Brief analysis of gold trends and some currency pairs on H4 time frame

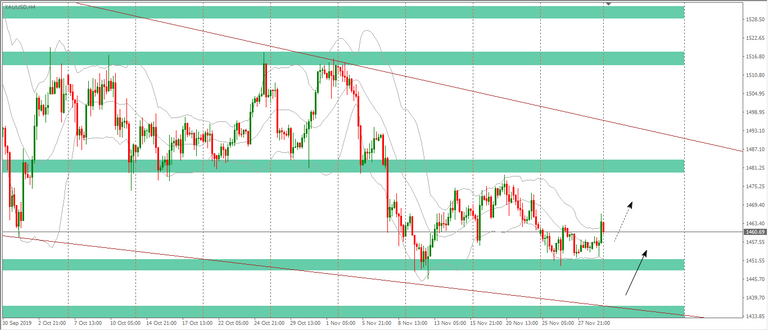

XAU/USD

Once again the price failed to penetrate the 1450 zone. In the medium term, we are seeing a giant falling wedge pattern on daily, the trend is increasing, so it is still in favor of buying. In the short term, there are bullish signals on both daily and H4 but relatively weak, so this time is still risky fo, you should consider. In case the price reaches the lower boundary of the pattern (the 1440 area), it can be bought when there are more bullish signals.

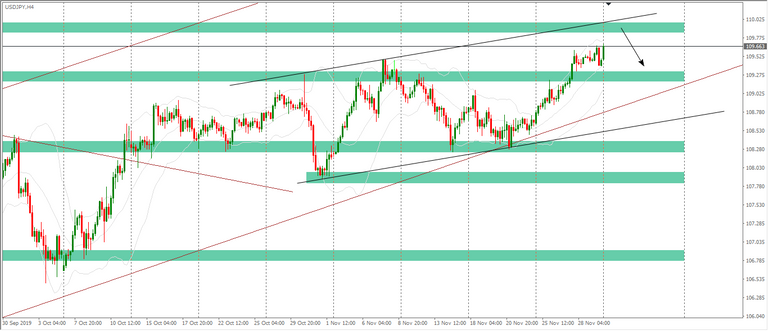

USD / JPY

At the end of the previous session, the price appeared a short-term bearish reversal pattern - an engulfed candle pattern. However, the price zone 110 has not been approached and the price has now rebounded so we will not sell at this time. Wait patiently for the price to reach 110 and sell on a bearish signal if any.

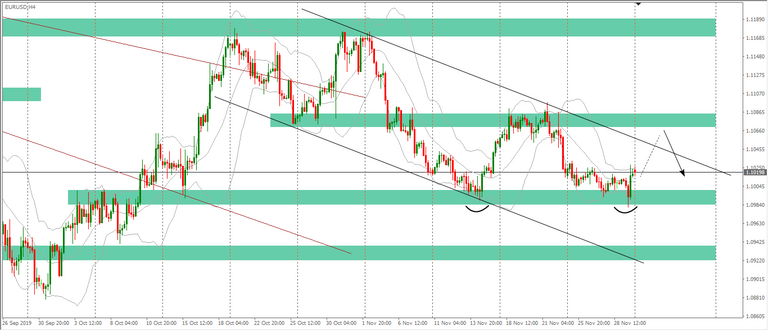

EUR / USD

Price has broken the 1,100 false threshold and has formed noticeable reversals. Our short view has changed, it is likely that today the price will bounce up to the upper border of the channel, then correct to decrease.

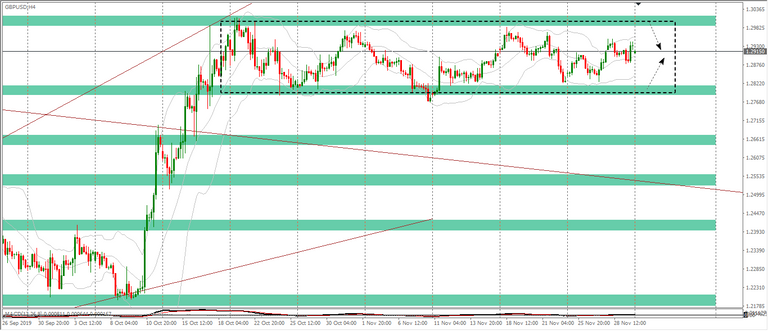

GBP / USD

GBPUSD is still consolidating the accumulation zone that has lasted for 6 weeks, the event that is expected to cause a major change for this pair is still the UK election on 12/12 so it is unlikely that this week it will be able to breakout. . The current market is only suitable for traders trading ranging with the margins of 1.28 and 1.30.

http://www.fxprimus.com/open-an-account?r=38793622®ulator=vu