Gold and silver have been an intrinsic part of America's financial system for the greater part of her existence. In fact, even the original founders mandated what the value of a dollar would be through the U.S. Coinage Act of 1792 where a unit of the nation's currency would be equivalent to 371.25 grains of silver.

But the 20th century has been one where both gold and silver have lost their perceived value as a store of wealth through the government facilitating its removal from the monetary system. And as such, individuals over time have turned their investments away from the precious metals and into real estate and paper based assets such as stocks and bonds.

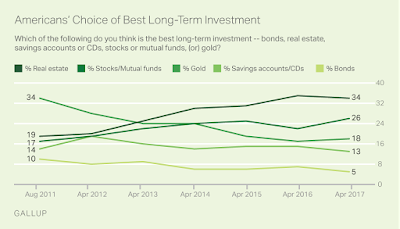

The financial crisis of 2008 brought back a glimmer of hope for a return to Americans finding solace in the precious metals where surveys from nine years ago showed that gold was deemed to be the best long-term investment, even above real estate and stocks. But after gold prices fell over 40% in subsequent years following their highs in 2011, a large portion of the country now ranks gold as the third best long-term investment behind those other two assets.

Yet there is at least one significant-seeming economic question with no reliable answer: How many Americans own gold?

Certainly a notable portion of the country believes that gold makes a good investment. Gallup annually surveys American adults on their perceptions about investments; in 2011, when gold prices were relatively high, gold was deemed the best long-term investment by 34% of respondents (real estate was next at 19%). As gold prices subsided, the percentage naming gold as the best long-term investment fell. Nonetheless, in 2017’s survey, gold still ranks as the third best-perceived long-term investment, behind real estate and stocks/mutual funds. – Los Angeles Times

However liking gold, and owning gold in America appears to be two different animals. And while it is extremely difficult to get exact numbers as to how many Americans own actual gold or silver bullion outside of jewelry and heirlooms, industry experts suggest that less than 10% of Americans actually own any precious metals in bullion form.

The World Gold Council, which gathers and disseminates mountains of statistics about gold, says it can provide no estimate for the number of Americans who own gold as an investment. Metals Focus, a London-based precious-metals consultant, says it has no figures that it can release. When I passed along an estimate that fewer than 10% of American adults own gold as an investment, a spokesman wouldn’t confirm, but hinted that it was accurate.

Because stocks and real estate prices have not only recovered from their declines following the 2008 financial collapse, but are also at or near all-time highs in certain regions and sectors, most investors have shifted away from gold, or at the very least own it in paper form on exchanges. But as the world appears more and more to be sliding into recession, and also towards a new financial crisis, it will not take long for Americans to once again look to gold and silver as true wealth protection outside the system, only this time there will likely not be ample supply for them like there was in 2008 when gold suddenly became relevant again to the masses.

<iframe width="560" height="315" src="

frameborder="0" allowfullscreen></iframe>

Cryptos, silver, gold, in that order. That's the way I see it!

The chart above is such a massive face palm as most people rate Real Estate and Stocks as 1 & 2. This collapse is gonna be epic.

Nope, gold, real estate and then cryptos

Junius Maltby was talking about this.

I have watched it too on Junius Maltby

I'm happy to be one of the "10%" who actually invest in and own real gold (and other precious metals). Great post Ken.

Following you now but recharging...

RESTEEM'D... Spot on argonath, and rounding out this post with a Dice man on the streeter is a good touch. I take heat for posting Dice's stuff but I like the guy and he's been at it a LOT longer than most of the haters on You Tube.

Long live the 10% and may we prosper and enrich our lives with our wisdom and foresight to see the coming storm! Followed and enjoyed. Thanks

I think it's a good time to start buying gold and silver while the prices are still low and everybody isn't trying to buy it.

Gold does hold value and that is why bankers hate it because they wish to control us and keep us poor.

Successive government and central banks have done there utmost to brainwash people into thinking gold is a worthless relic and debt and paper is wealth. But their past misdeeds are coming home to roost.

I've seen the one where everyone chooses the chocolate bar instead of the gold coin. Like pulling teeth. But yes very informative and good to know for when that USD comes crashing down. P.S. don't forget about confiscation that took place in USA many years ago.

Go Steem!!

I have to admit for a long time I got a kick out of folks who bought precious metals to store. That was back when I thought "cash was king" during a recession, or God forbid, a depression. With cash you could swoop in and buy the stock of great companies at a bargain, same for real estate.

Now we live in a world where the central banks (worldwide) have expanded the money supply so irresponsibly, that lots of people have lost their confidence in currency. There is a real possibility in the next meltdown, the dollar's (same for the Yen, Euro, etc) lack of intrinsic value will become apparent.

In this uncharted era, precious metals are no longer a joke to me, they are the most under priced assets on the planet. Better said, they are a real store of value. @roused

That's a beautiful gold coin. I want one!

You deserve one Sean.

If Clif High is correct, just buy a couple of kg of silver and by 2020 you might be able to buy that bad boy!

ANCIENT COINS, KINGS OF SASANIA, Sasanian Kingdom. Varhran (Bahram) II (AD 276-293). Gold Dinar, 7.30g. Bust of Varhran II right, wearing winged crown with korymbos. Rev. Fire altar, flanked by two attendants, both wearing radiate crown with korymbos (SNS type I (Bahram II) / 3 (Bahram I); Göbl type I (Bahram II) / 2 (Bahram I); Paruck -; Saeedi -; Sunrise 763, this coin). Well struck and well detailed, d elicately toned, extremely fine. Very rare hy brid. This Dinar is probably from the first issue of Bahram II because it uses a reverse from the last type (3) of Bahram I coinage, where both attendants wear radiate crowns with korymbos. ex Bellaria Collection, Triton VII, 13 January 2004, lot 590 From The Sunrise Collection $ 7,500

Thank you for sharing

Crypto currency like bitcoin is the new internet money gold!

We are doomed!!!

They will find out eventualy!

There are 480 grams in 1 troy ounce. 371.25 grains weighs 0.7734375 ounces.

so,if my math is correct, 1 dollar should be worth around $12 in silver.(today silver is selling at 16.67).

I have a good friend who is very wealthy and I have been talking to her for the past 3 years about investing in physical silver & gold but she like most people only see value in what her broker tells her. I understand that in the past when people like her parents actually held their stock certificates there was real value in those stocks but now all she has is a statement from her broker telling her she has those stocks. Forget about trying to explain cryptos to this mindset.

I had Christmas dinner with her and her family and was asking her grandson who woks at Amazon corporate headquarters in Seattle if he and his friends were investing in Bitcoin, he said he had never heard of it.....wow....

No end in sight though to the manipulation of the silver and gold markets. I'll keep holding anyway in the slight hope that they'll ever reach their true value..

SOON THE UNITED STATES WILL HAVE TO PURCHASE EVERYTHING IT BUYS FROM THE EAST IN GOLD... THE U.S. DOLLAR IS LOSING VALUE!!!

upvoted