Week 53 (2024) and Week 01 (2025) Investment Summary

This trading week is strange because it spans two years, two months, and two weeks. I will try to report on the FULL 5 trading days and discuss the results from Week #53 (2024) and Week #01(2025).

Here is what we are going to talk about in today's post:

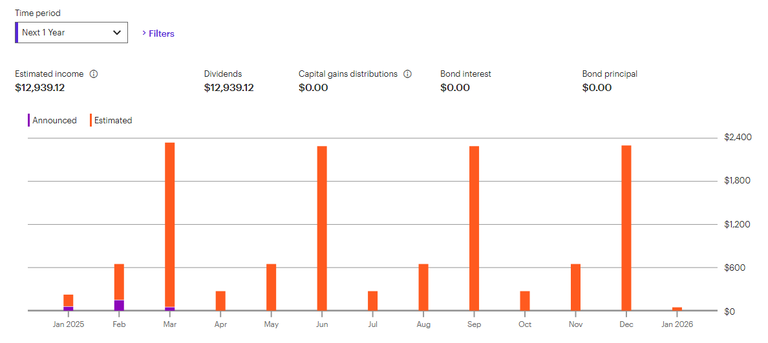

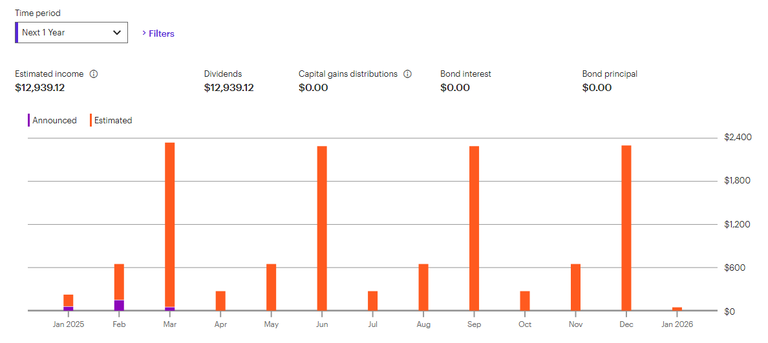

- 2025 Dividends (Estimate Income).

- Week 53/01 Investments Results

- Bitcoin moves (last 7 days)

- The last 14 days were "SLOW"

2025 Dividends (Estimate Income).

As of today, the estimate is about $13K in #dividends for 2025. For those that have been reading my investment moves for the last 3 or 4 years, you might be wondering why I have been hovering around the $12K area for the previous few years.

The answer is simple:

Between 2020-2023, I occasionally would sell my dividend stocks and use the proceeds to buy a new position. This will reduce the dividends that I receive since I rotating from a dividend holding to a non-dividend GROWTH stock.

Then in 2024, I pivoted using a different approach. I have been selling off some dividend stock (rounded down) to the nearly 100 shares lots. For example, If I had 207 shares I would sell the 7 shares and use that to buy high-growth POSITIONS. I did this because most of my HOLDING also have COVERED CALL options on them. Then for each future DIVIDEND payment, I would sell those shares and use the CASH to buy BITCOIN or QQQM.

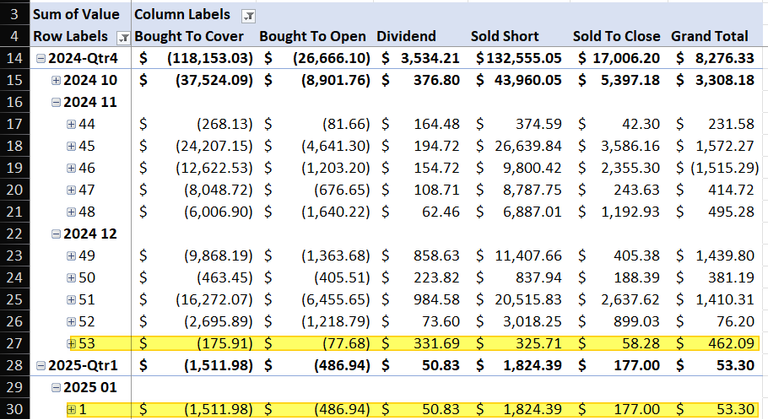

Week 53/01 Investments Results

For the last 5 days, I will show my options trading (and dividend) results from Dec 30 to Jan 3. As I mentioned earlier, the data will look strange on a PIVOT table because the dates span two years, two months, and two weeks.

As you can see, I make a small profit from Options Trading and the bulk of the money gained was from the DIVIDENDS that I got.

This week's profits were mostly from:

- Riot Covered calls.

- MARA Put credit spreads.

Most of my ADJUSTMENTS were mostly to REDUCE risk in the future by moving the STRIKE price away from the Market Price (for both Covered calls and PUT credit spreads)

Bitcoin moves (last 7 days)

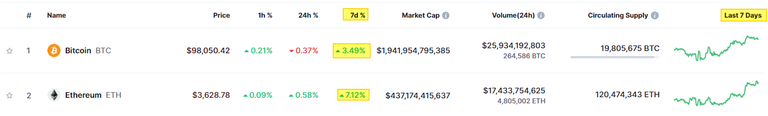

The last 7 days were mostly UPWARDS for #Bitcoin and #Ether.

This impacts any of my holdings that are correlated to the BTC/ETH price moves. This means RIOT and MARA would be most likely trading UP over the last 5 days.

On a side note, one of the best things is I got rewarded with $40 in BTC from my readers using my referral code for Coinbase. This is one way you can support me, is by signing up for Coinbase and starting your Bitcoin Investment holdings.

Link here: https://coinbase.com/join/VQXJYLR?src=referral-link

The last 14 days were "SLOW"

The period starting a few days before Christmas to a few days after New Year is mostly a slow trading period for PROFESSIONAL and RETAIL investors alike. My trade volume was LIGHT with me moving many of my OPTION trades into the 3rd or 4th week of Jan. I did notice that ETF and mutual funds do distributions/dividends during these last 14 days.

What are you doing in 2025 to get your INVESTMENT working for you?

Have a profitable day.

Posted Using InLeo Alpha