2024 Investment Year-End Summary

Here is my 2024 Year End Summary of the #Stockmarkets and my #investments. I like to create a snapshot of the highlights and what I learned this year. Then I want to talk about what changes I will make for 2025.

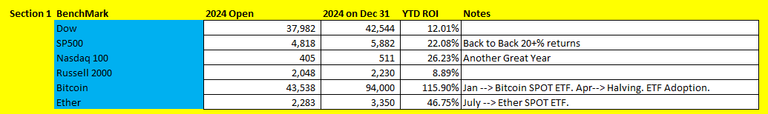

Section 1: 2024 Benchmarks ROI.

The S&P 500 has around 54 ALL-Time HIGHS in 2024.

Nasdaq 100 continues its win streak beating the S&P 500 again.The markets were #GREEN and it was a great year for investors and traders.

The biggest story of 2024 was not #AI or #Mag7 stocks, but it was all about #BITCOIN!

With a 100%+ return in BTC and 45+% in #ETHER, it is not surprising that both COINS beat the returns of all the indexes!!

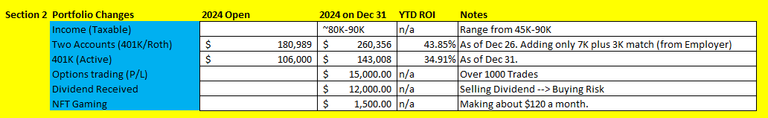

Section 2: 2024 My Portfolio Changes

Here is my data for 2024:

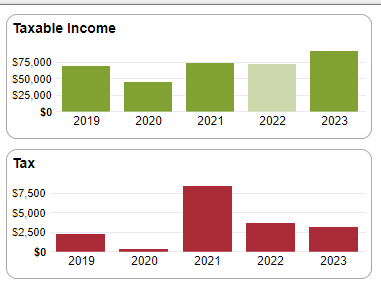

I use tax software that provides a detailed tax history over the last five years. Interestingly, most social media influencers earn between $150K and $250K annually. I have no problem sharing that my income (and/or taxable income) is often much less than many of the clients I assist.

I believe this gives me an advantage: earning 50% less than most people, but achieving 50% better results. This means I can't simply add more #cash to my account, as I don't have the extra funds. Instead, I have to sell one asset and use those funds to purchase another. Therefore, I need to effectively manage the little extra cash I earn from working.

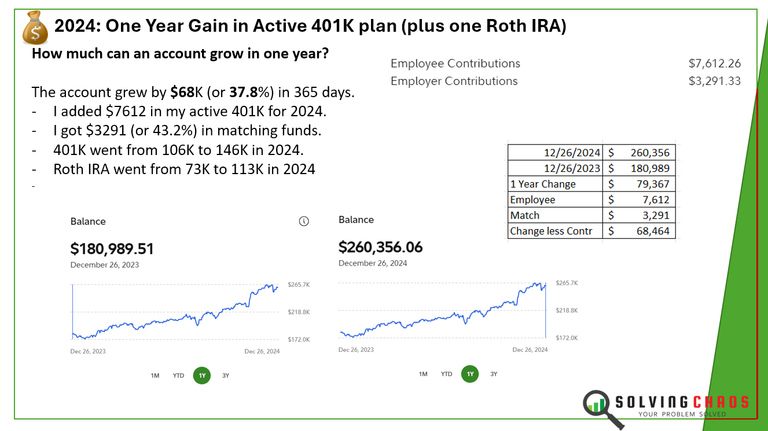

For instance, I'd like to share the progress of my public 401K account, which I posted about on social media. A few years ago, it was at $20K, and today it's grown to over $146K

In 2024, I contributed $7,600. Some people contribute $22K annually. If my income were higher, building a million-dollar portfolio while earning $150K or more a year would be quite easy. Achieving it on a $60K or $70K income is much more challenging.

My account went from 180K (Dec-26-2023) to over 260K (Dec-26-2024) with $7k coming from my 401K contribution. 3K was from Matching FUND. This means $68,464 (or about 37% ROI) was gained from the stock market changes ( $79,367 if you add in new contribution).

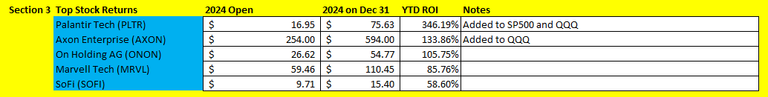

Section 3: 2024 Top Stock Returns

Here are some of the holdings in my portfolio:

This year has been incredible for me since several of my holdings in my portfolio were on the top 20 returns for 2024. I enjoy the ride in Nvidia like everyone else, but I wanted to bring attention to some new names:

- Palantir

- Axon

- On Holding

- Marvell Tech

- Sofi

- Bitcoin-related (more on that later).

On the other extreme, I wanted to talk about the industry or stocks that did not do so well.

- AMD - still waiting for AMD to follow an upward trend like NDVA.

- Intel - I have watched INTEL struggle since 2001. I have mostly sold off most of my holdings over the years, but I still follow them since I have a few shares left.

- Ford - The dividends are nice, but the TOTAL return is lacking. I don't ever recommend owning a stock just for the dividend. The total return is what you should look at.

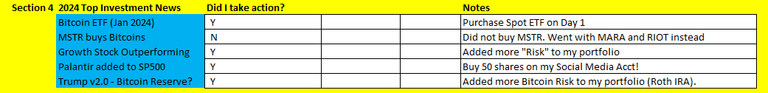

Section 4: Top Investment News - What I did what that information?

1. Bitcoin ETF news (Jan 2024)

I ended up doing a test between the new SPOT ETF from Fidelity (FBTC) vs Proshare ETF (BITO). The Proshare is a "NAV erosion-type" ETF with a large 45% dividend yield. I purchased them one day apart. What I was surprised by in my short 1-year test is that the MONTHLY dividend of Proshare is "holding up" well so far.

2. MSTR buy more Bitcoin (Since 2020 to now)

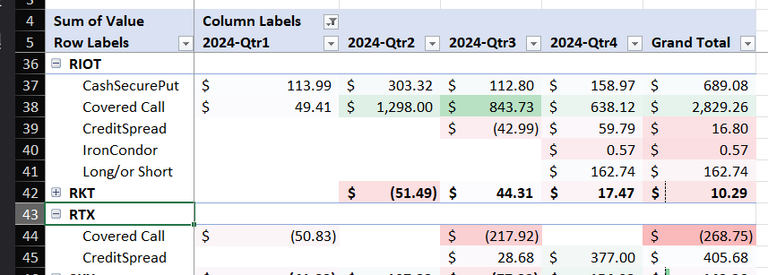

MSTR is one of the best stocks to buy and hold since 2020/2021. Did I buy MSTR? No. I do not own any MSTR but I do own RIOT for over 3 years and I trade those OPTIONS. I also added MARA to my holding recently in 2024.

My Pivot Table with my Options TRADE will tell you how RIOT has done for me in 2024. I made over 3K in RIOT, mostly from the COVERED CALLS that I use on the stock. This is one benefit of a stock not moving is the income I can make from the COVERED CALLS.

3. Growth Stock Outperforming.

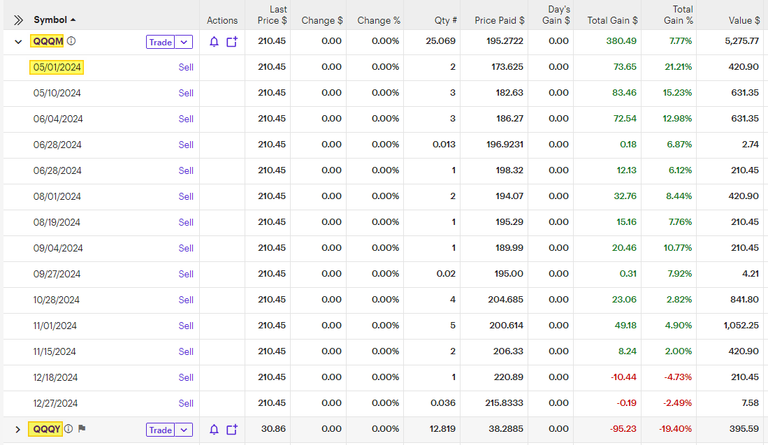

We all know that owning the S&P 500 is a solid choice, but there are ways to achieve higher returns. One popular strategy is investing in TECH or GROWTH ETFs.

While the S&P 500 ETF is my core holding, I decided it was time to introduce more risk into my portfolio. One approach was to evaluate my dividend stock holdings to determine if the dividends would grow faster within their underlying stocks or if the QQQM would be a better investment.

Using this method, I don't hesitate to sell my Visa dividends or any of my other "boring" stocks. I still view Visa as a strong long-term holding, with shares likely to trade at $400-600 in a few years. However, to better diversify my portfolio, I choose not to reinvest dividend payments into these positions.

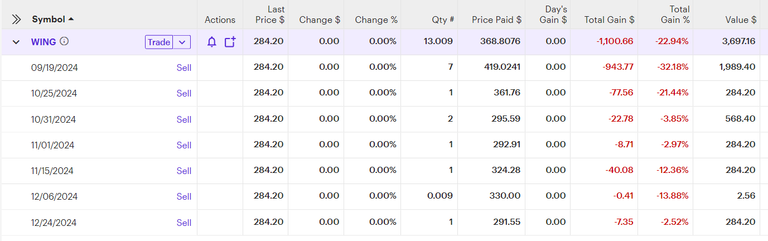

Additionally, I wanted to focus on adding a new holding with the potential for significant growth by 2030 and beyond. Although the price has dropped from $419 to under $300 per share, I plan to gradually build this position over time.

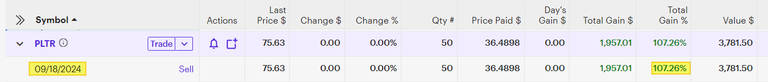

4. Palantir added to SP500

In September, when the news about Palantir was added to the SP500, I added 50 shares and posted this to my social media. I did this because the AI cycle and how PLTR will grow is just the beginning. I don't think we are late to the game on this pick. I'm super happy with the results so far, but I think we have a long way to go.

5. Trump v2.0 - Bitcoin Reserve?

With the new administration taking office on January 20, 2025, the Bitcoin world is buzzing with discussions about a potential Bitcoin Reserve. However, I believe this is just a "sideshow" and may not come to fruition. The bigger story, in my opinion, is the move by nation-states and sovereign wealth funds to buy and hold BTC on their balance sheets.

This is the new "arms race" or Global Game Theory involving Bitcoin. Given that currencies like the Yen, Pound, and Russian Ruble can be printed indefinitely, it makes sense for nations to print money and trade it for Bitcoin. The faster they do this, the cheaper they can acquire Bitcoin compared to other nations.

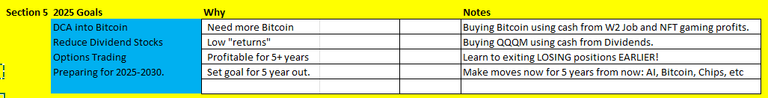

Section 5: 2025 Goals

Here are my goals for 2025.

- Buy more Bitcoin.

- Reduce Dividend Payout and Dividend Stock Holding (selling off assets).

Rebalancing a portfolio or rotating in and out of different asset classes is more of an art than a science. If the market were to drop 20%, I would buy more growth stocks and sell my value stocks. If the market is just range-bound, I will continue with my "sell the dividend, buy the growth" approach. I prefer not to lock myself into a fixed strategy when the stock market is dynamic and requires me to change and adapt as it shifts.

I looking forward to 2025!!

Have a profitable day!

Posted Using InLeo Alpha