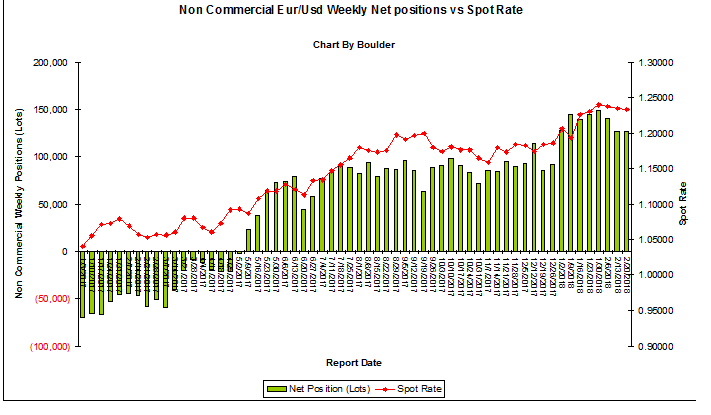

Until Tuesday, institutions were seen cutting their record long positions in Euro for the 4th consecutive week, which was shown in the latest COT as of Tuesday, Feb 20, 2018.

The institutions net long Euro positions decreased last week by 1,163 lots to 126,126 lots.

1,512 long positions were closed, and 349 short positions were closed as well. Now Longs total 229,273 lots vs shorts total 103,147 lots .

69% long exposure vs 31% short exposure, the same as previous week

This week from 2/14, the price first moved down to 1.2275 low and found support, then it rallied to 1.25 for third time, reached 1.2510 on 2/15 then 1.2555 on 2/16. But it got rejected once more , back down and closed at 1.2336 on 2/20 as of the report date.

Longs being closed, it indicates institutions continued profit taking on their long positions at 1.25s area

Small positions of shorts being closed at 1.22-1.23 support zone area,

Long term bullish but short term more to the downside

Please note institutions take weeks and months to build a position in the currency market. For Euro, they have built their net long positions since 5/9/2017.

Therefore, the bullish sentiment is more for long term outlook, not intended for short term trading.

Thanks for the report!

thank you for your upvote. return one for you