TL;DR

We went from $70 trillion market opportunity to $30bln and Genesis platform Revenue potential from $3bln to $135mln. Despite of this, the ICO has merit, due to viable and tested business model. Assuming the Genesis founders are able to deliver the projected Investment Returns are 18 times initially invested capital.

The Prologue:

For the sake of brevity, I boiled down the 31 pages of GV Whitepaper into the core ideas.

According to the Whitepaper Genesis Vision objective is to:

unite exchanges, brokers, traders, and investors into a decentralized, open and fair network, making the financial market even more global. This will allow successful traders to rapidly scale their trading strategies by attracting investments from around the world. The smart contract technology that underlies the platform will provide an automated and absolutely transparent system for investment and profit distribution….

Each [trader] manager in the Genesis Vision network has his own cryptocurrency. The size of the issue depends on successful trade statistics. The process of transferring funds to the manager is carried out by buying a manager's cryptocurrency on the internal exchange [Genesis]…

Internal exchange of the Genesis Vision platform is the place where investors can purchase and sell [traders] managers’ coins... Initially, these coins can only be purchased directly from the [trader] manager for a fixed price. Afterwards, they can be freely traded among the investors on the internal exchange [Genesis]…

At the end of reporting period, a key for decryption is published and the entire trading history becomes public and available for validation by hashes…

The project will receive profit from commissions on investment operations. Each investment will be charged 0.5%³ of the operation amount.

Considering our [founders’] more than 400 contacts with brokerages among our partners and advisers, we expect at least 100 brokerages to join our distributed system within 2 years. This will attract more than 100,000 investors and roughly 10,000 financial managers. According to industry reports,the average trading volume for a single investor is 5 Lots (500,000 USD including leverage) per month. Thus, the total trading volume in our distributed system could reach 50 billion USD.”

Genesis founders have identified 5 markets for Genesis platform with the vision of achieving $50bln in system revenue in 2 years.

In this writeup we will:

- Examine why out of 5 markets, the only feasible is 1 in which Genesis will face a strong and entrenched competitor.

- Estimate Genesis Revenue under Best case scenario for this market and debunk some of the financial claims in the process

- Arrive at ICO Valuation and Investment potential

- Answer the question if Genesis vision is a scam

Interesting titbit: Usually Revenue estimates are based on the calendar year. 100k investors trading 500k per month would translate into $600bln or 0.6T, not the stated $50bln… Are founder’s underestimating the Genesis potential?

Let’s find out, shall we?

ACT I: Markets, Marketing and Marketing Fluff

Genesis founders segmented the Total Addressable Market into the following markets:

- Exchanges

- Brokers

- Traders

- Asset managers

- Investors

If you look at the list, you can’t stop and marvel, as Genesis funders indirectly imply that the platform has the potential to disrupt $70T professional trading universe. I would argue that Genesis (save for one market, on that below) offers an inferior solution fraught with legal challenges to be adopted by professional market participants. For the sake of brevity, I would touch on most pertinent issues laid out in 4 facts:

Firstly, Ethereum blockchain (on which Genesis is planned to be built) has a theoretical potential of processing 100 transactions per second. Which is remarkable achievement over Bitcoin blockchain but still a far cry from processing speeds of a typical exchange. For reference NASDAQroutinely processes 10,000+ per second at market open. If any meaningful amount of orders diverted onto Ethereum blockchain will definitely freeze the whole network. Case in point is the Bancor ICO. This excludes Exchanges are potential users.

Secondly, In professional financial world, time is literally money. Celent did a study in 2012 on order execution speeds of various financial providers. The speeds ranged from 0.1 of a second for Exchanges to 1 second for Discount Brokerage houses (we are dipping toes in the retail segment now). This is the expected, base line for trade execution in the professional world. Needless to say, Ethereum network lags behind in this regard. This excludes Exchanges and big Brokers and Traders.

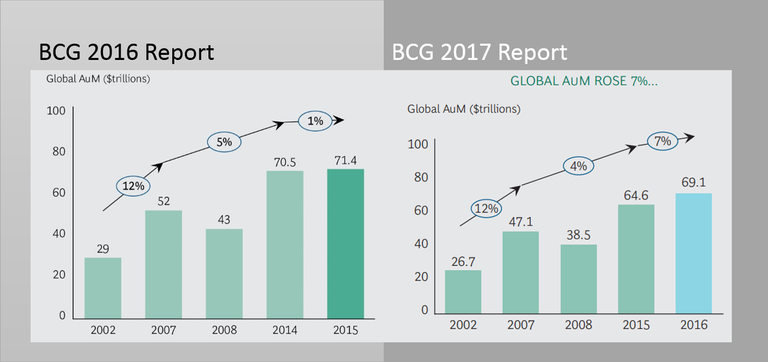

Thirdly, costs disparity. Genesis founders want to charge 0.5% per trade. For reference, it is 50 basis points (1/100 of 1%) in financial lingo. To tease the reader they identify Asset Management industry as a big, $70T opportunity growing at 7%. For reference, the provide snippets of Boston Consulting Group report. I am glad they did.

To start off, for some reason they used ’16 report (released 11-jul-16), while the ’17 updated version was published on 11-Jul-17. Why is this relevant? Because anyone following Bloomberg knows, that Industry is experiencing challenging times and ’17 report reflects that:

Citing BCG's ’17 Report:

The value of global AuM grew by 7% in 2016, to $69.1 trillion from $64.6 trillion. This was a marked improvement over 2015, when it rose only 1% ….But growth figures can be deceptive. The global increase in AuM was produced largely by the rising value of investments in buoyant financial markets. Net new flows—the industry’s lifeblood— were a tepid 1.5% of beginning-of-year AuM

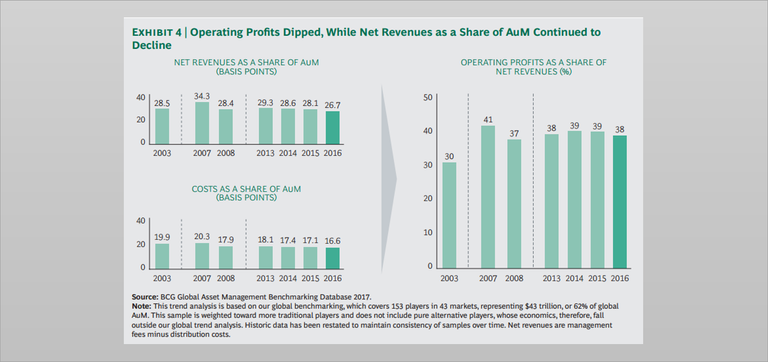

There goes the $70T and 7% growth rate. But the most important information is contained below and refers to the AUM revenue and costs structure:

As you can see the net AUM Revenues are 26.7 basis points and with typical costs of 16.6bps. A single trade at current fee structure of 50bps on Genesis platform is money losing proposition for a typical asset management firm. That excludes Asset management firms and their $70T business.

Lastly, Investors and in this paragraph I mean professional Accredited Investors. Even if they ignore slow execution speeds and exuberant commissions of Genesis platform, they cannot ignore legal uncertainty posed by crypto currencies. In professional word that means a legal risk of facing money laundering allegations and voidance of protection afforded by SEC when trading in registered securities.

However, not all is doom and gloom in Genesisville.

ACT II: Potential market opportunity or reading the Whitepaper tealeaves

The opportunity that lends itself to the distributed nature of Ethereum network is social or copy trading at mid-tier retail brokerages, with prime example being eToro brokerage. eToro was established in 2007 and now is the leading social trading brokerage in the world. The basic idea is to let average investor to programmatically trade alongside top traders, called gurus on eToro brokerage platform. Investors “follow” selected guru by dedicating part of their capital towards copying a guru’s trade. No amount of capital is actually reaches the hands of the gurus as the platform automatically places allocated capital alongside the guru’s trades on investor’s behalf. For instance if you have a capital of $10,000 and committed 20% of it to a particular guru, then $2,000 will be handled by eToro platform on your behalf. If trader decides to make a trade worth 10% of his capital, then the $200 (10% of $2,000) out of investors’ money will be invested alongside by eToro platform.

I believe that this market niche is where Genesis platform can shine. It is a market populated by retail investors (you and me) that are less price and latency sensitive compared to the professional players and that have a tendency to follow expert’s opinions in making their decisions.

Essentially, the Platform turns gurus into mini asset managers and the platform – into marketplace for shopping for excess returns.

This idea is also being supported by founder’s background in that Industry. The founder’s current business named Tools for Brokers, primarily develops plugins and scripts for MetaTrader.From Wikipedia:

MetaTrader is an electronic trading platform widely used by online retail foreign exchange speculative traders… that became popular mainly due to the ability for end users to write their own trading scripts and robots that could automate trading…and...is designed to be used as a stand-alone system with the broker manually managing their position and this is a common configuration used by brokers. However, a number of third party developers have written software bridges enabling integration with other financial trading systems for automatic hedging of positions. In late 2012 and early 2013, MetaQuotes Software began to work towards removing third-party plugins for its software from the market, suing and warning developers and brokers

Could it be Genesis' goldmine?

ACT III:Right Market, Wrong numbers.

For framing purposes, let’s refresh our memories on Genesis founder’s claims as they pertain to the market assessment. Reciting Genesis founders:

This will attract more than 100,000 investors and roughly 10,000 financial managers. According to industry reports,

the average trading volume for a single investor is 5 Lots (500,000 USD including leverage) per month. Thus, the total

trading volume in our distributed system could reach 50 billion USD.”

The actual business model is:

…The manager's coin itself is an asset. At any time, the investor can transfer/sell this cryptocurrency on the internal exchange... Initially, these coins can only be purchased directly from the [trader] manager for a fixed price. Afterwards, they can be freely traded among the investors on the internal exchange [Genesis]…

Meaning that the claimed 0.5% transaction fee accrues only in two cases:

- When the guru initially emits the coins in exchange for AUM funds

- When holders of the coins decide to sell (or more broadly trade) on Genesis platform

Therefore, our objective now it to assess the actual size of such AUM funds and the expected number of times the retail investor is likely to trade such coins. The two numbers combined would allow to estimate the Target Market of Genesis platform.

eToro platform (#1 in social trading) can serve as a reference and assuming that there is a room for second player of the same size, a model for Genesis valuation. The most recent numbers (Sep-17) indicate that the platform has 6.5mln registered users. According to Bloomberg, 9,143 investors that follow top trader contributed 11.5mln to copy trading. This translates into $1,258 per investor on average. Quite a difference between claimed $500k per investor, is not it?

The average deposit in turn implies eToro’s copy trading AUM book of $8.2bln. Such result was achieved in the span of 10 years.

To account for smaller players in the space we can round this number to $10bln, which we would take to represent the total Target Market for Genesis at this point in time.

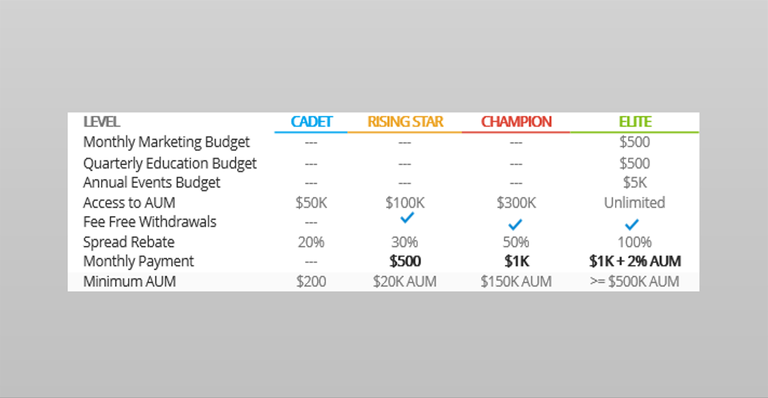

Now it is worthwhile to note that although the copy trading idea looks like an AUM business on the outside, in reality it is an affiliate marketing tool designed to promote eToro platform to less sophisticated investors. eToro actually used to pay upto 30% of the net revenues from new clients brought to eToro, which recently changed to monthly payments ranging from $500 to $1,000 at different AUM sizes.

Traders with more than $500,000 earn an extra 2% of AUM on top of it. eToro can afford to do so, because they are the owners of the platform and next to copy trading can offer more conventional products to introduced clients.

Genesis founders on the other hand are planning to push the platform through their broker network. Since Genesis model assumes decentralisation, i.e. no single actor can capture all of the platform’s value (which is the case of eToro) it is reasonable to assume that Genesis is likely to pay for the traffic to be pushed onto the platform. Essentially turning the brokers into Genesis affiliates. If eToro affiliate model is any indication, there would be a one-off payment on new trader introduction and the share in commissions from clearing trades in the issued trader’s token.

Likely that would mean that the 0.5% commission fee payable by trader for issuing token will be awarded to introducing broker and perhaps 10% (that is a guesstimate, eToro used to pay upto 30%) of 0.5% commission on tokens trades on the Genesis platform in the form of recurring broker revenue.

Now as to how often the investor would like to trade such token. Accroding to Credit Suisse the average holding period for an individual investor is between 104 to 124 days, meaning that issued tokens would turn on average 3 times a year.

This translates into $30bln recurring trades per year at $10bln AUM. The gross (before the affiliate’s stake of 10%) Genesis platform expected Revenue potential is $150mln per year.

Net of 10% affiliates take that would mean $135mln in Genesis’ potential recurring revenue.

Quite a step down from $50bln (or more correctly $600bln) in System Revenue and the Genesis Revenue potential of at least $3bln (at single trade per year).

However, despite overly inflated founder’s claims, I do believe that Genesis platform represents a viable business model and therefore we are going to assess the Investment potential of the ICO.

ACT V: Genesis’ ICO Valuation

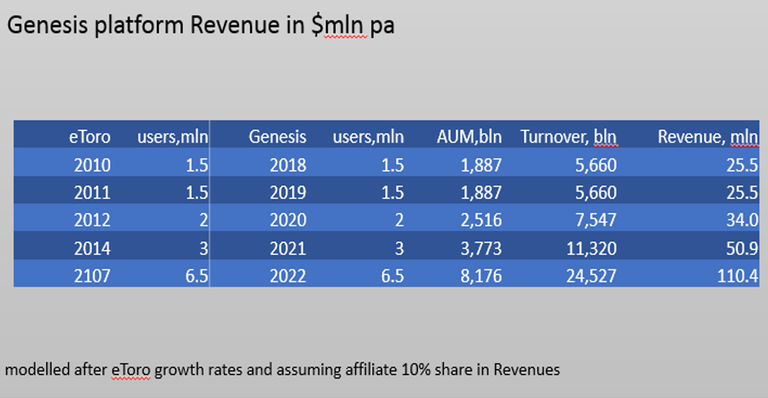

Given that Genesis’ founders assumed 100,000 investors would realistically yield only ca. $630,000 in gross recurring revenue p.a., we have decided to approach the valuation more holistically and model it after eToro growth rates.

TechCrunch archives were used to get the eToro user base per year, which were then superimposed on the Genesis’ revenue model. As a starting point of the valuation and in order to account to founder’s claimed network of 400 brokers, the $100bln in processed trades’ milestone was taken (which was also claimed by Genesis founders in the Whitepaper). For eToro that milestone translated to 1.5mln users and hence we took it as our staring point.

To arrive at present day value Genesis post ICO value we need to assume the growth rates of the platform in perpetuity and discount all of the projected revenue stream back to 2018. I assumed the growth rate of 8%.

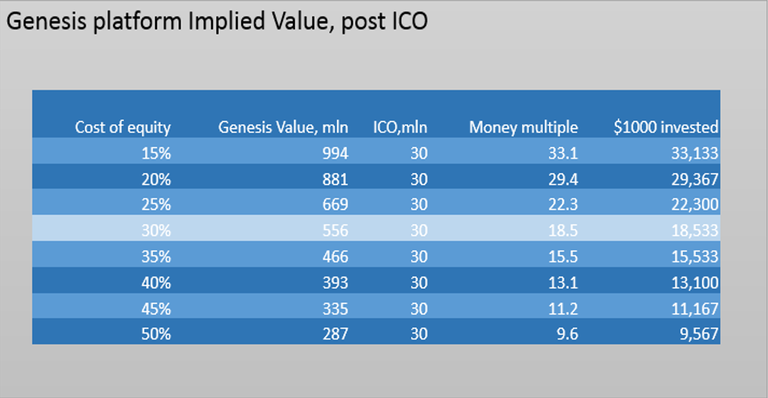

Now we need to agree on the discount factor, called cost of equity. You can think of the cost of equity as your minimum rate of return that you demand on your investment. Say if your demanded rate of return is 10% then you expect a minimum of $100 for every $1000 invested. If hypothetical investment yielding less say $80 (or 8%) you would decline it, if more you would take it. Obviously, the more risk you take the more you demand in return.

For this calculation, we assumed a cost of equity of 30% (meaning doubling your money every 2.4 years) during the growth stage to account to the risk and 15% after Genesis reaches the eToro size. This is in the essence of oversimplified Discounted Cash Flow model.

Based on the assumptions the Genesis platform post ICO is worth $556mln vs initial investment of $30mln, achieving a money multiple of x18.5. That is, every $1000 invested at ICO could potentially be worth $18,500.

For illustrative purposes, below you can find a table with with varied cost of equity values and its result on the return:

ACT V: Concluding remarks

Despite gross misrepresentation of the Market Potential and implied Financials, I cannot qualify Genesis platform as a scam. Underneath the marketing fluff, there is a valid and battle-tested business model that can benefit from the decentralisation the block chain technology is offering.

This is reflected in the assessed financials, which came down from $50bln to $30bln and Revenue potential of $135mln pa. Despite this, there is an Investment potentially yielding an 18x returns.

Of course that is assumed that there is a room for the second player of eToro’s size, that established players will not compete for this market share and ultimately that Genesis team would be able to deliver.

If you liked this writeup, consider subscribing as there will be more WTF Series to follow. Also, If you have an ICO on your mind that you would like to nominate, please leave a comment below.

What're your tohughts now after one year of the review and having the working product live at the moment?