The US Dollar corrected higher against its major counterparts. The bulk of the move followed the release of a better than expected manufacturing ISM survey and a cautiously upbeat set of minutes from December’s FOMC meeting. That helped drive front-end bond Treasury bond yields higher while the priced-in 2018 rate hike path implied in Fed Funds futures steepened.

ISM Data

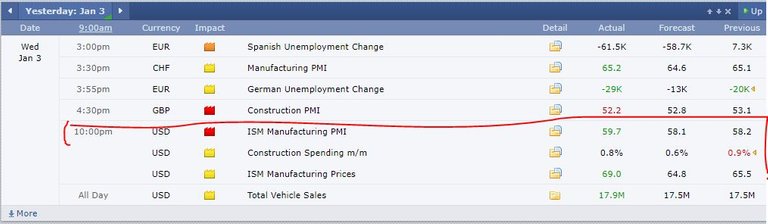

ISM manufacturing PMI rose from 58.2 to 59.7 in Dec vs. 58.1 consensus

U.S. construction spending up 0.8% vs. 0.6% estimate, 0.9% previous

U.S. total vehicle sales climbed from 17.5M to 17.9M

FOMC : Gradual rate hikes are still in order

FOMC: Several policymakers concerned about weak inflation

FOMC: Stronger inflation from tax cuts could be reason to hike more

The U.S. dollar recovered from its weak start this week when the minutes of the December Fed meeting supported rate hike hopes. Dollar bulls seem to have found assurance from the minutes of the latest FOMC meeting.

As it turned out, the outlook was generally unchanged and most of the members still supported the idea of gradual rate hikes. Many are worried about the weaker inflation outlook, but some pointed out that the tax reform package could spur price levels enough to even warrant a faster pace of tightening.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.babypips.com/news/forex-us-20180103