If you have been following our #pepEntropy Qualitative Investing Strategies you should have had opportunities to buy low and sell high. On the surface, it is not a complicated strategy. Dig deeper and you realize there are many factors that determine your proceeds from trading. The easy part is buying but what about selling and buying back? Are you able to manage the emotions that get triggered when an investment fluctuates from highs and lows. This is where holding some pepEntropy tokens is a great way to profit from risky investments. And #LEO is a risky investment. If you don't think so, please share why you don't think it is a risky investment.

Before we look closer at the recent chart, lets review a couple of previous reviews.

On May 5, 2024

https://peakd.com/hive-102963/@fjworld/beware-of-leo-continued-decline

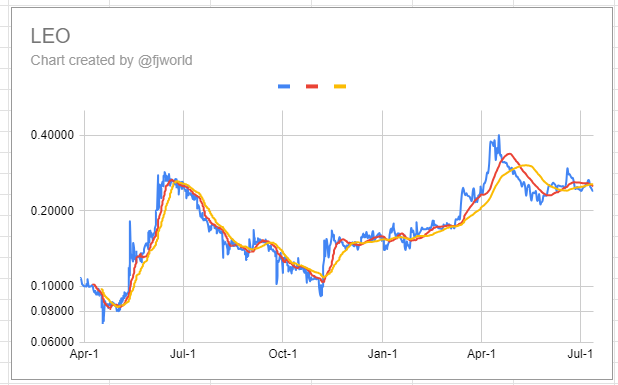

Did I mention, sell on peaks and buy on dips? Well, today, now that we traded below MA40, that is the 40 Day Moving Average, we need to be cautious that we could decline to the 0.25 and 0.20 level.

In early April profits were taken and allocated to Return of Capital for our pepEntropy holders.

May 16, 2024

https://peakd.com/hive-102963/@fjworld/leo-continues-to-drop-in-search-for-a-new-support-level

The current trend suggest we are more likely to be trading near 0.20 than 0.40 during the next week or so.

Well, we dipped near the 0.21 level, bumped up towards 0.28 and started to settle near 0.24 and 0.25

We experienced a pullback and tested the water for the next peak.

Today

Almost 2 months after our last review it looks like we are at another crossroad for short term traders. We see a 12k wall on the buy side at 0.24 but not so much energy behind the wall at prices as far down as 0.17

On the sell side we do not currently see a lot of sell orders so this points to the undecided players in the market. Hence, the crossroad for short term traders. For the long term investors, they are holders for the next new high but are they accumulating more?

When looking at trading data, pepeEntropy is not just looking at price and volume movement. A token like LEO is greatly impacted by marketing, ability to deliver on expectation and position of significant holders. Who is trading, how often and how much are all factors in getting to the true underlying value of an investment. Unlike some other projects, LEO is very fluid. That means changes are constantly happening so results are less predictable. Also, understanding a project management style is very helpful in the decision process to buy, hold, trade or sit on it for a few years to wait and see.

Back to our titled question.

Did LEO find a new support level or positioned for next drop?

My confidence is not high for trading above 0.40 and my gut is saying to prepare for a similar decline to what happened one year ago.

That's it for LEO so be on the look out for the next pepEntropy layer 2 token review. It would be my pleasure to address any concerns about pepEntropy and I welcome your feedback and suggestion for any specific layer 2 token review.

Thank you very much for your interest.

May Positive pepEntropy be with you.I'm having a #MEME of a #FUN time.

Hope you consider taking a position in pepEntropy

!MEME

Credit: shaungerow

Earn Crypto for your Memes @ HiveMe.me!

Credit: fun.miner

Earn Crypto for your Memes @ HiveMe.me!

!LOL

lolztoken.com

All you could hear around there was “guac, guac, guac, guac.”

Credit: reddit

$LOLZ on behalf of holovision.cash

(2/10)

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.@pepentropy, I sent you an