We did it. We own our own home.

Before I tell that story, let me back up a bit to when I was 15 years old. My parents lost the house we lived in due to financial trouble, and we had to move on to a boat we half-owned. Living on that boat for two years shaped my life. If you think it was glamorous and fun, read that post for a glimpse of the difficulties we faced. Going through high school without a home to call my own or a place to invite friends over to hang out was really tough.

My parents were amazing, wonderful people. They are no longer with us, but I think of them often and am so very thankful for the love they showered on me and my brothers and sister. My dad, like me, was self-employed, but didn't always make the best financial decisions. Thankfully, I ended up marrying an amazing woman whose parents handled money a little differently. That, and working for Dave Ramsey for about 4 years, taught me a lot about how to handle money the right way. I had already seen first-hand the pain and stress of debt.

Years ago, when the interest rates went low, @corinnestokes and I decided to refinance to a 10-year mortgage. We figured, even if we didn't pay anything extra, we'd own the home just as my oldest became a teenager. We'd have no debt on the house before he turned the age I lost my house growing up. If you haven't yet done the math on the difference between a 30-year mortgage and 15 or 10 year one, please, do yourself a favor and look into it now. You can literally save hundreds of thousands of dollars.

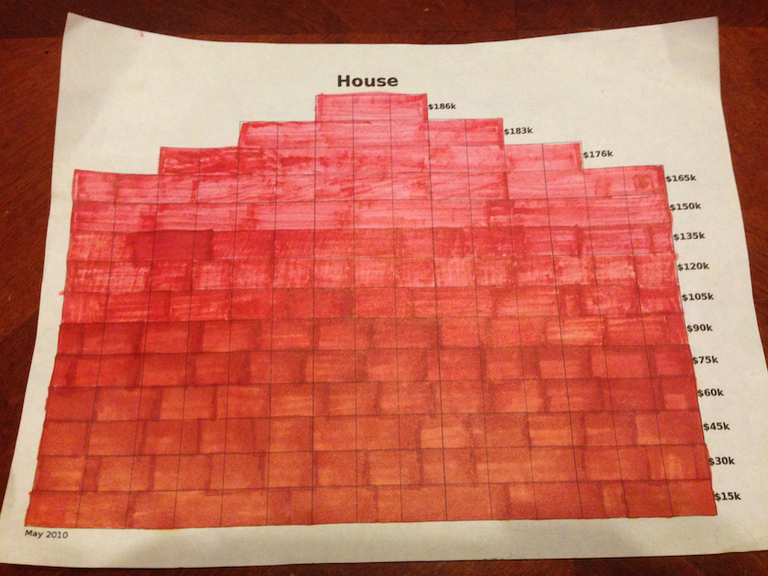

In order to create some encouragement towards getting out of debt, in May of 2010, we printed out a piece of paper with a single square for every $1,000 in principle we still owed on the house. We hung it up on our fridge so we'd see it every day. With each monthly payment, Corinne would figure out how much went to principle and color in that amount. Once we moved to the 10-year mortgage, we got even more encouraged to see more squares colored in with each payment.

We worked hard, we saved, and we made the payments. We even paid a little extra whenever we could.

Fast forward to today, January 25th, 2017, and I've got some fantastic news:

We own our house!

Tonight, we colored in all the squares.

My 7-year-old son Devon helped a bit as well.

How did we do it?

At the end of 2013, I had bitcoin fever and wasn't willing to sell any of our bitcoin stash at its all-time-high price. I later regretted it, because I realized I could have paid off my house and then used that mortgage payment money to reinvest into bitcoin at much lower prices to rebuild my stake. Hindsight is always 20/20.

I didn't want to make the same mistake twice. Last year, as the price started rising, we sold some bitcoin and put it right towards the mortgage. Then we sold some more. As the price neared the all-time-high again, we started thinking, "We could pay off the house!" The price kept rising, and we finally decided to do it. Thankfully, we didn't have to sell all the bitcoin, but we sold enough. Today, Corinne got the final payment amount, went to the bank, and sent a wire transfer. Our house is now our house!

I'm so excited and so happy, it's hard to describe. I know peace and security are largely stories we tell ourselves, but this story sure sounds good right now. No matter what happens in the future, I know I've worked hard to position myself and my family on a solid financial foundation. I essentially worked two full-time jobs for four years as I turned my code into a company. I've now been full-time self-employed for over five years and our business is still going strong.

Starting now, each month, my family will have an entire mortgage payment worth of income to save for travel, to give to those in need, to invest in mutual funds beyond just retirement, and (or course) to put into some more cryptocurrencies. Tonight we celebrated with a nice sushi dinner!

Here's a quick video of our celebration dinner:

Financial freedom is something few people have the privilege to enjoy. I'm so very thankful for the experiences I've had which led up to this moment. I'm already thankful for the future.

Thank you for sharing this moment with me.

Previous #journal entries: 1, 2, 3, 4, 5, 6, 7, 8

Luke Stokes is a father, husband, business owner, programmer, voluntaryist, and blockchain enthusiast. He wants to help create a world we all want to live in.

Amazing read, thanks so much for sharing your journey. As a father to two young boys this really hit home. ✌️

I'm really glad you enjoyed it. :)

I just came across this very old story on your house when I was looking through your blogs to find a guide on Bitshares.

You took two jobs and paid off your mortgage early. You learned the damaging impact of compound interest, did the maths and formulated a plan to defeat it. Well done!

42 years ago I was working two jobs to finance my first one-bedroom flat. It cost GBP 13'000. My first salary, as a beginner banker in the City of London was £900 a year. My second salary, as a nightime bingo-caller was £1'250. The bank rules didn't permit me to have a second job, but there was no way they could have found out. Back then it was so hard to get on the housing ladder. You had to really struggle, make a lot of sacrifices and compromises. Two jobs and a lodger was a necessity.

Some people today say house prices are too expensive for the ordinary guy. This just makes me laugh. They feel they have a sense of entitlement, and won't make sacrifices. Smart-phone or house. Netflix or a second job. Lodger or space. They won't make the tough decision.

In 1975 the interest rate on my mortgage was 12%, so all of my second salary went in mortgage payments.

I had nothing left to live on. I spent nothing, not even a TV. I moved in a girlfriend and got her to pay some of the mortgage interest instead of rent. Having a girl in my bed was good, but apart from that it was annoying with two people living in such a small space, so I sold the flat two and a half years later as part of my strategy of separation from her.

I made a good profit. I sold the flat for £23'000 after owning it less than 3 years. Nearly doubled my purchase price and made tenfold my equity. I learned that borrowing money can leverage your profit.

From 1975 to 1985, inflation was very high and it seemed like house prices were guaranteed to rise forever.

Roll forward to 2015. My bank was closing so I had to re-mortgage. I thought of paying off the mortgage in full. I had the assets - in investments. With interest rates below 1%, I figured the 3 % dividend yield would more than cover the mortgage interest.

6 banks bid to lend me the money. Finally I took out a 100% mortgage, (yes, I know that's illegal for the bank - but they are salesmen, and they need to do the deal, so we bent the rules a bit here, and a bit there to get to the 100%). I split the loan into 6 tranches with fixed maturities of 0 years (Libor float) to 5 years, all slices at fixed rates below 1%. My average interest rate was 0.89%.

Since then, a couple of the slices have matured, and I have rolled the maturing slices for 5 years at a new fixed rate. The interest rate on most the recent slice rollover was fixed for five years at 0.99%, so my average rate stll remains below 1% per annum.

As far as I am concerned, this is free money. Anyone should be able to make long term returns well in excess of 1% a year. That's why I didn't pay off my mortgage like you. I have more exciting investments to make. Sure, the leverage could go the wrong way - house could prices fall, equities might fall, gold somtimes falls, bitcoin falls, and interest rates could rise. It's a risk I'm willing to take. I might not retire so early if it goes wrong. Meanwhile, I am gradually increasing my bitcoin exposure, aiming for the 5% to 10% range. Could get there faster than expected if the price continues to rise.

Advanced financial calculations should factor in risk (and systemic, devastating risk as well). There's more to my story you can read here: Living on a Boat for Two Years Shaped My Life. My parents didn't respect debt and it bit them hard.

Be careful. Playing with debt is playing with fire. You're banking on the idea that you're smarter than the banks who get bailed out by governments. IMO, you'd be better off with no debt and using your income to work for you all the way, without risk. Right now, you're taking on the risk, not the banks, because if we hit another 2008 crisis they will do bank bail-ins instead of bail outs. People will become part owners in worthless banks. They will have "shares" that are worthless. It's some scary stuff. We should plan accordingly and for me and my family, being out of debt is the best move.

You are indeed absolutely right. Playing with debt is a dangerous game. When the next crisis hits - maybe bank bail-in, nuclear war, plague, south american default, new digital US dollar, (defaulting on the old one), or housing decline, those with too much debt will get slaughtered. In the back of my mind, I've always thought I had a plan, A,B,C,D and E if an asset class collapses, but I will re-evaluate how it would work out in a range of scenarios - and how I would feel. On the latter point I have some experience. I got divorced in 2008 and had to sell every asset I owned at the bottom of the market. House, car, pension fund, shares, gold - basically everything. Financially it hurt like hell, but I was happy as a lark as I had my work and could use the leverage of future salary, (in part that explains the 100% mortgage I now have), to re-leverage and get back to where I was before I gave it all away.

Well now I am back to where I was, l agree, it's a good time to pay off some of that debt. I will work out a plan. Hate to sell my BTC though.

I will read your other articles - e.g about the boat. There's a lot of your blogs I plan to read. I can see it is very high quality. You write well.

I think Bloomberg has a stress test function. You put in your asset allocation, and it tells you what would have happenned in virtually every crisis since the South Sea Bubble. It's going to be interesting to play with, but the obvious flaw is that the next crisis is a black swan and they have no data on that. Also, it can't tell you what happens to crypto, or these new things that everyone calls alternative investments.

Thanks for the compliments, I do appreciate it. Sounds like you've got a good plan and you're thinking things through. Good luck!

That's an unreal story, it is one for the ages man.

As a Realtor now of almost 30 years, I can honestly say I am proud of you guys.

The lessons in this blog post you share + the ones your kids will learn from this being good stewards that you are - really you need to be commended on several levels here.

None of that is lof on me, not the bitcoin lesson in here too.

Thanks Barry. It's been an amazing ride.

Congratulations! It's like that you have passed through the eye of a needle! Good job :)

It's such an amazing thing to have no mortgage! To own my house! To know this thing is ours, no matter what we face in the future.

Congratulations!! What a huge step towards freedom.

Congrats brother! Upvoted. Really great news. Proud of you man.

My comments above are very true and sincere, you are right! Proud and good lessons!

Agreed.

Thank you!

Now my next mission is to figure out who this Blazin8888 character is who dropped $130k on STEEM. Hahahah. :)

Luke, congrats my man! It's such a great feeling not to owe on your home. I own my primary outright. Now, my rentals....those I'm loaned up on and joyfully so. ;-)

Hey. Yeah, funny story there... when we first moved here from Southern California, we were like, "What? Houses are how cheap? We'll take two." We literally bought a rental property about a year after buying our main property and after reading Rich Dad Poor Dad by Robert Kiyosaki. We thought debt could be used to our benefit (even after everything I went through). There were so many times looking back I wished we had never bothered with that. At one point, the house lost $40k in value (on paper) and looked like a mess. Thankfully the market here in Nashville is going crazy now, and we've got a great property manager and some consistent renters. We may toy around with paying it down some more, or we might just leave it alone. Either way, we actually have some equity in it now, so that's nice. Less of a liability and more of an income creating asset. :)

Nice, yeah I've been hearing about the booming Nashville market from people for a little while now. Alot of people relocating there rather than crowding my streets in sunny south FL. Friend of mine wants to go check it out for a possible re-location, may take the trip with him see if I like it.

Although, I really do not like country music....pretty big there I believe?

Nice! Let me know if you do make it out here, maybe we could get a Steemit meetup going. Nashville's housing market is insane right now, that's for sure. The weather isn't that nice and I have a friend who went the other direction and moved to Florida. @corinnestokes and I don't like country music either. In fact, we rarely go downtown. There's plenty of other great stuff to see and do though.

Oh, man! I'm so happy for you, Luke and family! :D Truly a blessing. This is a real victory for cryptocurrency, and concrete proof that hard work and dedication will always win at the end of the day. Man, I was teary-eyed while I was reading the post! I'm just so overjoyed for you guys!

:)

Thanks so much, Jed. It's amazing to think how much of my life and effort over the past... I dunno 10+ years or so are wrapped up in this post. It's an amazing feeling. Thanks for sharing in our joy. :)

Man, as someone who knows you on a personal level, at least to some extent, I know how dedicated you are to everything you do that's why I'm so glad that you're reaping the rewards from all of your effort :D

Thanks Jed. The things we earn through dedication and hard work always feel that much more special.

Congratulations! You will enjoy not having those house payments, for sure! My strategy was to negotiate the lowest possible payment and let everything else float (interest rate, length of loan). Then I paid extra every single month, every spare dollar - which all went to the principal. Within 2.5 years, I was done. It gave me so much independence, I've been able to call my own career shots since. Here's to your future of financial freedom!

Nice! Well done. That's real freedom. :)

You will enjoy your freedome, too! : )

Well done Luke! Look forward to chatting about this more over at SunshinePHP!

Pablo! Great to see you here. Yes, definitely looking forward to talking about it and hanging out. We're adding a couple extra days in Orlando for vacation also. :)

First and foremost, congratulations!

I suspect you already know this, and I mention it not to rain on your major accomplishment but to simply state the truth: you don't actually "own" your home as long as you are required to pay rent in the form of property taxes. Stop those payments and see just how long you are allowed to live there.

I am assuming you don't have allodial title, that being a true and accurate title of sovereign ownership which is long gone in the U.S.. I'm not an expert when it comes to real estate, but I'm sure in the mountain of paperwork supporting who owns your home, there is legalese similar in form to titles for automobiles, that being you get a "certificate of title", not an actual title.

The actual title for vehicles is called a Manufacturer's Statement of Origin (MSO) which is sent to the State, who then issues a Certificate of Title to the buyer when payment in full is made. It is extremely difficult for buyers to obtain the MSO, but it has been done. There may be legislation requiring manufacturers to send MSOs only to the State now.

Being debt free is an huge accomplishment that shouldn't be minimized. You know first hand how important financial independence is, and that's a great lesson to pass along to your children. I managed to buy my home and am "debt free" also some years ago. I am under no illusions about who is in control of this property. Legalities can change, there is no absolutes in that realm. Let that not keep you from exercising your personal power to withstand your natural rights to what you've earned. It may not always be easy, but resistance is NOT futile!

Well said! Reminds me of an argument I saw on @larkenrose's Facebook wall just this morning. Technically, you are correct in that the "human farmers" of government do lay claim to everything within their geographic borders and we all pay rent to them as debt slaves known as "citizens" but the other side of the coin is also true:

Authority is an illusion.

Their claims of ownership are invalid and unjust. I pay because of the threat of violence against me, but I still advocate for a future which has no imaginary borders and individuals can own and improve their own property directly without a nanny state getting involved. The more people who free themselves from mortgage debt, the more people will ask, "What am I getting for this tax payment I have to make? More drone wars? This is ridiculous."

I'm all for voluntary payments to improve my community and if I am going to have theft taking place against me, a land tax in Georgian model doesn't seem all that terrible... but it's still theft. We'll get there some day, even if it's my children's children's children.

Perfect! I resteemed and FBed

Thank you!

Congratulations!!! :)

Thanks Tim!

Congrats. Well done @lukestokes :-)

Thank you! It feels pretty great. :)

Congratulations!

Now, how do you eliminate the "property tax man?" 😄😇😄

Get enough people to follow #anarchy and #voluntaryism :)

Let's keep working towards that goal!

Congrats Luke! That is awesome..., I only have 30 years to go! :)

Get that thing on a 15 or a 10! Seriously, the amount of money you'll save is staggering. Don't give that stuff over to the banksters. Use it for your life.

That was always the plan, then life happens! :)

It's surprising how you can just make it work though. We always make due, adapt and survive. Good luck!

What a huge accomplishment!

Thanks for sharing.

Thank you. :)

I'm loving your comics, by the way. Keep 'em up!

Congratulations. Pop some champagne and pat yourselves on the back.

We actually don't have any... maybe I'll pick up some along with OJ so we can enjoy some mimosas this weekend. :)

WOW! that's really cool to read this early in the morning with my first cup of coffee! the feel of freedom you guys have created for yourself must be amazing! Congratulations!

:) Thanks.

Congratulations man. I am working hard at paying mine off before term. We are all definitely shaped by our experiences when young. My parent were fantastic but my dad was hardly a great financial decision maker and that has made me crave financial solidity. I wish you well!

You'll get there, just keep at it! I know it'll be worth it.

Congratulations. You've worked hard and you have the right priorities. Very inspiring story!

Thanks @donkeypong!

Congratulations! I am looking to own mine... I love the idea of the colored house! That's such a great idea ^^

PS: I am looking forward to the day I will own my house too!

Feel free to steal that idea. Throughout the day, everyday, for almost seven years we've looked at that piece of paper. I kind of want to frame it now. :)

Keep working at it. You'll get there.

I actually may ^^

Also, seeing basically nothing move on a 30-year mortgage really creates incentive to get a 10 or 15 instead. :)

In my case, I directly stdarted with a 15 years one ^^ The other options are indeed waaaay too expensive!

congratulations! wow this is amazing to hear, good on you too for making the most out of your bitcoin investment

I'll admit, it wasn't easy to part with my beloved bitcoin, but owning my home feels really good.

I am really happy for you. Congrats. :)

Thank you!

Brilliant story Luke and what an achievement to do this so young. When we paid off our mortgage quite a few years ago it was the best thing we ever did and now that money goes towards holidays. Upvoted and following

Thank you!

Yeah, we've talked for years about how "once we pay off the house" we can start saving for traveling or a cruise (haven't been on one since the kids were born). That impossible day is now here, and it feels good. :)

Congratulations!! That's wonderful. I can only dream of owning a house but dreams are good :)

Dreams are powerful! They engage all parts of our brain to figure out how to accomplish them, even when we're not aware of it. Keep dreaming and work hard. You'll get there and amaze yourself.

thank you bud. I will keep dreaming but you know, my priorities are changing all the time and I think my dreams are getting bigger and involving more people. I don't know that all my dreams will remain compatible for much long ;)

I'm so happy for everyone who successfully got out of mortgage or was lucky enough to avoid it. Congratulations!

I know it'll feel even more real as my income stays in my account each month. :) Thank you.

Wow, congrats! I know how it feels :D

Nice! How long have you been free? How did it change you?

I always been free :D

But I had two big loans, feel much better now for sure!

Good luck

Congratulations, you must feel great with the yoke removed.

One thing many young families do is move into larger homes and then back to smaller once the children leave. Each time it sets them back... buy one stay put... that and adding extra as you did when possible will get you there in your lifetime!

Great read this morning, nothing like hearing of someones success... Thanks!

It doesn't feel great. A while back we considered moving back to California, but the numbers just didn't make sense. Homes there are so expensive, it would have been like starting over. We're quite happy now, and I feel if we did move, I'd consider another country where our money would go even further (and the weather would be more consistently nice). Glad to know this post is so encouraging to you. :)

Look at San Miguel, Azores

Never heard of it. Will have to check it out, thanks!

That is an incredible story. My family is very slowly working our way toward freedom of debt. The Dave Ramsey way makes perfect sense. Of course it will help if the price of Steem soars!

Sounds good to me!

Dude, that made me emotional!! I am so happy for your family.

Thank you, Randy!

Congratulations to you and your family for a fantastic journey. I paid off my 30 year mortgage in 15 years by doing a bi-monthly payment plan. That was a very satisfying day! I know exactly how you feel! Well done!

Ah, very cool! Well done. It's amazing how these loans are structured to put all the interest up front.

Wow, what an accomplishment! This is the type of stuff I love to see - starve the banksters!

Starve 'em good! :)

That's awesome Luke! Congrats. Didn't it feel like someone took a gorilla off your back?

We learned late in the game about the insidious oppression of debt. By then, we'd drank so much Kook-Aid that we're still dealing with it, and will be for a while longer. If I'd have understood 20 years ago, we'd be enjoying the same freedom you are now.

Some ideas, just to keep the thought process going.

Some people will put a house in a trust, then set up a corporation that "borrows" from the trust to buy the house (or is it the other way around... hrmmm, been awhile). It's just an additional layer, and you really don't care if it ever gets paid off, since you set up both anyway. It keeps anyone from going after it in the event of some idiotic lawsuit. There are other structures that work too. But, in case asset protection interests you...

Thanks Joe! Yeah, it feels great. Corinne was so excited this morning to see the Wells Fargo account listed as "paid in full." :)

We briefly looked into the living trust stuff and have relatives that do it in California. Since TN doesn't have state income tax or the same inheritance tax issues as CA (what a mess there) I've heard it's not as beneficial to set up here. Either way, the fact that we have to waste so much energy jumping through these hoops is just ridiculous. If I'm going to be stolen from via taxes, they might as well make it easy with a flat tax or land-based tax so those who set up the laws can't jump through the loop holes to avoid them.

Yeah, there are a lot of reasons to set up asset protection for your property. One of them is that if it's done before anything happens, then it tends to stand scrutiny better. If TN changes the laws then you might enjoy some grandfather protections. I honestly don't know, but it might be worth looking into. I studied a lot about asset protection for a few years, but haven't really kept up in the last couple. I have a friend who does though, so I know where to go.

You're right. We shouldn't even have to worry about all the nonsense. But that's part of living in the land of the free... feudal title. :/

Another reason to consider for establishing a trust for your property is it provides a measure of privacy. This is especially true for your vehicles. They can essentially be named anything you want. You can add any property to it, your home, your vehicles or whatever. The title on your vehicles is listed in the name of your trust, not your personal name.

Trusts can be very useful tools, but like any legal matter it requires good research and is subject to changes in the laws which can occur at any time and be unpredictable. I considered using a trust for my property and ultimately decided to employ a different strategy.

I highly recommend you look into it though. It may be important to your family and your next generations to come, as well as in your old age.

So awesome, man. Congrats!

Thank Sean!

Frame the brick house. Your best investment was the demonstration to your son. Perhaps he could start one where he colo in parts of his first car!

We probably should. It's back on the fridge again, and I've just been smiling big every time I see it. My kids already do jobs around the house to earn money and save for things they want to buy. I'm really hopefully they're learning some super important lessons early on.

This is really great, congratulations! I'm so happy for you. :)

Thank you!

Excellent Article here for Steemit. May I say, Very Mustachian of you. I truly enjoy Dave Ramsey's Books and information. I'm encouraged by this post to pull one of the shelf and give it a re-read.

Don't tell Dave but I purchased most of his books at the Goodwill $2 rack. (I let others pay full price) I'm going to add you to the follow category. Congratulations on your major milestone. Ever considered Retiring Early? (:

Nah, I have too much fun "working" on my business. Retirement is for people who no longer love their job. :)

Oh wow!! Good on you mate! Well done! Have more sashimis!!

The answer to most questions is probably MOAR SUSHI! :)

Thanks.

Right!!

I also shared it on my Facebook. We also Tweeted it with the @Steemit account. The biggest thing that matters to me as the social media guy is the traffic. Your numbers don't lie!! I had 17 likes on your post when I shared to my FB wall.

I love hearing that. :) Thanks for sharing.

very good story, fantastic! have a look in to Iconomi, such of great project to be in, as investor or as a share holder, u know that u are a BTC master, or also Jumbucks, coin swap starts today, Bittrex.

I just read this story @lukestokes

A phenomenal feat in and of itself. My parents did this in 2004 after flipping properties here in the UK and then downsizing, but this market is batshit crazy, lack of supply and money creation like no other.

Thanks!

The markets are getting crazy all over the place. Money itself is so manipulated and there is so much debt in the world that determining actual value is becoming increasingly difficult.

this is amazing read, too bad I can't upvoted and resteemed it anymore, true story and true life! crypto space is way of the future... Steem ON!

This is quite encouraging. Glad you now own the house 100%

valla muy buena nota, te felicito que pagaras tu casa, felicitaciones

¡Gracias!

I have been explaining bitcoin to my wife since 2013. She is finally showing interest as my bitcoin balance is getting close to our mortgage amount. 😀