Despite the sharp reversal from the 1270's level, a downswing is still ahead in gold. A bearish reversal candle on Friday with high volume signals that a downmove is imminent. Notice the very high volume, this is Supply hitting the market. Cumulative Volume has also been in decline during the uptrend. This signals that demand is waning as buyers are weakening. Gold is also late in its daily cycle at 29 days, so it only makes sense that it pulls back from here. My best conservative guess is that we may see the 1250 - 1260 level next.

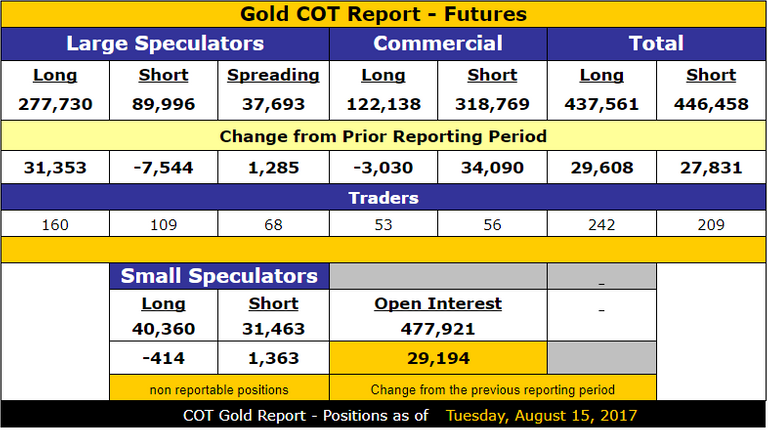

Also we can see from the COT report below that the Commercials have added to short positions, the total now stands at 318k. Gold cycle tops usually occur at COT levels of 300k+ which is what we have now.

The miners are also signaling that a gold top is in or very near. Notice that gold has been making higher highs at cycle peaks but yet the miners are still making lower highs

Miners are still in a frustrating basing pattern but I believe the end to this chop is near. Once we get this dip in Gold it will be an excellent buying opportunity. In my opinion gold will decisively break 1300 on the next up-leg and the mining shares will hopefully catch-up and make a higher high at the next cycle peak signalling a new uptrend. I am expecting GDX to go north of the 24 level.

The problem with gold and silver stocks right now is that big money is still pouring into the US stock market. Until we get the real crash in Stocks then miners and gold may just slowly move upward as they have been doing so far. However, in the years to come the upside potential is Huge based on the length of accumulation. GDXJ should get back to 100+.

Comments and Upvotes appreciated

Follow @traderyen

Agree, last Friday was a significant top and a reversal is underway in gold. Miners have yet to confirm but are looking very weak. Nice write up!

Thank you. We may be in store for another short pullback. But this choppy range is getting long in the tooth, hopefully there is a real breakout before the end of year