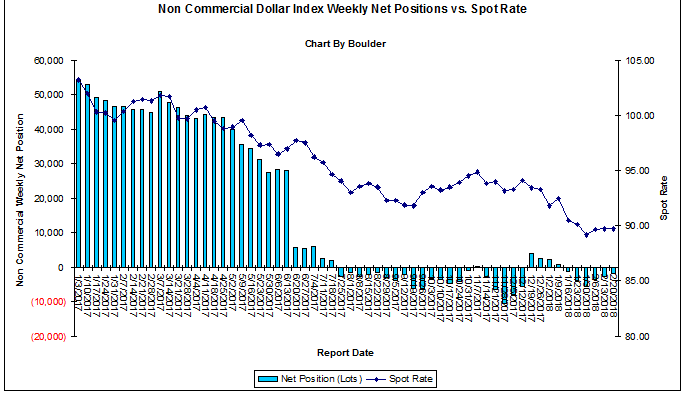

For Dollar, the latest COT as of Tuesday, Feb 20, 2018, institutions decreased net bearish bets by 832 lots, this is the 3rd consecutive week net change was positve for the dollar

341 long positions were closed and 1,171 short positions were closed as well, Now Longs total 23,861 lots vs shorts total 25,799 lots .

48% long exposure vs 52% short exposure , Longs added 1% and shorts dropped 1% from the previous week

Dollar near term resistance at 90.50 and support at 88-89 area. Price has been in this range for five weeks

Once the daily resistatnce 90.50 proved tough to break. Some longs being closed,

More shorts being closed at 88-89 zone , which helped dollar moving up to challenge daily supply zone 90.5-91 .

Long term Bearish, Short term neutral, Wait for trend confirmation.

Please note institutions take weeks and months to build a position in the currency market. For dollar, they have been decreasing their net long positions for over a year

Therefore, the bearish sentiment is more for long term outlook, not intended for short term trading.

Thanks for the report!