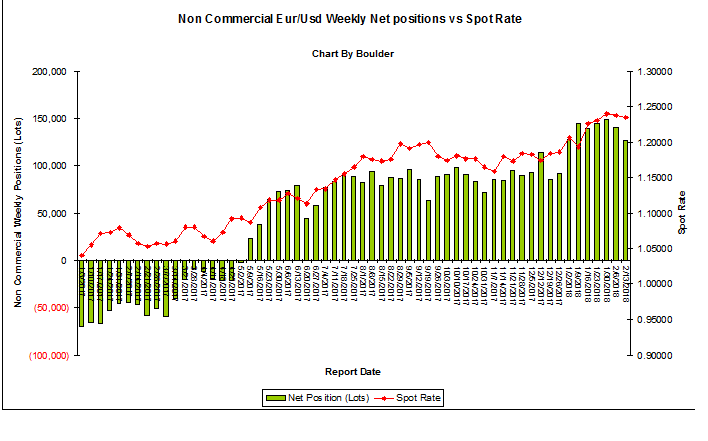

Until Tuesday, institutions were seen continuing to trim their record long positions in Euro for the 3rd consecutive week,

which was shown in the latest COT as of Tuesday, Feb 13, 2018.

The institutions net long Euro positions decreased during last week by 13,534 lots to 127,289 lots.

20,584 long positions were closed, and 7,050 short positions were closed as well. Now Longs total 230,785 lots vs shorts total 103,496 lots .

69% long exposure vs 31% short exposure, the same as previous week

Previous week on 2/1, Euro retreated after hitting 1.2523, monthly supply zone. This week from 2/6, the price first moved down to 1.2205 low and found support

It turned around and on the way to challenge 1.25s once more. Euro closed at 1.2350 on 2/13 as of the report date.

We did witness after the report, Euro challenged monthly supply zone for the 3rd time hitting 1.2555 on 2/16 and then back down once again last Friday

Large order of longs being closed, it indicates institutions continued profit taking on their long positions

Some shorts being closed at 1.22s support zone area, which helped pushing up the price for their longs.

Long term bullish remains but short term trend more to the downside

Please note institutions take weeks and months to build a position in the currency market. For Euro, they have built their net long positions since 5/9/2017.

Therefore, the bullish sentiment is more for long term outlook, not intended for short term trading.

Thanks, always good to know what institutions are up to

nniko, please post something on your blog to get upvote lol

Have not seen you post anything there !

create some new posts nniko!

:)

Sweet!

My steam power is still low at 70%, will do upvote for you all tomorrow :)

Thank you again!