EUR USD

Positive if breaks above 1.2315

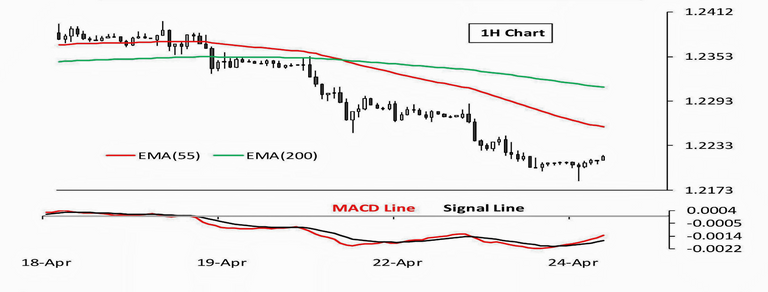

The Euro traded lower against the US Dollar in the last session to end at 1.2209, after data released in the Eurozone showed that the growth in the region’s manufacturing sector slowed to a 17-month low in April. Currently, the pair is trading with a mildly bullish showing on the 1H chart, ahead of the Germany’s business climate and expectations data, due later today. Also, the MACD indicator is sharply heading towards the north, further endorsing the positive stance. Key resistance is placed at the 1.2240 level, followed by the 1.2275 and 1.2315 where EMA 200 is trading. A surge above the latter might trigger upside momentum in the pair. Conversely, crucial support resides at the 1.2180 level, followed by the 1.2150 and 1.2125 levels. A breach below the latter might lead to further weakness in the pair.