Bitcoin reached a new All-Time High with 2900 $.

Normally this would be a reason to celebrate for all Bitcoin enthusiasts.

Nevertheless, one important consideration remains :

Will other Altcoins overtake Bitcoin?

Will the Flippening cause a change at the top of the cryptocurrencies ?

Let's look into it.

First the good news:

Bitcoins are currently traded on coinbase for around 2800 $ !

(https://www.coinbase.com/charts)

Bitcoin as an investment proved itself again.

But paradoxically there is a reason to concern for btc holders.

For a while the increase of Btc was in the 3-digit percentage range.

But several altcoins reached profits in the 4-digit percentage range.

Many people are beginning to talk about "The Flippening"

- the event which turns the coin.

Bitcoin would be no longer "The Mothership" of the cryptocurrency space.

It would be just another cryptocurrency.

Will this happen?!

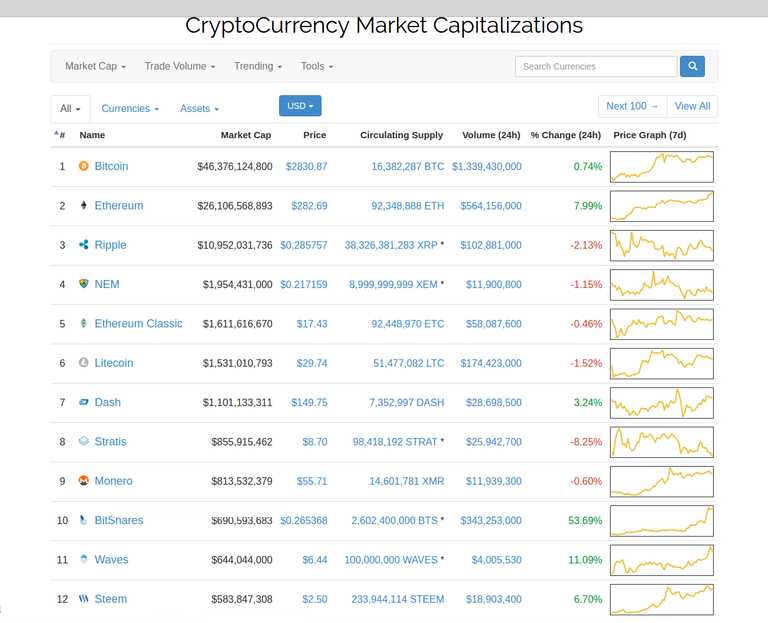

Let's look into into the top ranked cryptos after Bitcoin.

Which Coin has the potential to ascend the throne ?

How Altcoins surpass the Bitcoin profits.

A good website to easy visualize the Flippening :

This site maintains API connections to numerous stock exchanges and documents the exchange rates of all traded cryptos.

Today, we achieved a total market capitalization of more than 100 billion dollars.

This Market Cap represents the value of all cryptocurrencies.

This value increased dramatically over the last few months.

In January 2016 it was about 7 billion dollars, in January 2017 more than 15 billion and in April about 28 billion.

At the end of April, the value suddenly began to rise like crazy.

https://coinmarketcap.com/charts/

Why is this happening?

It's hard to find an explanation.

Maybe it's part of a "bubble"...

The most interesting thing about this "bubble" is, which cryptocurrencies are affected.

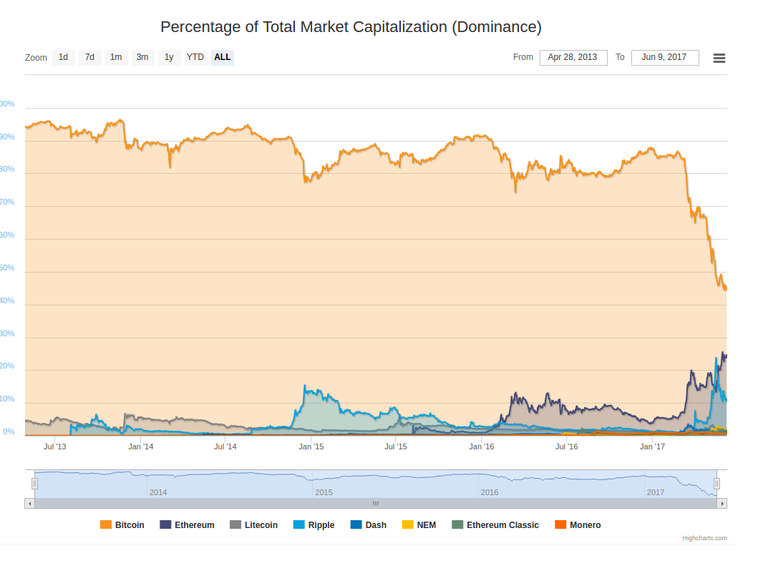

All earlier bubbles - e.g. autumn 2013 - consisted almost completlty of bitcoinvalue.

In winter of 2013, Litecoin, Peercoin and other altcoins suddenly increased.

This was a clear sign. The bubble had reached its peak.

But today many Altcoins are big parts of the bubble, without any signs of slowing down.

Bitcoin's dominance on the cryptomarkets is in danger

A chart which is gaining more attention these days is the "Dominance Percentage Index".

This graph shows the proportion of Bitcoin compared to the biggest altcoins.

While the total market cap of cryptocurrencies shot up vertically, Bitcoins percentage within the total market started dramatically to decrease.

(https://coinmarketcap.com/charts/#dominance-percentage)

It's not hard to imagine how this trend continues.

Bitcoin will fall under 40 percent, ends up at 30, perhaps even falls to 20%,...

While other Cryptocurrencies are catching up.

One day probably some "Altcoin" will be equivalent to Bitcoins Value and if this continues one or several will overtake Btc.

Variety or Flippening?

It is conceivable that the cryptomarkets of the future will be more colorful and diverse.

It is unconceivable that a single currency will hold more than 20-30% of the total market.

We will have a variety of currencies that are used for several purposes.

(e.g. privacy/transparency, security, micropayments, smart contracts,...)

Probably these currencies will continue to circle around the digital gold standard of Bitcoin.

This scenario would relieve Bitcoin, without attacking its position as a reserve currency.

On the other hand we could argue that there can be only one large reserve cryptocurrency, as if there is money involved, sytems are affected by the networkeffect (e.g. Facebook).

Some people believe that a further decrease of bitcoins dominance won't cause a multitude and varity of cryptocurrencies, but a different currency will replace Bitcoin and become the new reserve currency.

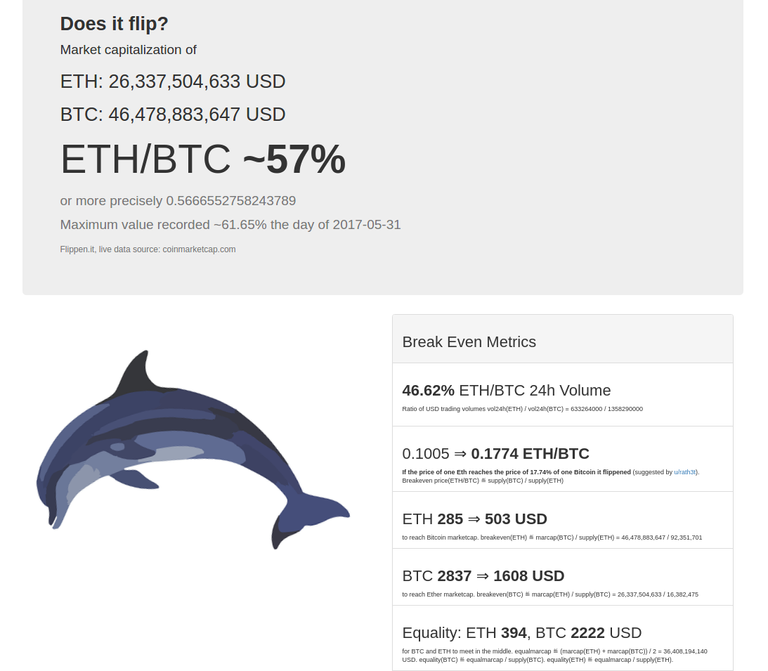

This event is called "Flippening" !

Will Ethereum be the new drafthorse ?!

The currency, which qualifies like no other is Ethereum.

The blockchain started in 2015 with a turing-complete scripting language.

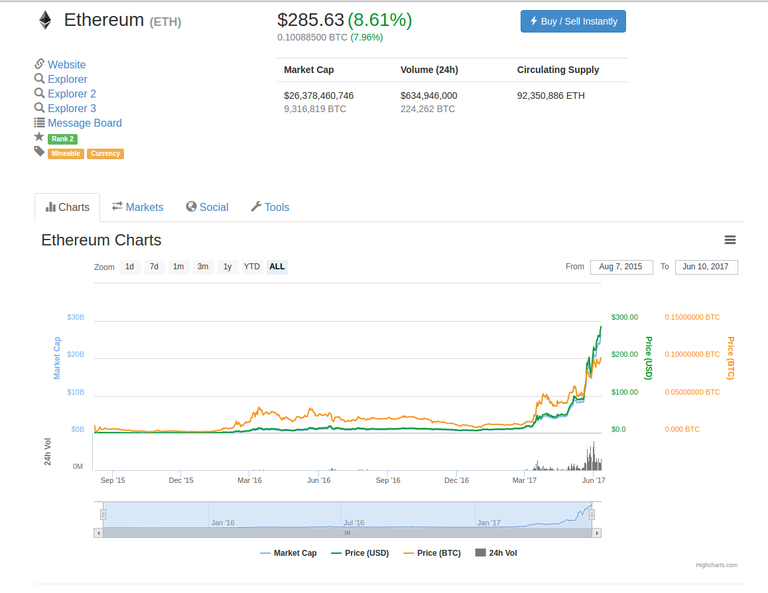

The Rise of ETH since the beginning of 2016 is exceptional, even in the crazy cryptomarkets.

- In January 2016 still about 1 dollar worth,

- in the course of 2016 to 10-15 dollars,

- in March 2017 still ~ 16 dollars,

- in April at 50 dollars,

- in May at 100,

and today at ~280 dollars !

(https://coinmarketcap.com/currencies/ethereum/)

Ethereum became kind of the reserve currency for the issuance of ICOs, as recently the BAT by Brave.

On many Altcoin exchanges, Ethereum is like a second reserve currency for trading with other Altcoins.

Shapeshift's CEO Eric Vorhees recently said that they are holding parts of their revenue in ether.

Thanks to the many possibilities offered by Smart Contracts on the Ethereum Blockchain, this becomes more and more a magnet for new developers.

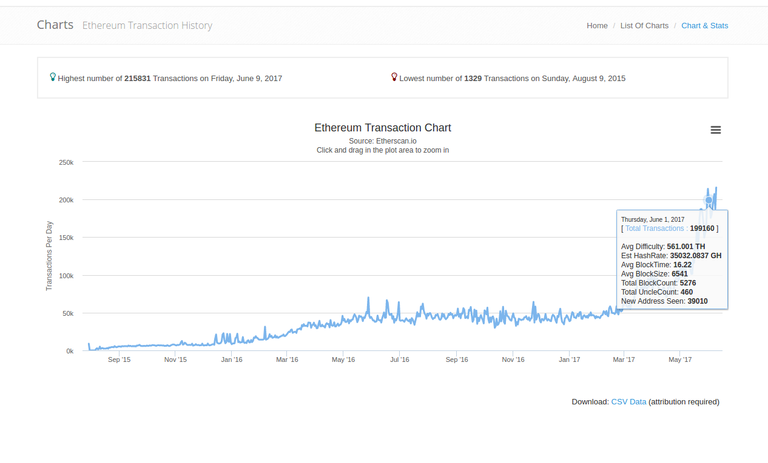

And with more than 200,000 transactions per day, Ethereum is almost as much used as Bitcoin.

The assumption of a great future for Ethereum is strong within the community.

This is covered by a market capitalization of $ ~ 25 billion, which is as much as Bitcoin was valued at the beginning of May.

Today Ethereums market capitalization is more than half of Bitcoins.

Ethereum could catch up this last distance really fast.

The Ethereum community is celebrating this with a website that shows the Flippening state.

But Ethereum isn't ready yet

The Developement of Ethereums infastructure is still far behind Bitcoin.

There are no or just a few Ethereum ATMs, there are almost no wallets for mobile devices, no light wallets, just a few exchanges, no or almost no OTC trade such as LocalBitcoins, no widely acceptance in shops and so on.

Ethereum is an exciting platform for Smart Contracts, Token Crowdsales and further exciting developments, but without doubt it isn't at the level of BTC in terms of representing digital cash.

It's a long and hard way to become a widely accepted "currency".

Furthermore, Ethereum has to prove that it can scale as it promises !

Ethereum don't only deals with transactions on the blockchain, like Bitcoin.

It is also processing contracts and tokens, in other words, code.

As a result, 200,000 Ethereum transactions are likely to require much more space than 300,000 Bitcoin transactions, while the promise of Ethereum is, to bring everything to the blockchain ! (games, contracts, exchanges, prediction markets, etc.)

As a result monetary transactions, such as bitcoin, will only be a small part of blockchain activities.

But Ethereum needs much more capacity to reach the same economic activity as Bitcoin.

While it is clear that the developers are willing to provide this, there is no clear indication that they will succeed without the blockchain to collapse under the data load.

The tendency of the charts seems to indicate the expected "Flippening" from Bitcoin to Ethereum.

The "facts" on the other hand produce some doubts if this will actually happen in the foreseeable future...

References

https://www.coinbase.com

https://coinmarketcap.com/

https://bitcoinblog.de/

https://etherscan.io

https://rolandkofler.github.io/flipper/

I think Ethereum's going to hit $500-550, but it won't replace BTC. It makes a lot of sense that more and more larger coins will appear on the market, each one having different ideas and plans with it. People can pick and choose, makes it friendlier for the average user. Stable too.

I hope that ETH will reach this year 500€ and Steem 10€

Ethereum is not promising. But steem will undoubtedly records in upcoming years.

it is that optimism which drives steems upcoming growth.

self-fulfilling prophecy

some altcoins are exploding after sitting around for years

Congratulations @joshbreslauer! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Regardless I still think we are on pace for a $5K Bitcoin

It amaze me to see the altcoins growth in the last 3 to 4 months.