Content adapted from this Zerohedge.com article :Source

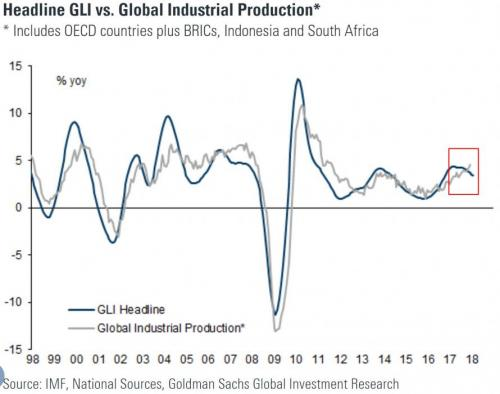

The global economy is weakening according to Goldman Sachs. Seven of the ten indicators in the Goldman Sachs' Global Leading Indicator (GLI) weakened in February. It went from 3.56% to 3.46%.

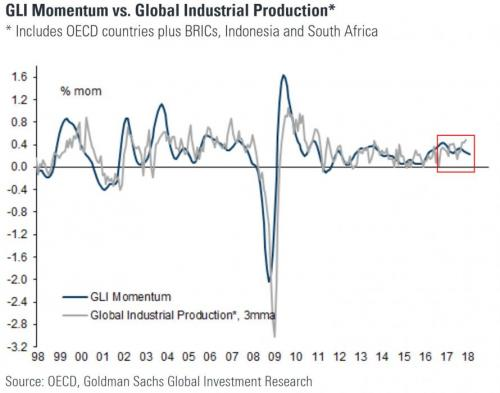

MoM growth also showed a decrease to a level not seen since March 2016. This went from .249% to .234%.

The only component that showed a meaningful improvement was US initial claims, which fell to a 49-year low today.

The largest declines came in the Japan IP inventory/sales ratio and the aggregate of the Australian and Canadian Dollar trade-weighted indices, both of which softened by roughly one standard deviation.

The global new orders less inventories component and Korean exports also worsened, with relatively minor moves in rest of the components.

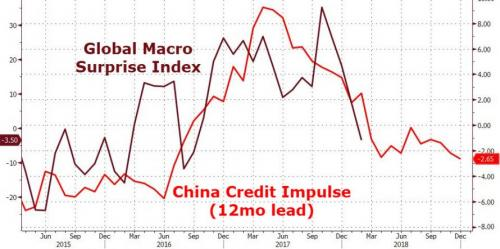

China appears to be leading the way, causing the major economies of the world to start pulling back.

Non-adapted content found at zerohedge.com: Source

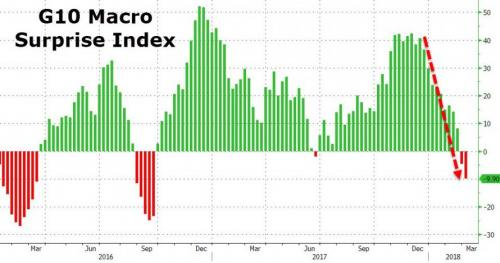

The macro surprise index is really bad , i don't know where the globe economy is heading but am sure with all those bubbles stimulating the economy we are down a slippery slope ,we may not get to the of there year before we see a market crush.

One of the reasons affecting the US economy and the rest of the world, is falling productivity and productivity growth is one of the main reasons GDP growth is slowing all over the 🌎. Global GDP growth and productivity growth have a strong correlation, as a matter of fact they move in the same direction at the same time and it’s declining. Along with other issues we are heading the wrong direction. On the other hand It seems like the elites want to collapse the economy, but this is another subject for another time.

Sucks for the world, record low unemployment claims in the US will be good for wages here.

Those concerns are valid. Having said that, I'll caution that currency devaluation results from Depressions too.

So, to the extent one can, it's wise to invest some portion of one's savings in assets capable of meeting their short-term needs until the national economy is restored. A good example would be land capable of providing a living space and source of food.

Those living in large cities are for the most part going to be screwed. If one owns a building capable of serving as a soup kitchen or housing for others, that may provide a source of income and food to those living in cities.

Enjoyed your economy market analysis. Good overall discussion of chart volume for any investment. Good signals usually occur whenever you get divergence... (price down/volume up). Also thanks for the share tip. Have it bookmarked now.

The entire global financial system was within hours of collapsing. We arent just talking about hedge funds and US banks that played around and fucked up, we are talking about pretty much every major bank in the world, whether they did anything wrong or not. This would mean literally hundreds of million to a billion people having their entire savings wiped out.

According to economic theory, derived empirically, the economic crisis repeats itself every 11 years. The last crisis was in 2008. Unfortunately, until 2019 there is not much left.

Thanks for sharing this @zer0hedge

Nice job @zer0hedge, this information is important for beginners, i need the others Parts... :D

well post for all steemit user,,, thanks for share that sir....

A great lesson, my friend and you are absolutely right that the graphs are of great importance in trading, as it is possible to predict the volatility of prices in a certain analysis. Continue you very well get to explain the state of things when trading! Thank you @zer0hedge

High interest rates are spooky and at the same time Goldman urges that there are ''attractive trades to be found in high-dividend payers that are also growing their yield at a quick pace. By Goldman's measure, the top 25% of dividend-growers in the S&P 500 have outperformed during past rising-rate environments.'' [BI]

I mean, pushing for short-term high-dividend payers at this point in time? Not interested.

Compare that to their outlook for growth in January and you'll realize that their predictions are not based on any foundation. 2018-2019 predictions will be even worse in that regard.

US investment bank Goldman Sachs said current market turmoil was only a "modest" risk factor for his "optimistic" view of the global economy because most of the losses occurred in the US stock market due to rising bond yields and concerns about inflation.

"Our results are in line with our market team's assessment that last week's sales wave was largely technical and not of a fundamental nature," Goldman wrote in a research note.

"The history of market corrections during periods of strong economic data indicates that this correction will probably be short, shallow, not long and extended," he said.

The global economy is indeed weakening signified by the falling stock prices, high inflation, and high interest rates all around the globe. Central banks are struggling to cope with this crisis.

Japan as far as i know has had a huge influence in this... their economy is growing much lower which I believe has resulted from a drop in inventories of oil and other raw materials and a downward revision to private consumption. The oil prices rising was the biggest factor here leading to a drop in demand which combined with regular maintenance of tanks and refineries to cut the volume of oil stored in Japan.

Well, I do think that there is a need of performing an extra mile to achieve an economic rise. More nation's are no longer advocating for economic integration and tend to focus on personal benefits.

Look at what happens with Brexit, when The United kingdom felt stronger enough to resist and perform an economic boom with no other countries support.

The spirit of feeling superior will always lead to a breakdown of the economy but the acknowledgement of others views and perception will bring the economy to a rise.

This is what actually happens with china. They approach Africa countries, provide affordable goods and strengthen relationship with them. The result is that the African merchant no longer dream to purchase something from the U.S or Europe.

For a strong and durable economic boom there should always be cooperation among the countries. Not as masters and slaves but as friends in the same journey. The supperpowers will loose their power and the sharp ones will take it from them.

It's all begins with us and ends with us.

@jona12

Thanks for your valuable and informative post.

We can gather a lot of information by your post.

By dint of we can increase our skill that is beneficial for all steemians.

I will always visit your site & wait for your upcoming post.

Thanks .

@Resteem done.

Maybe we should all start growing food.

Seriously, think of how many problems we could solve by growing food in our backyards (where legal of course, because it's illegal in some states because why not have absolutely crazy laws) and helping each other.

I really don't get the economy, it's like, you're telling me all we need is food and shelter and certain advances for comfort, like clean water, yet we go to all these lengths to create more killing machines and more robots and more space ships and more work.

All I ever hear abouta t work is that we're getting more work and finding more work and working harder and I just wonder WHY?

Why not relax a bit, what's so important about pushing forward blindly before we have a secure foundation to operate from.

Rant over

As we can see on the first graph, every time the GLI line crosses the Global Industrial production, immediately the Global Economy starts a descending path, it is very important to avoid peaks like after the crisis, so we can keep a stable panorama. Going down for a bit, its not bad if we have everything prepared to bounce back up.

China debt is no surprise for anyone, the problem is that everybody is ignoring the sleeping giant hoping that he never awakes. In my opinion we should be trying to prepare ours economies for that eventuality.

Look at what happens with Brexit, when The United kingdom felt stronger enough to resist and perform an economic boom with no other countries support.

The spirit of feeling superior will always lead to a breakdown of the economy but the acknowledgement of others views and perception will bring the economy to a rise.

This is what actually happens with china. They approach Africa countries, provide affordable goods and strengthen relationship with them. The result is that the African merchant no longer dream to purchase something from the U.S or Europe.

please visit my blog @mulyadedi thank you https://steemit.com/history/@mulyadedi/teuku-nyak-graveyard-aceh-the-story-of-aceh-commander-without-the-head-teuku-nyak-graveyard