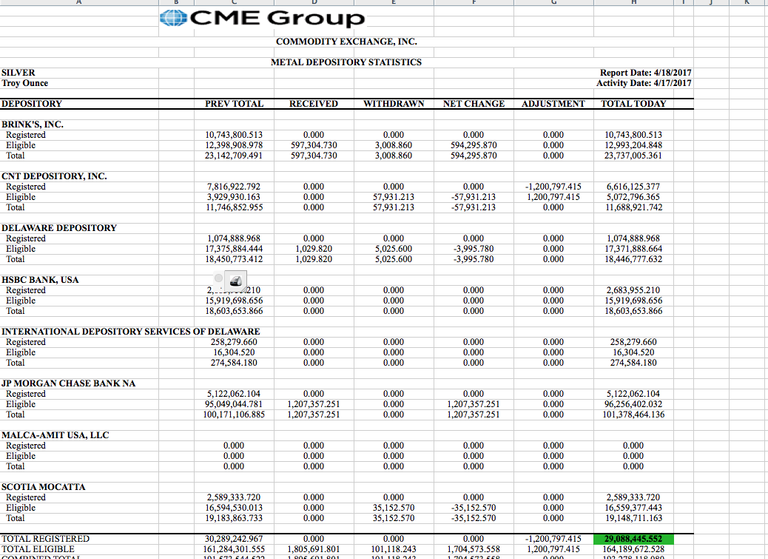

1- Indicator: Registered Silver on the commodity exchange

The rule here is, anything under 30 Million ounces of Silver in the registered category is BULLISH for the price of silver.

As of 18.04.17 - There is 29 Million registered ounces of Silver.

On a scale of 1-10 ( 10 Being Bullish, 1 Bearish) : 7/10

2- Indicator: Mining shares

Im going to keep this simple. Silver was at $16.30 in Early January 2017.

First Majestic (NYSE:AG) was at approximately $7.50 per share in early January.

Fortuna Silver (NYSE:FSM) was at approximately $5.00 per share in early January.

These two brilliant companies are at similar levels today as they were back in January 2017. When you remember that Mining companies almost always lead the price - this is bearish and indicates thats the silver price will need to come back to the from its current level of $18.30 to the $16.50 level.

So the miners don't have too much downside left - however the Silver price should catch up with the miners & correct in the short term.

On a scale of 1-10 ( 10 Being Bullish, 1 Bearish) : 3/10

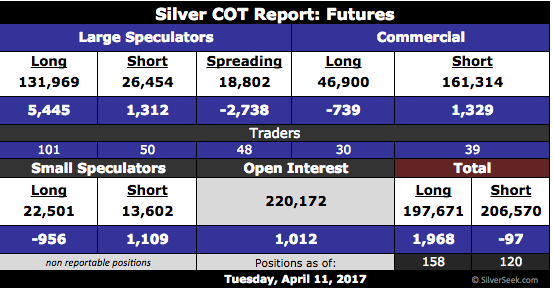

3- Indicator: Commitment of Traders (COT)

Open interest is at all time highs which is very bearish indeed.

As many people in the Metals space know, the commercial banks can drop Billions of Dollars of paper silver and gold onto the market. The COT report above indicates how much ammunition they currently have - Take it from me - They have alot!

Just look at that smash yesterday at around 10am Eastern Time. That is what manipulation and fraud looks like!

On a scale of 1-10 ( 10 Being Bullish, 1 Bearish) : 2/10*

*The only reason i have put 2/10 and not 1/10 for the Commitment of traders report indicator - is because of the small chance we see a short squeeze/the breakdown of the comex.

Takeaway: Mixed outlook in the short term - I believe there will be a better entry point in the Gold and Silver Market than at the current levels. Get your cash on the sidelines ready!

Looks like i was bang on! The Bottom cant be too far away now at $16.50.

Mining Shares look really cheap.