 times. According to the company’s claims, Alipay is used by 850 million people around the world. However, it would be safe to assume that most of the demographic are Chinese.

Unlike western developments, both Chinese apps rely heavily on QR codes to complete payments. On the contrary, Apple Pay relies on a technology named near-field communication, which allows clients to utilize point-of-sale terminals on locations and pay with their phones similarly to how they would with plastic cards. Many major corporations and banks have since come forward with their own mobile payments solutions, especially in the US. However, most of the attempts to catch up with Chinese Giants and mobile payments pioneers and not very successful.

Image courtesy of Bloomberg

Why should you use a mobile wallet?

There are many advantages to using mobile wallets compared to more traditional payment methods. Mobile wallets allow for more speed, security, and convenience while allowing you to forget about the hustle associated with carrying around a physical wallet.

Convince

If you think about it, what was the last time you didn’t bring your phone along with you on a walk? The truth is – we always keep our mobile devices close by, and with the time that we spend using them, they are becoming a natural part of our lives. Since we already have our phones with us, why not use them for payments? Needless to say that the need to manage a separate bulky object like a wallet that can be easily forgotten or stolen becomes unnecessary.

Speed

Mobile payments usually take seconds to process. And if you are sending money to your friend or family directly, even if the recipient is in another country it won’t matter one bit. Compare this to traditional SEPA or SWIFT transactions that may take over 10 business days to arrive and sometimes get lost. Using NFC to swipe your phone when making a checkout at a grocery store also takes just a second. In essence, mobile payments provide the fastest user experience out of all payment methods, including EMV chip payments.

How secure are mobile payments?

In short – very secure. Mobile payment providers use multiple layers of encryption to hide your personal data from potential fraudsters. But, there is a caveat. Not all mobile payments are equally secure. Because these most mobile wallets are developed by private companies, you should choose which mobile wallet you are going to use very carefully. Some of the more traditional applications that rely on past-generation code may allow the developers to gain access to your funds. Of course, a scenario like this is unlikely, but nevertheless, it should not be neglected.Thankfully, this problem is solved in new-gen apps with the use of blockchain technology. In essence, blockchain apps do not hold your funds in any centralized location. Instead, they are securely kept in the blockchain itself where only you can have access to your funds. The developer, hackers nor even government could even theoretically gain access to your account.

Types of mobile payments

- Everyday transactions: This is when you can use your phone to make a direct transfer to a receiver. It may be a personal contact or business contact. The application will usually charge your bank account directly and withdraw funds from there. However, some apps allow holding funds in them directly, allowing to bypass a necessary step and improve convince. It should be noted that only blockchain apps can be fully trusted withholding your funds.

- POS payments: when you are visiting a store and swiping your phone over a terminal you are conducting a Point Of Sale payment. These payments are very popular today and lots of retailers already have the infrastructure to provide them to their customers.

- Closed-loop mobile payments: These types of mobile payments are popular in applications developed by companies that sell their own services or goods. One good example is the Starbuck app that lets you pay for your coffee and reserve a spot in the line. These payments are often combined with loyalty program benefits which makes them extremely worth it.

- Carrier payments: Do you remember those TV ads that ask you to send an SMS with a code to a certain number to make a donation? Those are examples of carrier payments. They utilize the service of your cell network provider and you are actually charged only when it’s time to pay the phone bill in most cases.

What mobile wallet should you use?

Today there are lots of options when it comes to choosing a mobile wallet. A lot of corporations and reputable companies have developed their own solutions, while smaller companies and startups are making advances when it comes to innovative technologies and user experience. Let’s talk about some of the best mobile wallets that are available today.

Exscudo Channels

This mobile wallet combines the functionality of an encrypted messenger such as Telegram, currency exchanger and a full-fledged mobile bank in a single amazing package and provides users with the highest security level. The app is based on a custom developed blockchain which ensures the safety of funds under all conditions. Your account is secured with a cryptographically encrypted private key which can not be hacked and your money are held in the blockchain rather than in the app itself.

Fun fact: in the whole lifetime of the application the team has recorded over 1000 hacking attempts, none of which were even remotely successful. To further test the app security the Exscudo team has offered a bounty to white hat hackers 3 times, but the testers had to give up every time upon realizing that the funds are secured with blockchain.As a result, people trust Channels and it is already being used by over 30,000 users who transfer 200,000 in USD equivalent every day.What’s more, because your new mobile wallet is essentially an app that fully replaces the functionality of banks, it can offer an expanded feature set like integrated video or audience calls and new exciting ways to send money. Channels allows users to:

- Hold both fiat currencies and crypto currencies: at the moment Channels supports EURT, ETC , ZEC , OMG , XMR, TUSD, DASH, BTC, RUB, EON, CTKT, USDT, LTC, EUR, USD, ETH, BCH, QTUM with more currencies to be added soon.

- Exchange currencies right within the app: channels provides users with great rates that are sourced from the most liquid markets like Bitstamp, Bitfinex and GDAX.

- Make cross-border transactions in an instant: Block update time in the EON blockchain on which Channels app is based is 3 minutes. This means that your transaction processing time physically can’t take more than 3 minutes/

- Pay for goods with crypto: thanks to automatic conversion at checkout and soon to be issued credit card that will be connected to the app, you will be able to spend crypto at any retail spot in the world.

- Make secure audio and video calls: your communication is secured with a unique private key which ensures that your privacy with channels is absolute.

Apple Pay

This is a great option for iOS device users. Apple Pay allows you to make a payment at any POS terminal that supports this technology. The money will be withdrawn from your credit or debit card, but using your mobile wallet is much safer and more convenient than a traditional plastic card.A fingerprint reader is used to validate the identity of the user which makes potential fraud very unlikely. There is also no need to worry about verifying additional information like the 3 digit security code on your card since all the data is stored within the wallet in an encrypted format.

Samsung Pay and Android Pay

These two wallets are very similar in design to Apple Pay and basically, present the best mobile payments alternative to Android users. Both wallets support the NFC technology to allow for swap payments and these payment methods are accepted at a variety of retailers all around the world.

Bank Apps

Bank of America, Simple, Wells Fargo, and Chase are a few examples of banks that developed their own mobile applications. These apps allow users to transfer funds to other clients of the same bank in a very similar fashion to mobile wallets. However, they have more limitations such as the inability to cheaply send money abroad while bypassing the limitations of SEPA/SWIFT transactions.However, if you are going to use these wallets for your everyday shopping needs it is still a better alternative to plastic cards.

Third party Apps

Some private fintech companies are developing applications that allow conducting the same or some of the same financial operations usually provided by banks. Some examples of applications include PayPal, Square Cash, and Exscudo Channels. Many of the modern fintech apps are extremely innovative, but you need to conduct your own research and use your best judgment when choosing a third party mobile wallet. Some of them offer more features than others, but many use outdated centralized architecture which makes them potentially insecure. Make sure to only trust blockchain-based apps such as Exscudo Channels.

What is in the future for mobile payments?

Today, a fintech app like Channels can already replace your mobile network provider, mail and a bank. However, the fact that people are becoming more and more dependent on their phones can not be denied and soon smartphones will become the main hub for almost all our daily activities, both social and financial.Developers of Channels promise that with the next iteration of the app it will be able to replace not only your bank but your very office, allowing users to make money and then spend them with awesome discounts from the same application.