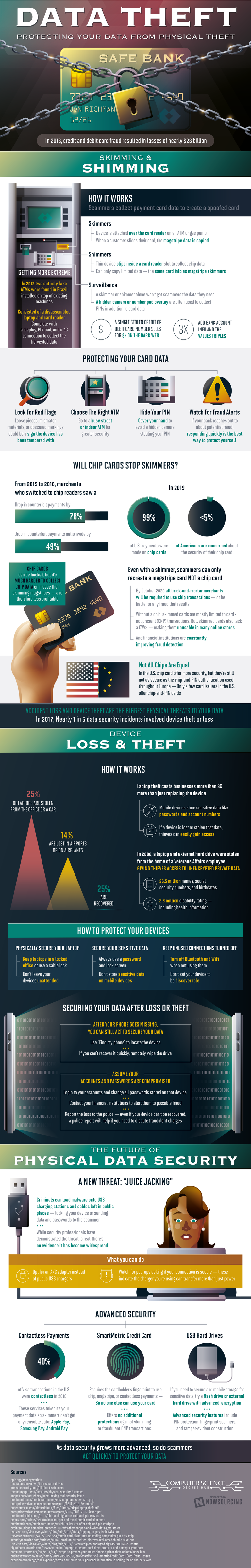

Odds are, a professional scammer has stolen your information from a business you frequent. Have you been to an ATM or gas station recently? Skimmers and skimmers - thieves who install data collection devices on and inside of card readers at places such as the aforementioned - thieves can earn $5 on the dark web. Adding your account and routing number can triple their profit. Does the mystery overseas charge - although your card is in your wallet - make sense now?

Data theft happens more often than not, and these aren’t the only methods thieves have in obtaining your financial records. Physical robbery and device loss can also place your confidential information in a state of vulnerability. It’s as easy as forgetting your laptop at the airport or having your car broken into. This is why setting a password, enabling features like “Find My iPhone,” and guarding your expensive tech is crucial.

In 2018, credit and debit card fraud resulted in consumer losses of nearly $28 billion. In 2019, 99% of U.S. payments were made on the safer-than-magstripe chip cards, but scammers are still finding new approaches. To find more protection tips and understand how credit card theft happens, continue reading below.

Infographic link: https://www.computersciencedegreehub.com/data-theft/